MYX: The optimal solution for Binance's alpha brush volume under the thunderstorm

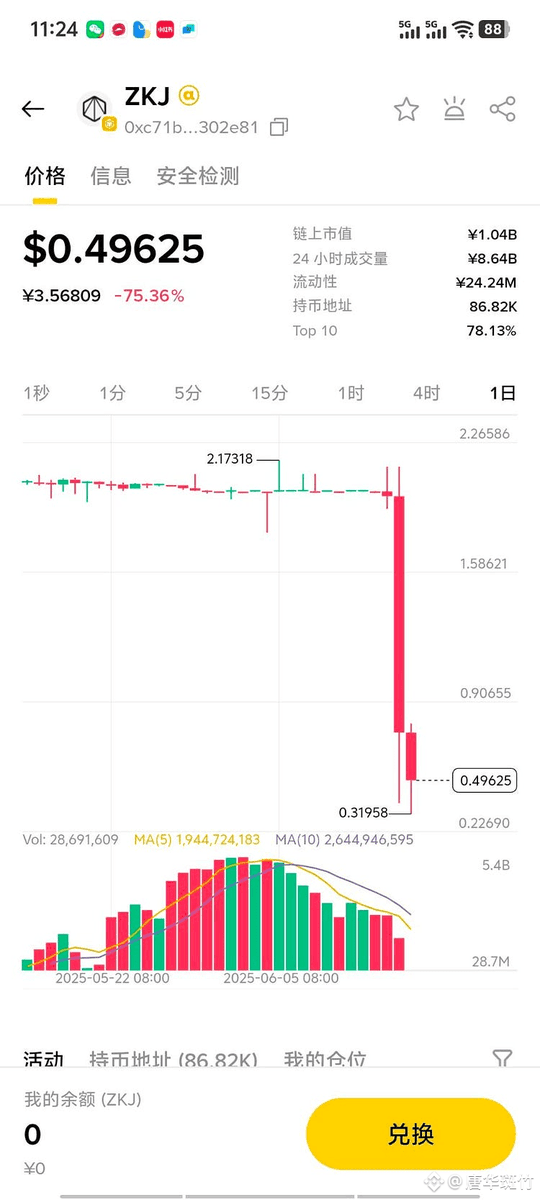

There is never a shortage of excitement in the currency circle, but behind the excitement is often a bloody lesson. The collapse of $ZKJ and $KOGE is like a well-designed harvest, with 90% of the market value evaporated, LP lost all their capital, and the contract was liquidated in a series of triggers, allowing countless people to experience what it means to "return the principal to zero" in just a few hours. The problem of this kind of project is very direct - there is no real support, it is purely maintained by liquidity and emotional speculation, once the large funds are withdrawn from the pool and sold, the price falls directly into the vacuum area, and there is no chance to escape.

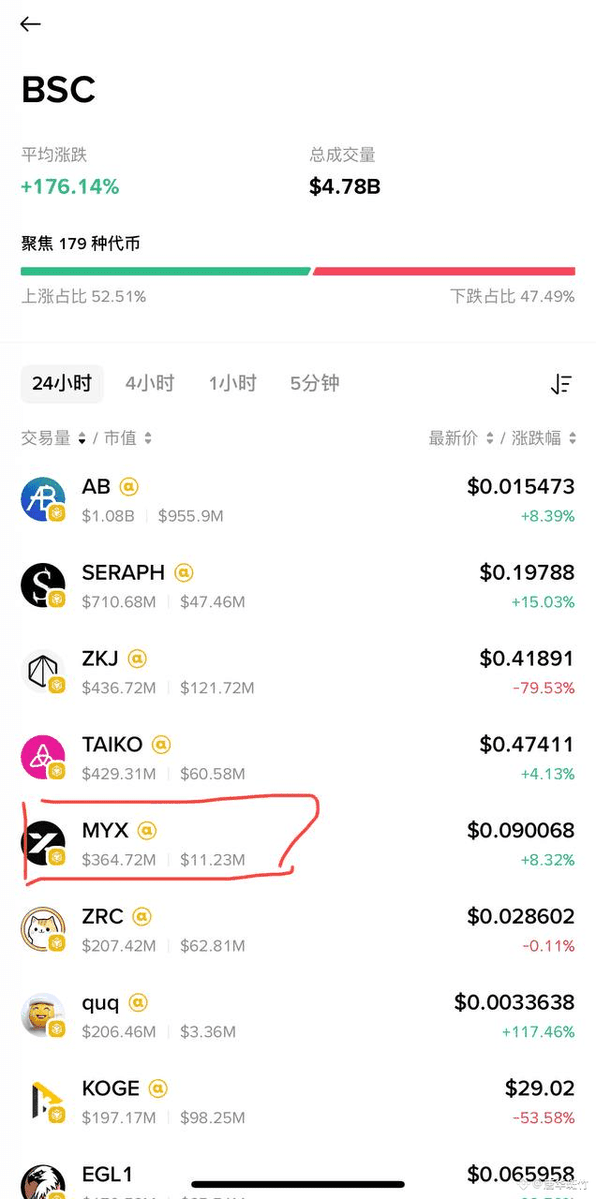

But the alpha strategy itself is right, and the wrong thing is to choose the wrong target. After the thunderstorm of ZKJ and KOGE, the market needed a real and reliable project that could withstand the pressure, and $MYX proved its value with data - not afraid of the thunderstorm, the trading volume ranked in the top five, the currency price fluctuated normally, and the pool depth was solid. This is not an accident, but the result of studios and users voting with their feet. In other words, when other projects are still playing the "run fast" game, MYX has become the most stable choice for brushing Alpha, just follow without brains!

Why can MYX withstand market pressure?

First of all, MYX is not an aircoin. It has the support of actual products, the team background is clear, and the market share has gained a firm foothold in the subdivided field. In contrast, ZKJ and KOGE have hardly any substantial business support other than trading volume and liquidity, and it is only a matter of time before they crash. The underlying logic of MYX is completely different - its pool depth and market value are reasonably matched, there is no excessive leverage or false liquidity, and the price stability of the currency is much higher than that of similar projects.

Secondly, MYX has extremely low wear and tear. After three rounds of quantitative testing, the loss of the principal is negligible, which means that long-term brushing of Alpha is extremely cost-effective. In order to attract traffic, many projects will give exaggerated incentives in the short term, but once the funds are withdrawn, the wear and tear will rise sharply, or even swallow the principal directly. MYX is clearly designed with more sustainability in mind than short-term hype.

Finally, MYX has a low circulating market capitalization, but the pool is thick enough. This combination means that the price of the currency has a lot of room to rise, but it is extremely difficult to smash the market downward. For an alpha strategy, this kind of underlying is almost perfect - both to stabilize the brush volume and to ambush potential gains. In contrast, although the pools of ZKJ and KOGE are deep, they are completely dependent on the opposite brush, and once the large funds are withdrawn, the liquidity will dry up instantly, and the currency price will collapse directly.

Studios and users have made their choice

After the ZKJ and KOGE crashes, many similar projects began to desperately pack new gimmicks in an attempt to attract traffic. But players who have actually experienced the crash have understood that a fancy story is not as good as solid fundamentals. MYX did not follow the hype, but won the trust of the market with real products and stable liquidity.

The numbers don't lie – after the crashes of KOGE and ZKJ, MYX's trading volume has been stable in the top five, because studios and users are voting with real money. For an alpha strategy, the most important thing is not short-term explosiveness, but long-term stability. With low wear, thick pools, and stable currency prices, MYX is one of the few targets in the market that can take into account both brush volume and principal safety.

If you're still struggling with which project to choose to brush Alpha, you might as well take a look at the market's options. The lessons of ZKJ and KOGE are deep enough, don't give money to the air disc anymore. MYX's pool, wear and tear and fundamentals have proven that it is the most reliable alpha target at this stage. Brainless to follow? Maybe that's the smartest thing to do.

#BinanceAlpha

Show original

61.11K

97

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.