The Hammer Candlestick Framework 🧵

Most traders treat candlestick patterns like cheat codes.

Smart money doesn’t.

They read them as contextual signals, not confirmations.

Let’s decode the Hammer:

What it is. What it isn’t. And how pros use it 👇

1. What’s a Hammer, really?

It’s not “bullish.”

It’s rejection.

→ Small body near the top

→ Long lower wick

→ Appears after a sustained down move

Mechanically, it shows this:

Sellers drove price lower → Buyers stepped in → Close near the high

• The wick = failed auction

• The body = regained control

2. The Psychology Behind It

It’s a battle.

• Bears tried to push lower, but they failed.

• Bulls absorbed the sell pressure & reversed it by close.

But here’s the key:

• That’s not a reversal.

• It’s a warning shot.

3. The Hammer is a Signal of Change, Not Proof of It

The smart interpretation:

“Selling pressure may be drying up.”

Not:

“Price is about to go up.”

The distinction separates disciplined traders from impulsive ones.

4. The Setup That Matters

A hammer means nothing in isolation.

But a hammer into:

→ Key Mid-HTF S level

→ Final leg of a liquidation cascade

→ Volume spike or divergence

= A potential structural pivot

Price > pattern

Context > candle

5. How Smart Money Enters (if at all)

They don’t chase the candle.

They let it form → wait for confirmation, → look for clean risk.

Example flow:

→ Hammer into Mid-HTF level

→ Follow-up engulfing or inside bar

→ Retest entry, defined invalidation

→ Risk-adjusted size

No predictions. Just risk-framed behavior.

6. What to Avoid?

× Buying every hammer

× Ignoring trend

× Disrespecting structure

× Assuming wicks mean reversals

Pattern > Setup > Structure > Execution

Most stop at the pattern.

Final Take

• The Hammer is not a “bullish reversal.”

• It’s a shift in character, nothing more.

• When placed in the right location, with the right narrative, it’s a powerful tell.

Use it like a professional:

Not as a trigger, but as a clue.

If you found this valuable:

• Follow @THE_MAGNATE for more high-IQ trading frameworks.

• Bookmark 🔖 this for your trading journal.

• DM ✉️ open for collabs, insights, or 1-1 Masterclass.

#PriceAction #SmartMoney #TradingTips #BTC #ETH #Altcoins

1 The Marubozu Candlestick Framework 🧵

Zero-wick candles.

Clean conviction. No indecision. Just pure momentum.

Used properly, Bullish & Bearish Marubozu reveal institutional intent before the crowd catches on.

Elite Smart Money Mode 👇

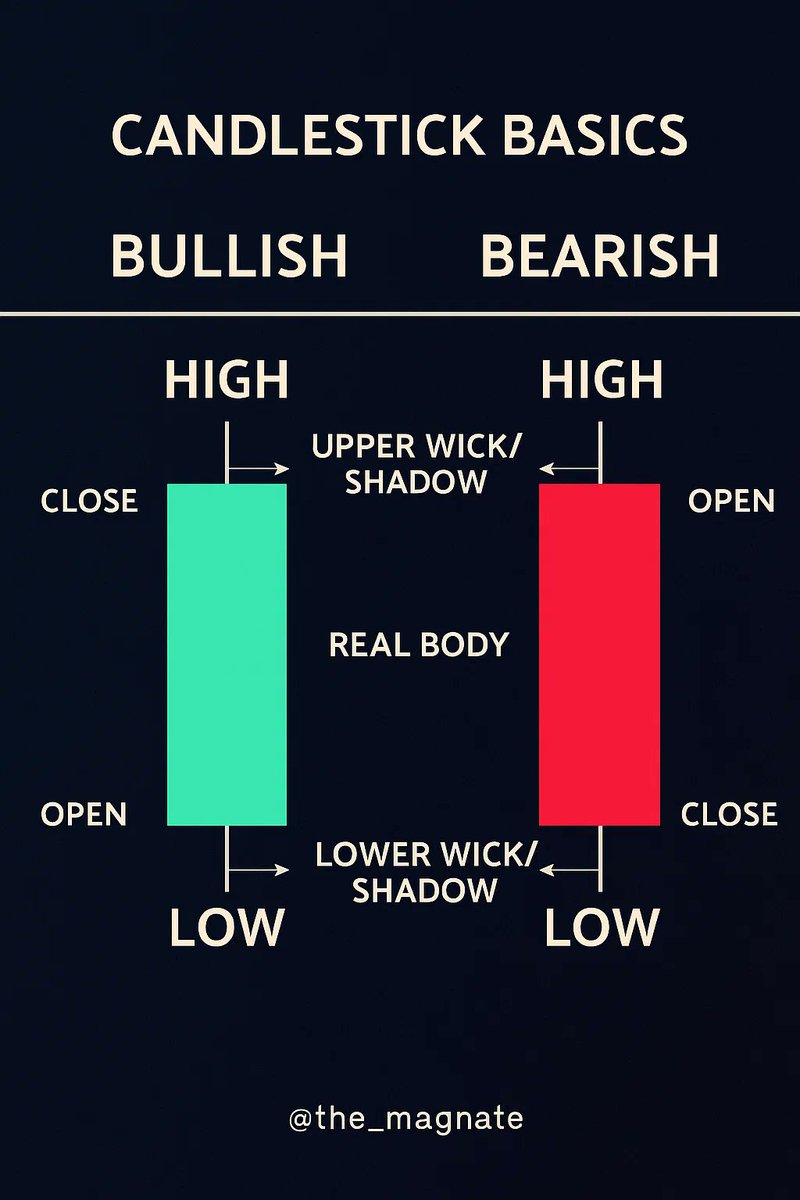

2 First: What is a Marubozu?

A Marubozu is a full-body candlestick with no wicks (or nearly none):

• Bullish Marubozu: Opens at the low, closes at the high.

• Bearish Marubozu: Opens at the high, closes at the low.

It’s not about "patterns", it's about the efficiency of price movement.

3 Marubozu = Total dominance by one side.

• No rejection.

• No hesitation.

• No “maybe.”

These candles often mark breakout moments or the start of an imbalance.

The key is where they appear.

Context > Signal.

4 🔍 Smart Money Read:

• A Bullish Marubozu on volume, from a base or after accumulation = institutional markup.

• A Bearish Marubozu from a distribution range = controlled markdown.

Think of them as institutional signatures, not random occurrences.

5 🧠 Mental Model:

“Conviction Candle Theory”

• Wickless = Uncontested control

• Volume-backed = Intentional

• In context = Predictive

You’re not trading the candle. You’re decoding who is behind it & why they printed it there.

6 🏗️ Framework for Use:

❶ Identify Marubozu in HTF context (4H, 1D)

❷ Map surrounding structure: breakout, reversal, continuation?

❸ Validate with volume & liquidity sweeps

❹ Plan entries on retest zones/imbalance fills

❺ Manage risk with invalidation beyond the candle's origin.

7 🚫 Common Mistake:

❶ Chasing after a Marubozu without context.

❷ Not every strong candle is smart money.

❸ Some are just liquidation or noise.

Always ask:

“Does this candle emerge from structure, or into it?”

8 ✅ Clean Confirmation Use-Case:

• Consolidation (range) breakout

• Clean Marubozu

• High volume

• Followed by consolidation (bull flag/bear flag)

Smart Money doesn’t just initiate, they often follow up with controlled pauses to let you in. That’s your edge.

9 Remember:

Marubozu isn’t a signal, it’s a footprint.

When you see a full-body candle in context, you’re watching conviction unfold in real-time.

Read it like a message.

Decode the sender.

Act only when the structure aligns.

10 📌 Recap:

• Marubozu = wickless conviction

• Best used in Mid-HTF structural context

• Think like Smart Money: Why now? Why here?

• Avoid chasing, wait for structure, wait for clues

• It’s not a pattern, it’s a tell.

If you found this valuable:

• Follow @THE_MAGNATE for more high-IQ trading frameworks.

• Bookmark 🔖 this for your trading journal.

• DM ✉️open for collabs, insights, or 1-1 Masterclass.

#PriceAction #SmartMoney #TradingTips #BTC #ETH #Altcoins

1.83K

1

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.