➿ In The Loop #002

A biweekly digest covering Loopscale strategies, integrations, product updates, and the best yields.

Thread below↓

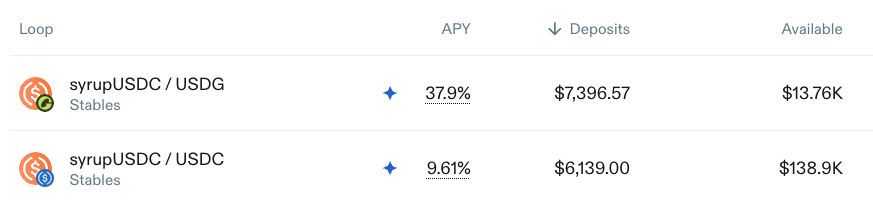

Now live: @maplefinance syrupUSDC🍁

Loop it for up to 37.9% APY, or use it as collateral to borrow.

The 3rd largest yield bearing dollar asset meets the power of Loopscale's credit markets.

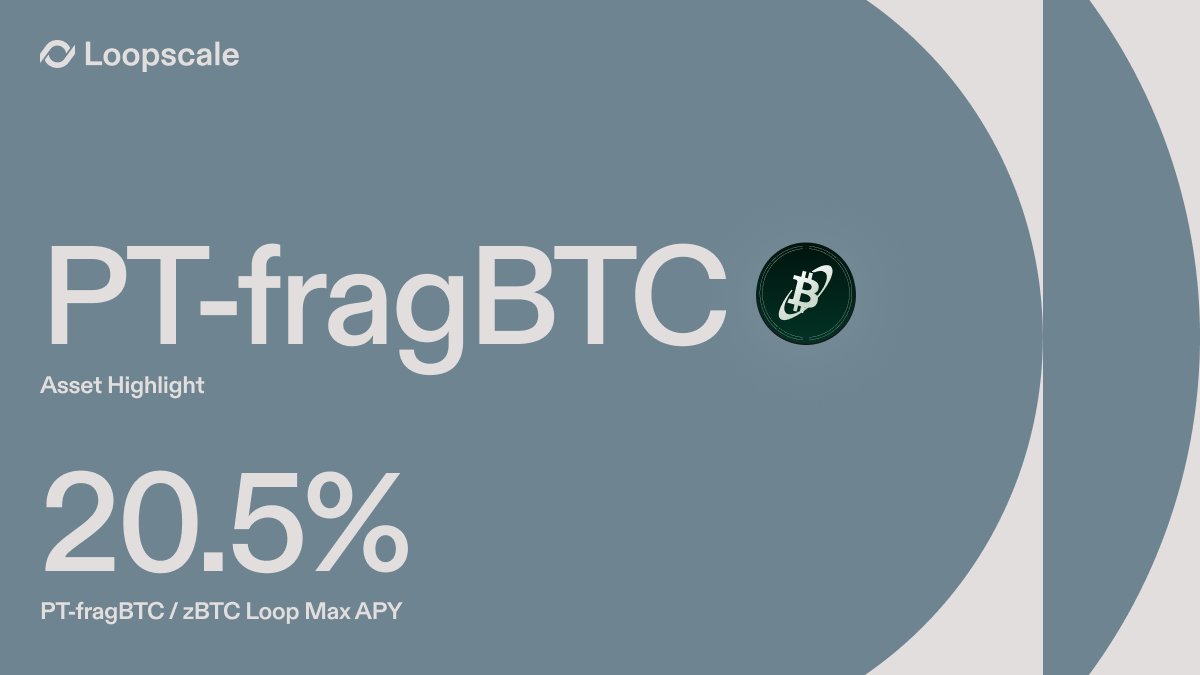

For the Bitcoin enjoyers:

The pt-fragBTC / zBTC Loop is currently providing 15.5% APY.

Keep your exposure to Bitcoin and earn yield. All on Solana.

@ExponentFinance

@fragmetric

@ZeusNetworkHQ

The sphSOL / SOL Loop continues to provide excellent leveraged staked SOL yield - APY currently sits at 22%.

1,344 sphSOL is currently deposited in this Loop.

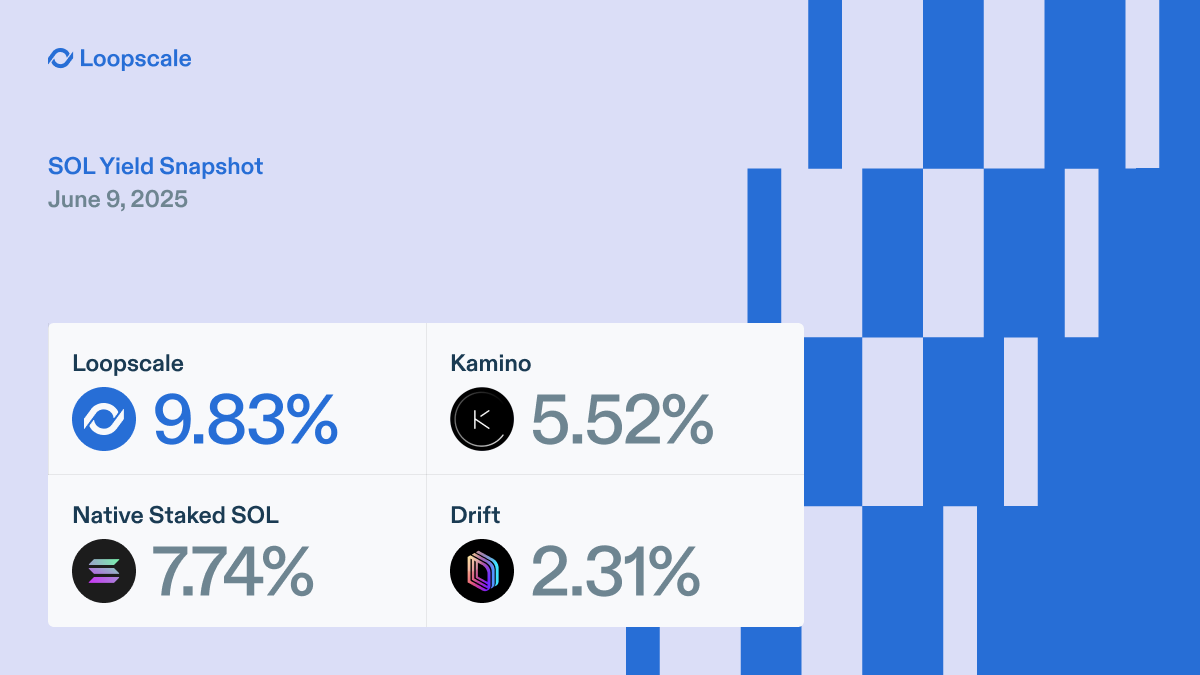

Loopscale's SOL Vault continues to offer a high APY thanks to continued borrowing demand - currently providing 10.7% on SOL, including extra rewards from @sphere_labs and @SolanaHubApp.

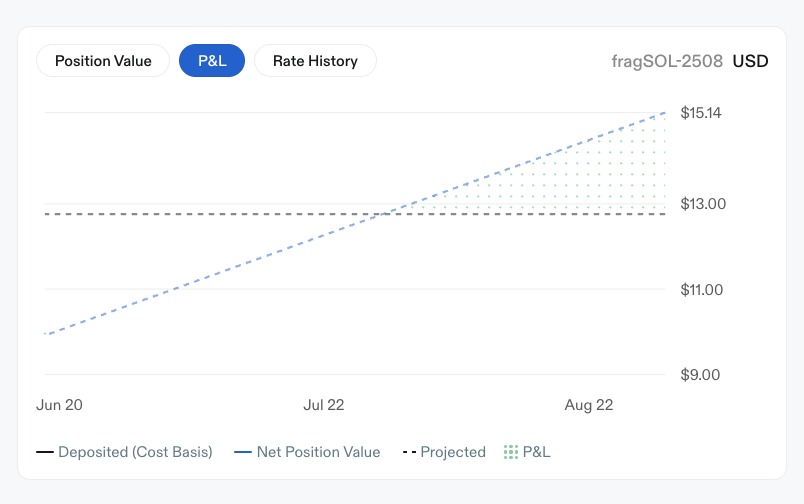

Product update: Better Loop charts for positions in your portfolio. Position value, PnL, and rate history.

PnL charts and projected PnL are particularly useful for PT- (fixed yield) tokens, which reach their maximum return at maturity.

More UX updates for Loops coming soon!

This week, our co-founder @marygooneratne met with @jacqmelinek and shared how Loopscale is reshaping credit onchain.

Accelerate.

The latest @Solana Sessions is with @marygooneratne, cofounder of @LoopscaleLabs ✨

We discuss institutional vs retail borrowing behavior, Loopscale's recovery after a $5.8M exploit, how its Loops product passed $1B in volume, and why she believes DeFi can rebuild global credit markets.

This episode is a part of the Solana Sessions campaign that @Token_Relations and @_TalkingTokens are doing, diving into founders’ journeys and startups building on Solana.

TIMESTAMPS:

0:00 Mary’s background and founding Loopscale

2:24 From tokenized whiskey casks to crypto credit markets

4:23 Why lending hasn’t evolved like trading on Solana

6:01 Pool-based model limitations and capital inefficiency

8:11 Why Solana was the only viable chain

11:02 Inside the $5.8M exploit and recovery process

13:08 Lessons from the hack and security upgrades

17:12 New risk controls and protocol design changes

20:03 Who uses Loopscale: LPs, whales, and institutions

21:24 What products are growing fastest

24:07 Why idle Solana liquidity is a huge opportunity

25:58 The future: real-world assets and institutional lending

27:10 What institutions want from on-chain credit

28:21 Global credit markets and underserved borrowers

30:13 What’s next: sponsored credit vaults

30:29 Final advice: talk often and talk to builders

2.19K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.