Trying to wrap your head around what @veda_labs is?

Here’s the 5-minute breakdown I know you need on: what it is, how it works, and why it’s quietly becoming a foundational layer for yield across DeFi.

Let’s dive in 👇

At its core, Veda is infrastructure. Not a flashy app, not a points campaign machine, but the backend yield engine already powering colossus, like etherfi vaults, Mantle’s cmETH, Lombard’s LBTCv, and others.

Actually....You might have used it without even realizing it!

The problem it solves is simple: most protocols and chains want to offer users embedded yield, but building that infra in-house is complex, risky, and distracts from their core mission.

Veda steps in with tokenized vault infrastructure that abstracts strategy management, yield rebalancing, risk constraints, and capital allocation, all wrapped into plug-and-play vaults.

Protocols plug in Veda vaults to offer composable, tokenized yield, across ETH, BTC, USD, and altcoin primitives.

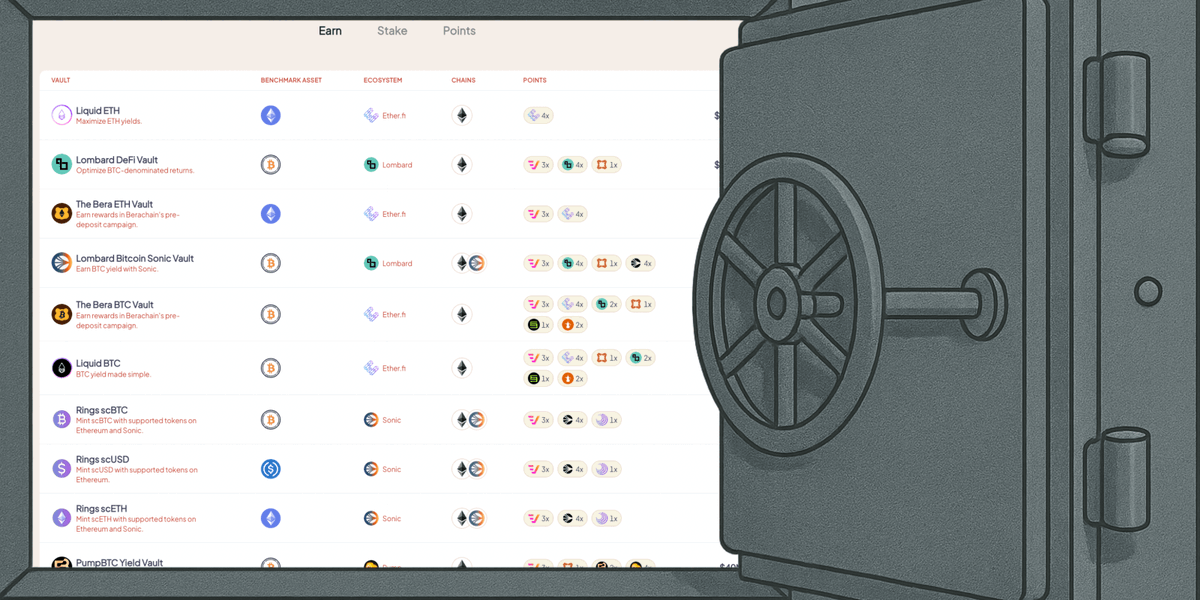

Veda now secures over $2.7B in TVL, while being

also the biggest on Defillama's "Onchain capital allocator" category, with major deployments in:

- cmETH vaults ($545M)

- liquidETH ($505M)

- eBTC BTC vaults ($397M)

- LBTCv by Lombard ($163M)

- weETHs and sETHFI vaults

(In case u want to dive deeper:

ETH-based assets make up 65%+ of total vault deposits, but Veda’s BTC and USD vaults are growing fast, with $710M in BTC strategies and $42M in USD yield vaults.

Importantly, Veda’s not limited to one chain. Vaults are deployed across Ethereum, Solana, Berachain, Base, Arbitrum, and more, with funds routed into protocols like Symbiotic, Karak, Aave, Uniswap, and wrapped BTC markets.

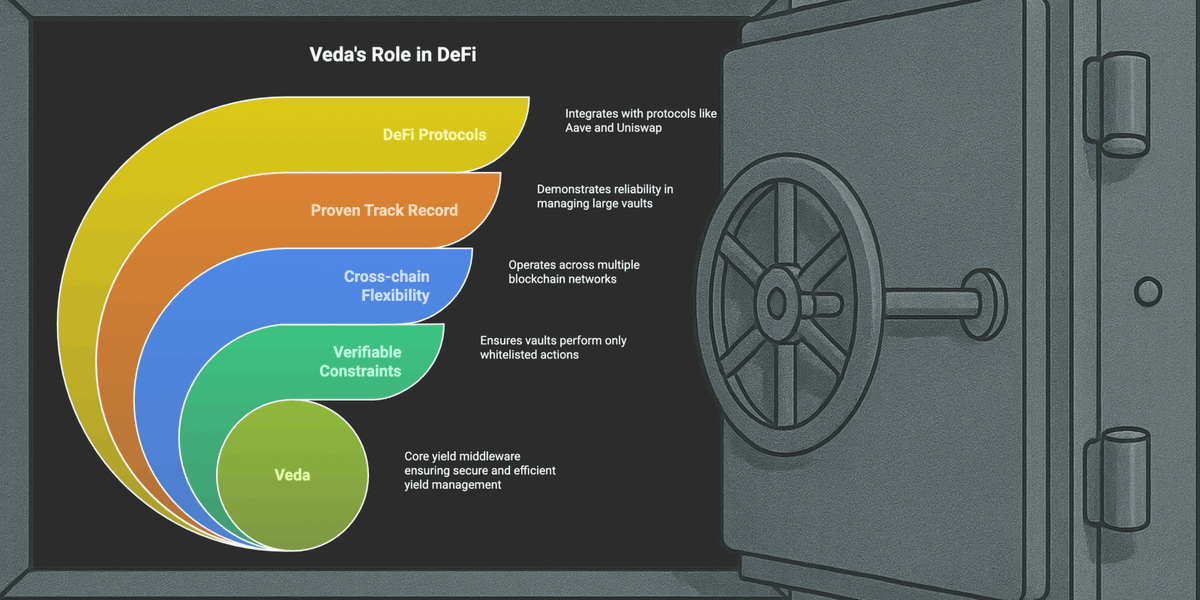

From what I’ve seen, their edge comes from 3 things:

→ Verifiable constraints (vaults can only do whitelisted actions)

→ Cross-chain flexibility

→ Proven track record in managing blue-chip vaults at scale

Whether it’s @SonicLabs, Rings , or @ether_fi, most teams I’ve spoken with use Veda to focus on UX and adoption, while delegating yield engineering to a team with the bandwidth and audit history to back it.

Some might even say that it feels like Veda is shaping up not only to be DeFi’s yield middleware but also its vault infrastructure can be used to create any type of structured DeFi product, which, in my opinion, is one of the pieces that connects real protocols with real yield, without exposing users to hidden risk or janky wrappers.

PS: eBTC is the first ever vault token to go live on Aave

And as L2s, RWAs, and restaking assets start embedding native yield by default, Veda might just become a core dependency layer. One you don’t see, but that everything runs on.

101.83K

82

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.