You thought the Crypto Queen saga was crazy?

Meet the teenage brothers who vanished with 69,000 Bitcoin.

They promised 10% monthly returns using "AI-driven trading."

Investors poured in $$$.

Then one day in 2021, everything vanished.

Here's how they pulled it off 🧵👇

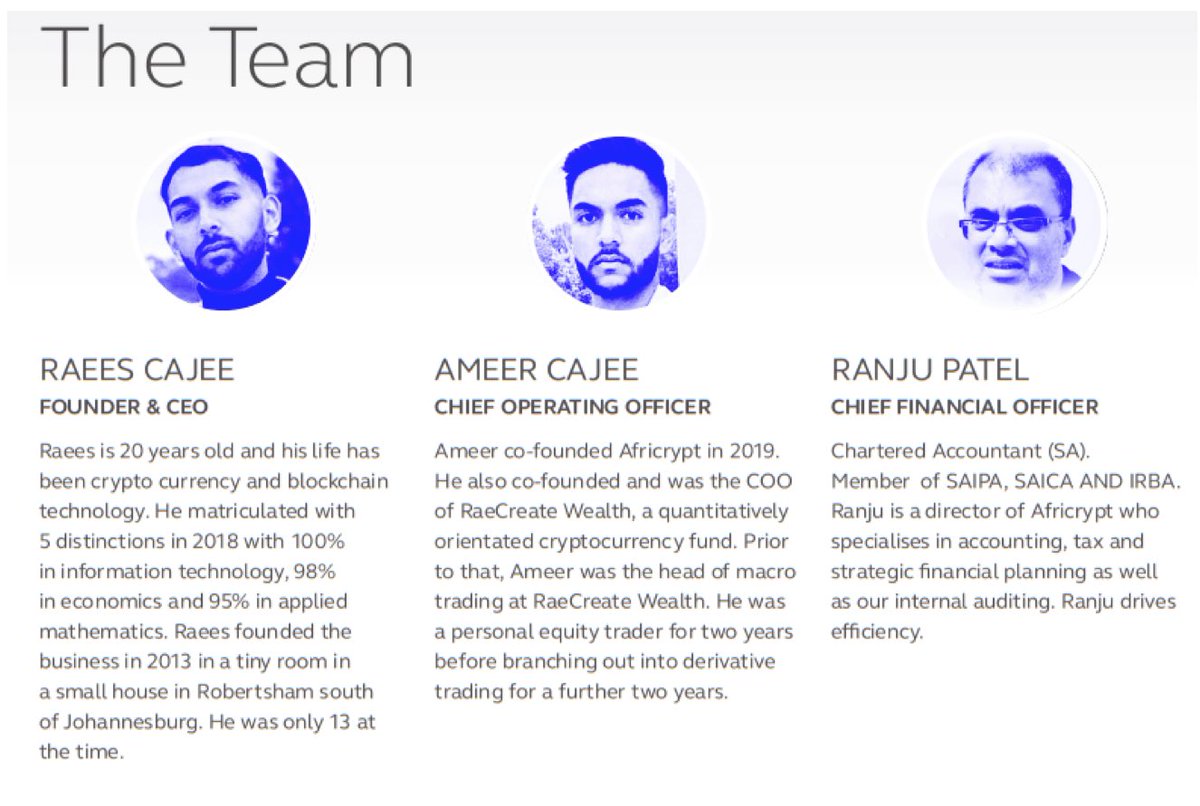

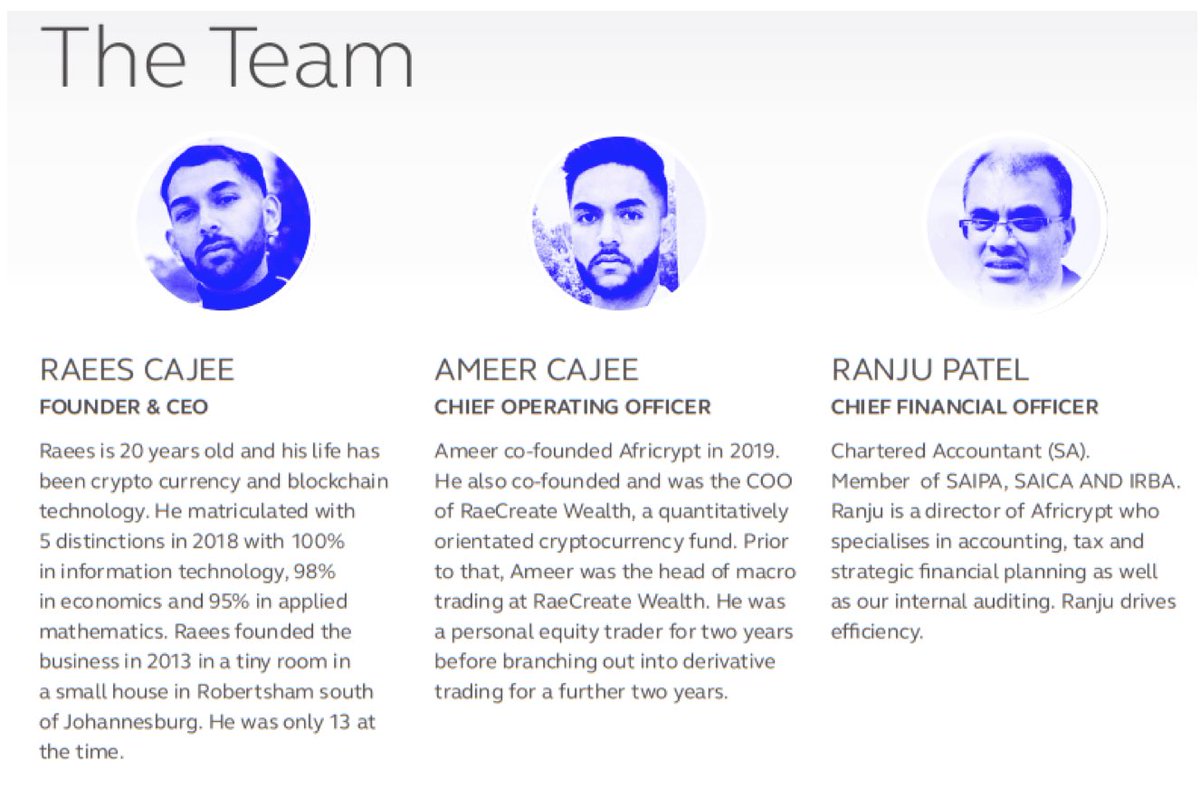

Meet Raees and Ameer Cajee. Ages 19 and 17 when they started Africrypt in 2019.

They weren't desperate kids looking for quick cash.

They are sons of a respected family.

Based in Johannesburg.

They came from money, had connections and a believable backstory.

And they built what looked like a legitimate business.

The setup took two years.

2019: Launch Africrypt as South Africa's first AI-powered crypto fund.

2020: Build trust with consistent "returns"

2021: Execute the perfect disappearing act.

They engineered trust, then weaponized it.

Raees claimed he'd been mining Bitcoin since age 13.

➫ Built trading algorithms in high school.

➫ Got invited to China by major crypto exchanges.

True or not, it sounded believable.

And that belief got people to invest.

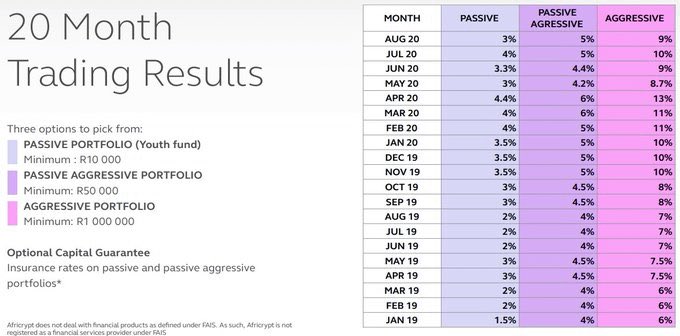

What was Africrypt?

A crypto investment platform that “used AI” to trade Bitcoin for you.

➫ Deposit BTC or cash

➫ Choose one of three plans (passive, semi, aggressive)

➫ Sit back while the bots “worked”

The returns were 10 - 13% per month.

The catch? There wasn’t one.

Or so it seemed.

The website looked clean, the branding felt trustworthy and the brothers spoke like tech prodigies.

But the real selling point was the lifestyle:

➫ Lamborghinis.

➫ Designer clothes.

➫ Mansion parties.

➫ First-class travel.

Early investors were getting big gains.

Then people got greedy and eventually… they got rekt

By 2021, they were managing $40 million in investor funds.

But …. they weren't actually trading anything.

Those monthly "returns" on statements were pure fiction.

They were just moving new investor money to pay old investors.

Classic Ponzi scheme with a crypto twist.

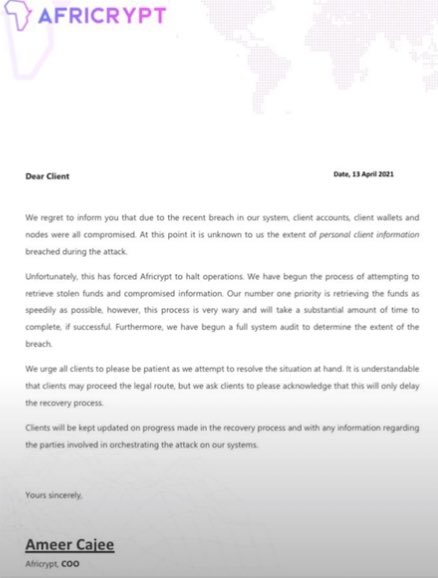

On April 13, 2021, everything collapsed.

A mass email went out.

Raees said Africrypt had been “hacked.”

"𝘞𝘦'𝘷𝘦 𝘣𝘦𝘦𝘯 𝘩𝘢𝘤𝘬𝘦𝘥. 𝘈𝘭𝘭 𝘤𝘭𝘪𝘦𝘯𝘵 𝘧𝘶𝘯𝘥𝘴 𝘢𝘳𝘦 𝘤𝘰𝘮𝘱𝘳𝘰𝘮𝘪𝘴𝘦𝘥. 𝘗𝘭𝘦𝘢𝘴𝘦 𝘥𝘰𝘯'𝘵 𝘤𝘰𝘯𝘵𝘢𝘤𝘵 𝘢𝘶𝘵𝘩𝘰𝘳𝘪𝘵𝘪𝘦𝘴 𝘢𝘴 𝘵𝘩𝘪𝘴 𝘸𝘪𝘭𝘭 𝘴𝘭𝘰𝘸 𝘳𝘦𝘤𝘰𝘷𝘦𝘳𝘺 𝘦𝘧𝘧𝘰𝘳𝘵𝘴."

The site vanished. So did their phones.

The Cajees were gone.

But the story didn’t end there.

Private investigators were hired.

Blockchain forensics teams stepped in.

Turns out… the exit strategy was months in the making:

➫ December 2020: Quietly obtain Vanuatu citizenship (visa-free access to 130+ countries)

➫ March 2021: Employees had been locked out of backend systems

➫ April 2021: Liquidate personal assets

You want another twist?

This wasn’t their first time.

A previous company, Ray Creates, also got “hacked.”

Same brothers.

Same pitch.

Same result: funds vanished.

It barely made headlines.

And it gets worse.

They built in a liability waiver into the investor contracts.

If Africrypt got “hacked,” you couldn’t sue.

Nobody read it.

Why would they?

They were getting rich.

Since fleeing South Africa, they've been ghosts.

Spotted in Tanzania, Dubai, London, Turkey. Always one step ahead of investigators.

In 2024, Ameer surfaced in Switzerland trying to access safety deposit boxes containing crypto hardware wallets.

He was arrested. Released on $320,000 bail.

Charges later dropped as complaints were mysteriously withdrawn.

183.61K

406

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.