Too many bets get you sidelined:

1) How many end up sidelined

2) How I'm playing a bull cycle

3) What do I do from here?

I think the difference between me and others here is that I'm not trying to predict every single daily move.

1) How many end up sidelined

The probability of 1 bet playing out is higher than winning 10 bets. Losing bets along the way is okay, but they could ruin your higher-timeframe bet.

In this part of the cycle (since late 2023), in my opinion, the most profitable bet to make is that we will continue to rise higher in the cycle.

I wanted to bet on this by allocating early and selling at higher prices later in the cycle via spot exposure.

This is a bet that unfolds over a very long time frame and takes years to play out.

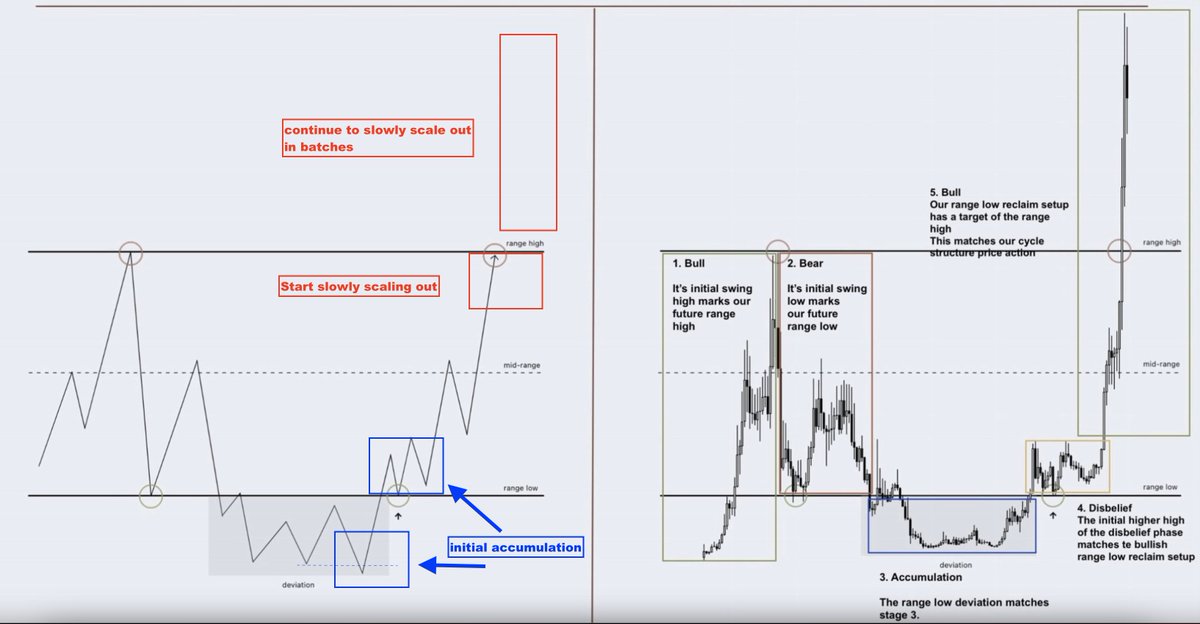

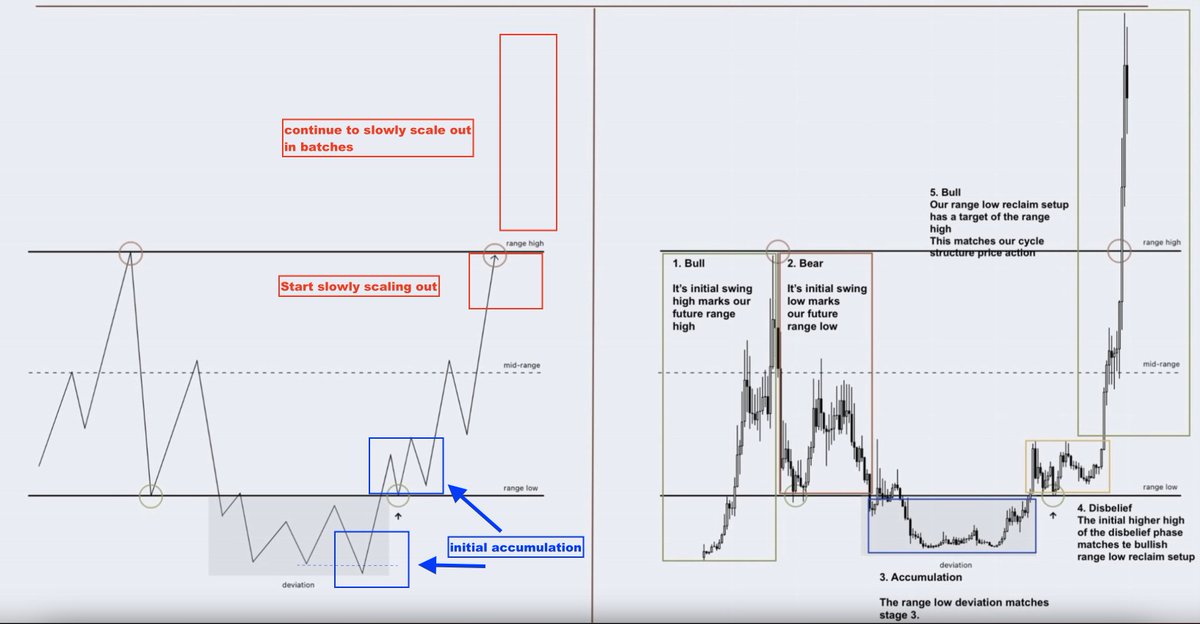

My process for this single bet:

1. Understand the cycle and deploy early in the cycle

2. Scale out slowly late in the cycle at higher prices

3. Mid-cycle -> rotation-style redeployment of unused funds still in the game

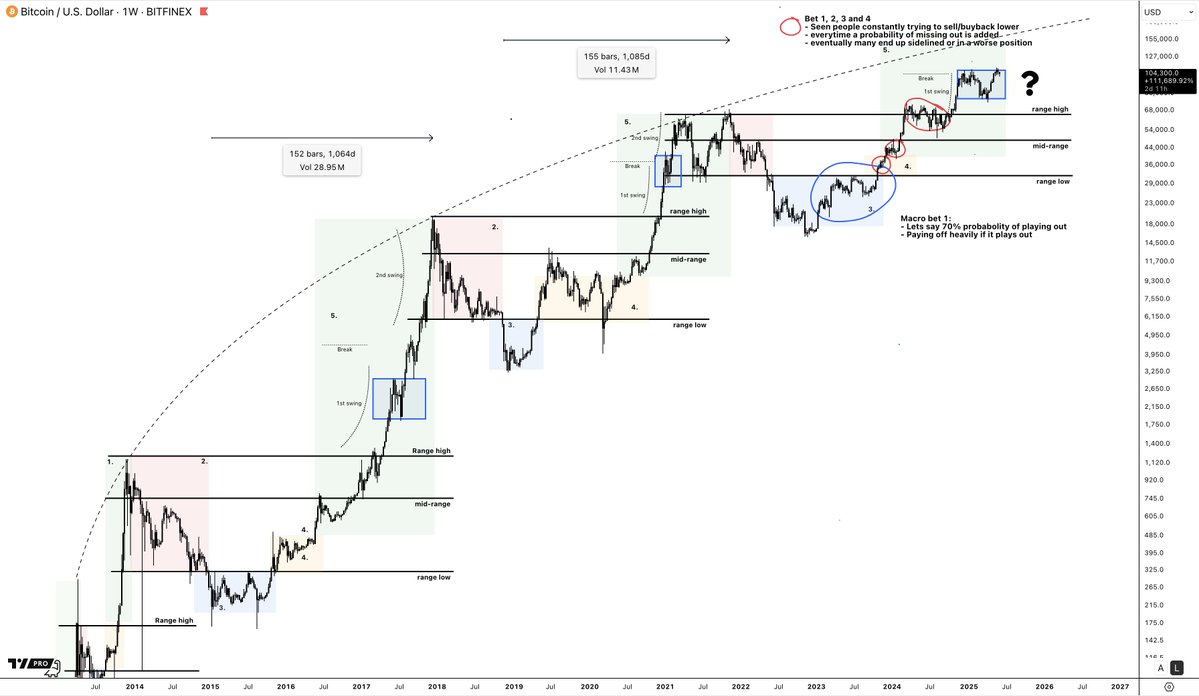

- Bitcoin and Total Altcoin Market cap charts will show the same range and cycle structure

- Most Altcoins will print a similar structure

Simply bet early, scale out at the upper range into price discovery.

As long as I execute well, I will win if this single, high-probability bet plays out. (already did to a certain extent)

But with every bet, regardless of how good you are, comes a certain probability that you are wrong.

Take enough bets, and everyone will be wrong at least once after a couple of bets, which is okay and perfectly fine.

But the problem here is that people often want to a) bet on the bull market and ride it up as far as possible, but b) also try to bet on all the ranges and fluctuations in between.

You can bet on the volatility in between, trying to sell a pullback, BUT if you do this with the majority of your exposure, you will inevitably be wrong at some point and miss out.

Will continue in the tweets below; 👇

A few extra notes to clarify some of the above:

- While betting on the HTF trend, I will not actively bet with my exposure on LTF moves.

- But, sir, my altcoins did nothing when the total 3 (total altcoin market cap) chart bounced from the range low. → Dilution makes it more challenging to pick the right altcoins, but it still has no bearing on my main cycle tactic. You have to put in the effort to catch the altcoins that are receiving attention and money inflow.

- But how about protecting capital/gains in case of LTF pullbacks? I scale out of assets, first the ones early in the cycle money flow (later more on this), once specific charts (BTC/total charts) are hitting the upper part of the range. These profits won't flow back in this cycle. Any downside, before or even after my first profit-taking levels, I'll eat.

2. How am I playing this bull cycle?

What do we know?

> We understand the different cycle stages: stage 3 is for accumulating spot holdings, stage 4 is for adding and holding, and stage 5 is for holding and scaling out slowly. Stages 2 and early Stage 3 are for more active LTF trading, while the others are for accumulation, holding, and scaling out.

> We know that the Bitcoin chart, total market cap, and total altcoin market caps are showing similar cycle structures. Use this to measure the entire crypto market and your exposure.

> When the total chart, or Bitcoin chart, gives you a trigger to get more exposed, → use the cycle/range structure from the Altcoin you want to buy to get in.

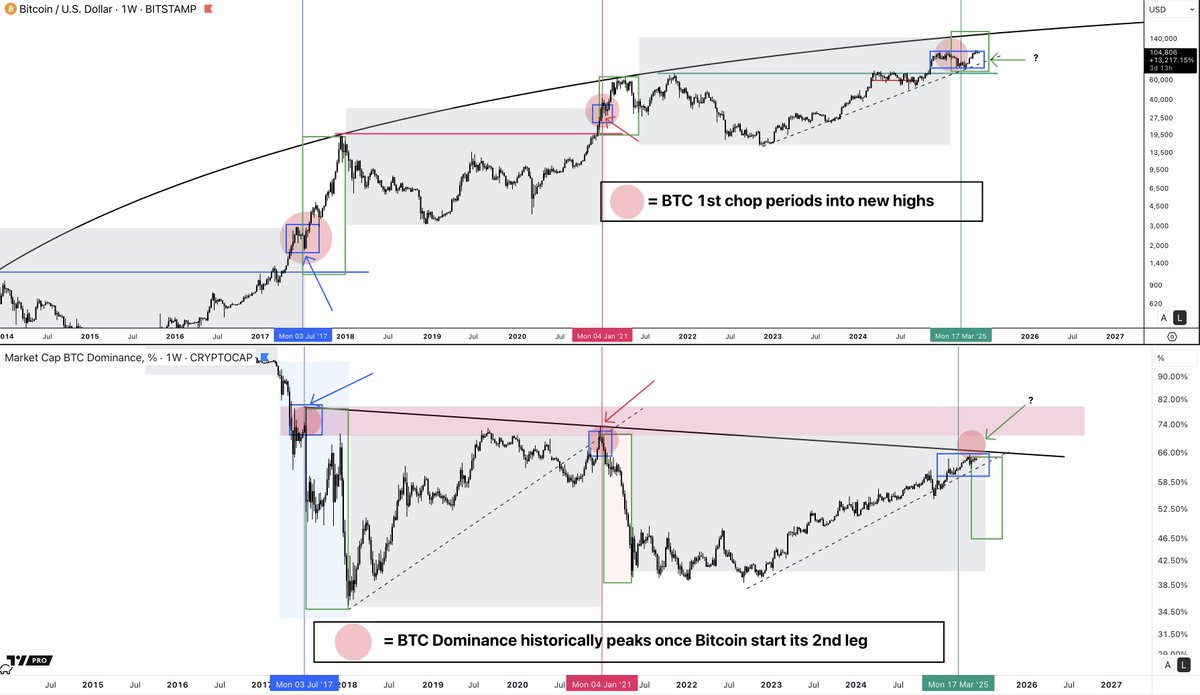

> We know BTC usually goes first, after that the major Altcoins like SOL and XRP (total 3 chart) followed at the tail end of the cycle by the rest of the Altcoins ('others' chart) (see chart below)

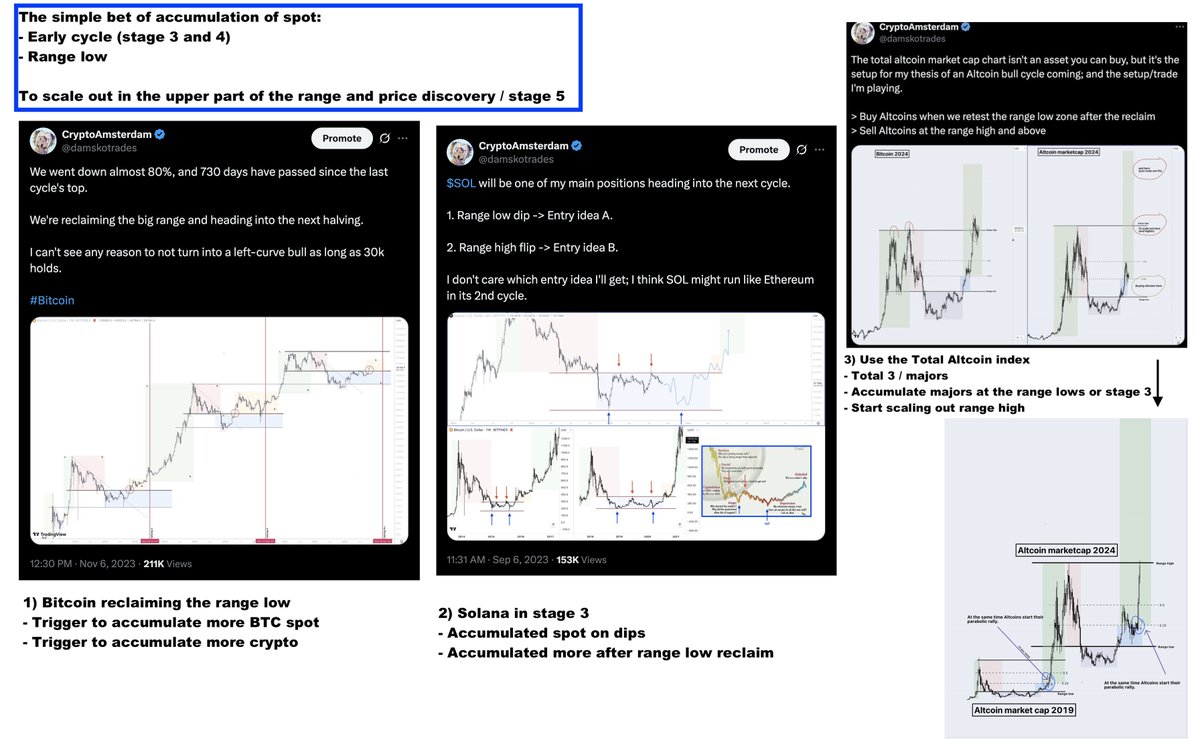

> How did I play this cycle so far?

Entry:

> Late 2023, we got triggers on the Bitcoin chart of being in stage 3 accumulation + later, with now a higher probability, a trigger after reclaiming the range low (stage 4)

> We knew BTC would go first, and majors would follow after → I used the Solana cycle chart to make it my second-largest position after Bitcoin.

> Later, we added Altcoins after the Total 3 chart hit the range low and aimed to slowly scale out starting from the upper part of the range and later in price discovery.

Profit taking & left over positions:

> Majors: Bitcoin and Solana were the major positions, and they started to hit their range high, so initial profit-taking has been done. I've cut the rest of Solana after breaking the market structure at $180. I'm still holding most of my Bitcoin, and will likely add a bit more than usual after a cycle into my longer-term stack.

> The profits taken there because cycle targets started to hit won't flow back in the cycle: protect gains and stop rotating at some point.

Sectors: I also got some meme and AI tokens, as they were the hottest sectors. Some did well and started to hit upper parts of the range, others stopped out, underperformed, or the meta changed, and I decided to close these positions. These funds are now being used or are ready to be used in the market again.

3. How will I play it from here?

Let me be clear:

I believe the best is yet to come for Altcoins, and I also think there's still upside for Bitcoin.

At the same time, I believe we are late in the cycle, and it's not the time to expose yourself in the same aggressive way as in 2023. Focus should also be on how you are going to scale out, and profits I have already taken out won't flow back in.

Mid-cycle rotations:

> As said, the available funds come from plays that didn't play out or funds in metas that lost attention.

> In the initial part of the bull (2023), my focus was on BTC and SOL as Bitcoin and majors usually go first, my focus now is on playing the catch-up of the 'others' market cap chart.

> Historically, Bitcoin dominance cracked down once Bitcoin starts its final and second leg into new highs.

TLDR:

Positioning after the first part bull:

> Profits majors have been taken → not going back in

> Still holding majority spot → planning to scale out on next market macro leg up

> Free funds from plays that didn't work out → planning to play the next leg through spot Altcoins plays

> How am I going to play the second part of the cycle?

As in the first part of the bull, I'm not planning to play the mini moves within the bigger trend.

The 'others' chart is still at the range low zone, and I'm interested in accumulating Altcoins here.

> Enter around range lows others chart

> Exit slowly over a longer period, starting once we hit the upper part of the range, range high → into price discovery

> Not all Altcoins will go → focus on what the market showed its interest in: AI, agents, etc, etc.

When do I accumulate?

> Keep it simple, and zoom out.

I don't care if we do something similar to what we did earlier this cycle and spend more time ranging. I'll accumulate slowly after deep red dips.

> Initial buys were after we broke the trendline at $81k, and added after the range low reclaim at $90.

> Focussed on: HYPE, ETH (because the chart is clean), and AAVE+CRV as stablecoin-related plays

> Planning to accumulate a bit more but will not do it here at the range high resistance: waiting for either deep pullbacks again, or a confirmed breakout and continuation.

> Mark out the HTF charts of your favorite altcoins, wait for the bitcoin pullback, and buy HTF support. OR if we don't pull back and confirm a Bitcoin range high breakout, → focus on the potential resistance reclaims/range low reclaims on these Altcoin charts.

Do not fomo at resistance or after green and stick to spot.

Ethereum as an example:

> BTC pullback (deep one maybe low 90s) → we can buy the macro range low support

> BTC no pullback → We can buy the 0.25 (range quarter resistance) breakout. (You can always cut if the BTC breakout fails, and Ethereum falls below)

> Will NOT cut my current Ethereum spot exposure (since Daily close above range low) because of being scared of a LTF move or trying to play a potential Bitcoin dip → this is the thing I meant with making too many bets and ending up sidelined.

Keeping it simple: range low reclaim setup → buying range low → scaling out upper part range, range high, and potentially above. Not playing around with moves within this setup.

Just wanted to explain why I can't answer the questions like 'do you think bitcoin will pull back to $[insert number] and ended up trying to explain my whole cycle tactic.

Hope you guys enjoy it. 🤝

43.94K

192

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.