Katana — A DeFi Layer-2 for Those Who Still Believe in Yield

If you’re exhausted by meme-driven L2s and unsustainable farming loops, Katana is a refreshing change of pace.

It’s a new chain that’s rebuilding DeFi from first principles — no short-term narratives, no gimmicks.

→ Real yield.

→ Tokenomics without inflationary spam.

→ Liquidity that stays on the chain.

Let’s dive into @katana through the lens of a DeFi purist 👇

#DeFi #Layer2 #KatanaNetwork #Polygon #Yield #vKAT #RealYield

1. Katana’s Narrative:

A “DeFi Layer” that rebuilds value creation from the ground up:

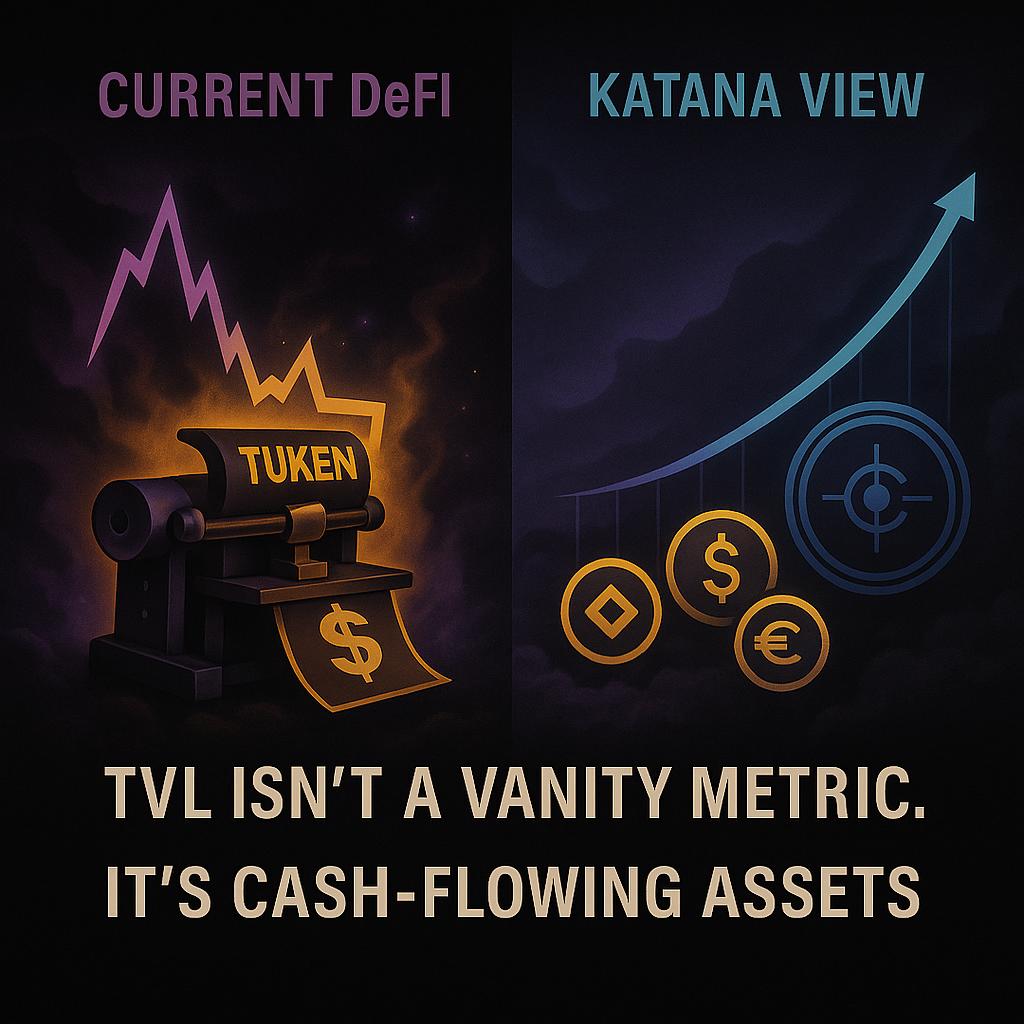

– TVL must generate real cash flows

– CoL (Cost of Liquidity): liquidity stays native, no leakage

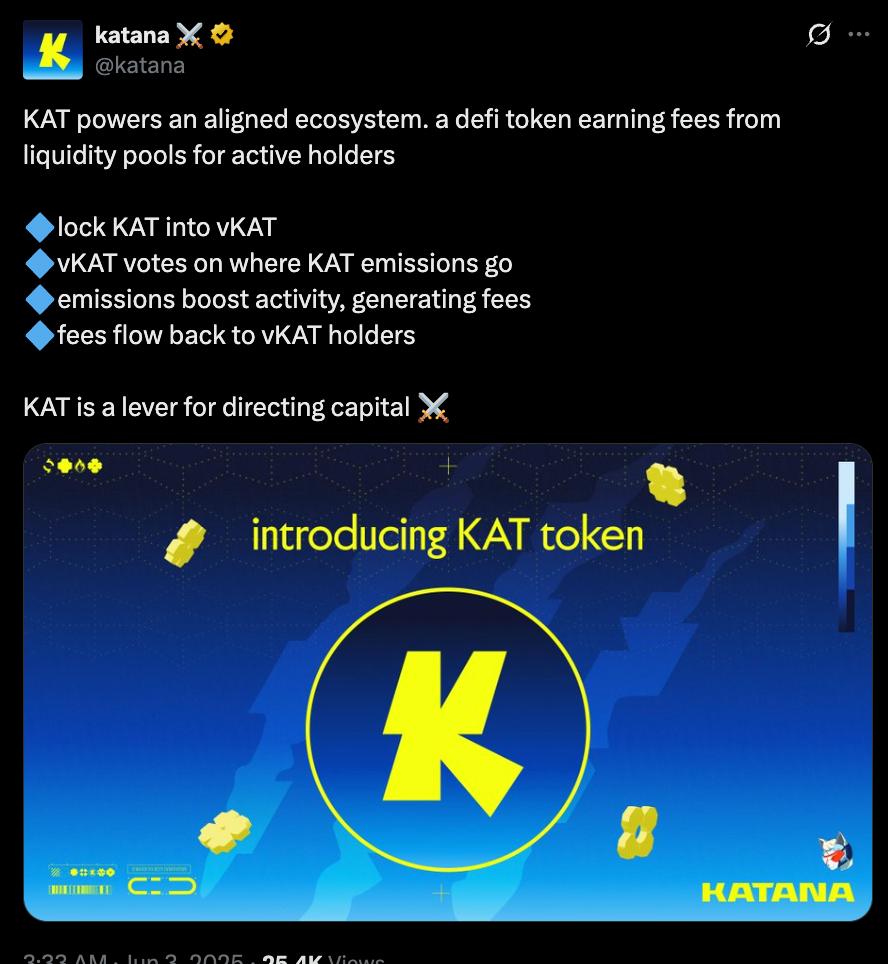

– vKAT coordinates incentives → governance without farm & dump spam

This isn’t just another chain for app deployment —

It’s a full reset of DeFi’s macro logic.

→ Katana’s overview post:

2. What’s wrong with DeFi today?

– Most yields are fake: print tokens → distribute → collapse

– TVL surges, locks… then exits

– Most L2s lack native apps → no liquidity retention

Katana sees the core issue — and focuses on fixing it.

3. Katana’s Solution Stack:

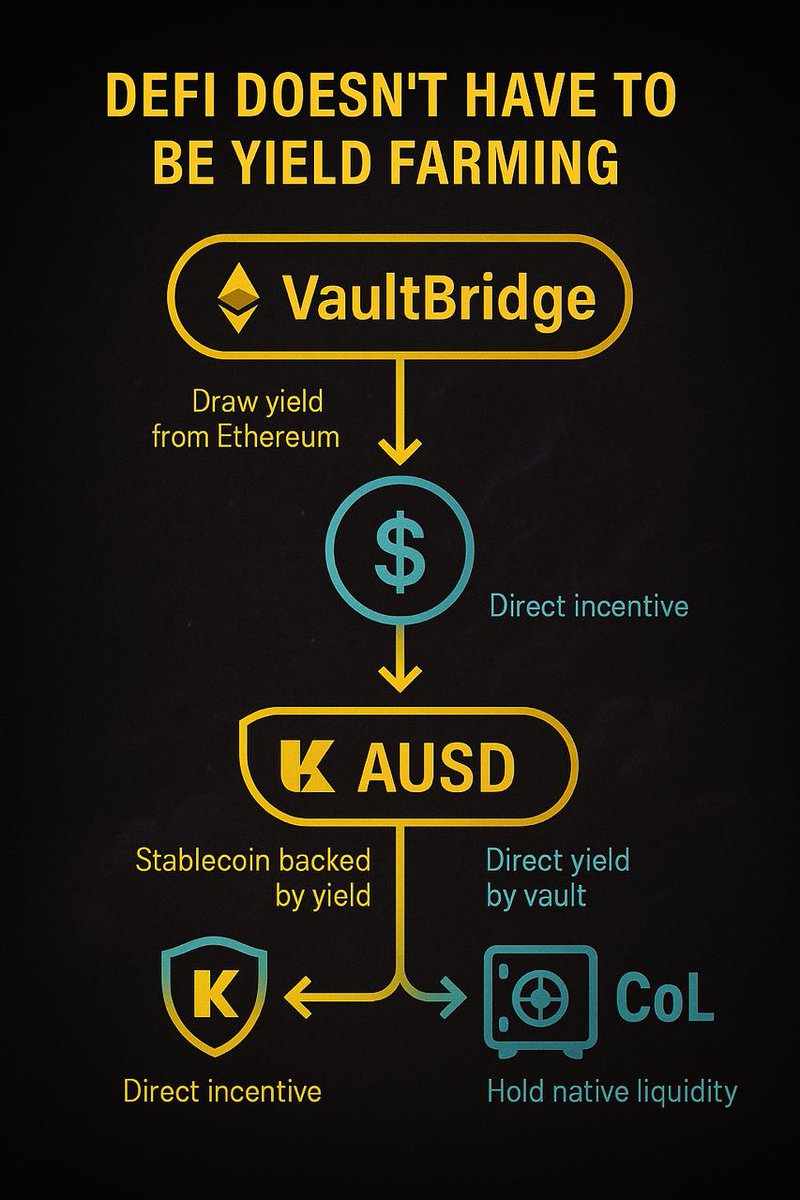

– VaultBridge: pulls real yield from L1

– AUSD: a stablecoin backed by productive assets

– CoL (Cost of Liquidity): aligns long-term liquidity with the chain

– vKAT: a system-wide incentive gauge for aligned rewards

No burns.

No over-farming.

Just a model that makes real yield sustainable.

4. Technical Architecture:

– CDK + opGeth, built on Polygon’s AggLayer

– zk-withdrawals for near-instant liquidity exits

– Mainnet expected in June 2025

→ A modular, fast, Ethereum-compatible L2 that doesn’t sacrifice usability.

5. Launch Strategy:

– Core apps already interested: Sushi, Morpho, Vertex

– Pre-deposit airdrop + POL staking

– vKAT extends ve(3,3) for rewarding real users

– No VC token inflation — value flows back to the community

6. Team & Backers

– Raised over $50M, backed by Polygon Labs, GSR, Atomico, and Northzone

– Supported by EU programs and integrated with Polygon’s AggLayer

– No early unlocks ahead of the community — allocation is reserved for real users, not insiders

→ Signals a long-term builder mindset — not chasing short-term cycles.

18.86K

96

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.