Recent thoughts on RWA and real income:

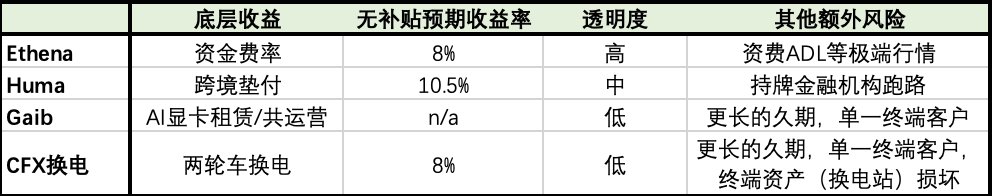

TLDR: The crypto space needs real income, but the trust cost is very low. Currently, RWA projects rely on token compensation to gain sufficient attraction, comparable to native crypto yields (lending/fees); however, the transparency is far inferior to native crypto projects. Therefore, any projects that show even a slight improvement on this basis are good projects.

⬇️⬇️⬇️⬇️⬇️⬇️

The intention behind writing this is that a friend from a web2 listed company recently asked me about RWA, saying they want to invest in a solar power station overseas, but due to the complexity of ODI, there is no foreign financing entity; they thought RWA might solve this problem (permissionless USD bonds?). So, I was discussing recent projects I’ve seen while contemplating this industry.

Recently, I saw two projects on my timeline: @gaib_ai's fundraising to buy graphics cards and @Conflux_Network x @dForcenet's two rounds of battery swapping, which are essentially no different from the solar power station my friend proposed. Both aim to raise funds, with returns on-chain to investors, and the expected yield (excluding token subsidies) is around 8%.

Moreover, the RWA projects available to retail investors now have a similar structure—real demand terminals find project parties to issue bonds, and the project parties act as GPs to underwrite to retail investors. Previously, more compliant RWAs were not accessible to retail investors, who could only circulate within whitelists.

From the terminal's perspective: web2 financing is heavily regulated, and people are smart with their money. Financing is easier to come by in web3.

From the project party's perspective: I ensure compliance and earn the money I should as a GP. As long as I can issue tokens to incentivize retail investors to buy my products, that’s enough.

From the retail investor's perspective: I trust these projects backed by big names; they sound reliable, and I’m essentially mining points. It’s fundamentally about sacrificing liquidity to earn money from the secondary market/MM.

Previously, there was a fairly thorough discussion under a tweet from CFX, and today GAIB also came to the Pendle community for an AMA. To be honest, for "veterans," the attraction seems insufficient. There are already very few buyers in the secondary market of crypto; truly innovative or long-term valuable projects are the only ones whose tokens will be worth something.

To compare with two projects I participated in:

1. Ethena, a representative of native crypto yields, even though it has now scaled to 6B, it still offers an average annual yield of over 8%. The transparency is good enough, with monthly CEFFU audit reports, and you can see the money in the custody wallet on-chain, making it operational. The duration is short, with a 7-day redemption period.

2. Huma, with a 10.5% native yield. The transparency is not as good as pure native projects, but due to Payfi's characteristics, it will utilize blockchain, so each loan is still traceable, which is better than purely offline products (what if the graphics card gets stolen or the solar power station gets blown up?). The duration is technically around a month, but the current redemption time can be made very short, and the exposure of each fund is also sufficiently short. There won’t be issues like not breaking even after three years of operation, being unable to redeem, or facing a bank run.

So, in my view, what RWA project parties need to do now is to find better PMF. Is there money that can only be earned in the crypto space? (Payfi?) They need to achieve higher yields or improve transparency compared to purely offline projects. If it’s purely token subsidies, thinking that crypto money is easier to attract than web2 money ultimately consumes their long-term credibility. The "dumb money" in crypto will eventually be drained one day.

In fact, the current "RWA" circle in Shenzhen is already very close to the trading circle and the previous P2P circle; sometimes, the slide happens in an instant.

Show original

24

5.46K

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.