🧵 My partners and I launched The Free Markets ETF $FMKT June 10th, and we just added Archer Aviation $ACHR to its portfolio. Why? It’s a perfect case study of a deregulation strategy in action. Trump’s regulatory rollbacks create major tailwinds for $ACHR. Here’s how. (1/10)

$FMKT's proprietary R2Q AI system scans policy databases in real-time to identify companies poised to benefit from regulatory shifts. Our AI flagged $ACHR given Trump’s recent executive order which impacts companies involves in drones, flying cars, and supersonic flight. (2/10)

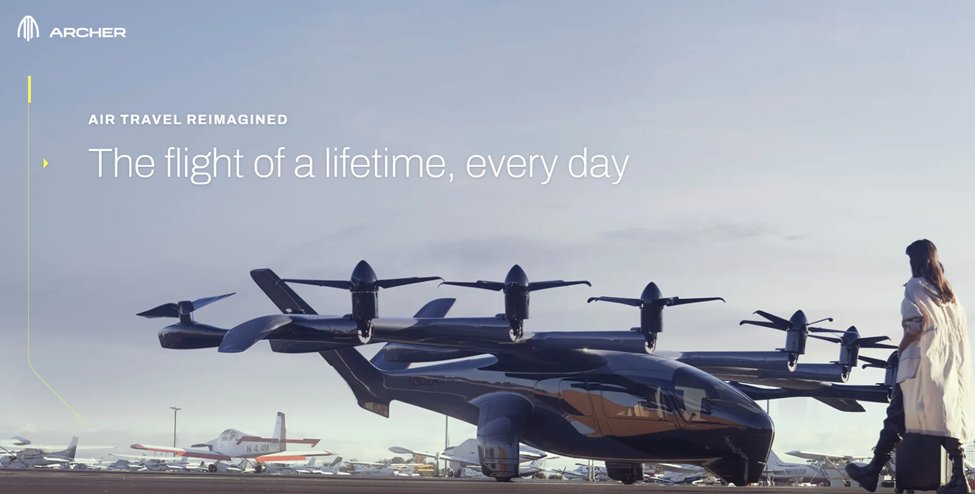

Archer Aviation $ACHR isn’t just another Electric Vertical Take-Off & Landing (eVTOL) play. Their Maker aircraft (60-mile range, 130mph) is set for 2025 launch. It's in $FMKT. because the company’s positioning to capitalize on Trump’s aviation deregulation push. (3/10)

Trump’s Executive Order 14304 (signed last month) is reshaping aviation regulation. The 10:1 deregulation ratio means for every new rule, 10 must be eliminated. This dramatically reduces compliance costs for innovative aircraft manufacturers like Archer. (4/10)

I think the repeal of certain overland flight restrictions and new noise-based certification standards are huge. They slash regulatory hurdles that previously added years to certification timelines and millions in costs. That's what we want to invest in for $FMKT. (5/10)

United Airlines' $UAL commitment to purchase up to 200 Archer aircraft provides crucial market validation. This partnership isn’t just about sales—it signals that major industry players believe regulatory barriers are finally falling for next-gen aviation Great for $FMKT. (6/10)

eVTOLs combine helicopter convenience with airplane efficiency—all electric. They take off vertically from small “vertiports” & fly at 280km/h. Archer just secured $850M after Trump’s Executive Order boosting the industry. Deregulation is the catalyst, $FMKT is the fund. (7/10)

$FMKT ’s metric screening process identified Archer as uniquely positioned. Our AI detected the potential for significant reduction in regulatory burden—translating directly to improved margins and Return on Invested Capital. (8/10)

The aviation sector currently shows strong metrics: 3.6% annual passenger growth, demand for 43,000+ new aircraft by 2044. Yet investor sentiment remains cautious on eVTOL plays. This disconnect creates the opportunity $FMKT is exploiting with our Archer position. (9/10)

206.34K

204

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.