Why do POS projects not have the stability of POW and have a high market cap?

Because the POS and these additional coins are all printed out of thin air

It's all for nothing, and when it is printed, it will definitely be smashed directly

And pow each coin is dug up with real money and at risk

Miners will value coins more than they spend their money on

Can it be the same? So, I'm still very bullish on PoW coins

It's hard for me to say if the cottage season will come if you ask me

But if Bitcoin continues to skyrocket, then there will inevitably be a big wave of high-quality POWs

What's left of POW?

What other cryptocurrencies are POW-based?

New leeks may not yet know what POW and POS are

I think it's good to get to know it

Bao Er Ye also said that POW is the white moonlight in his heart

Pick a POW coin to buy some in case you get rich?

-

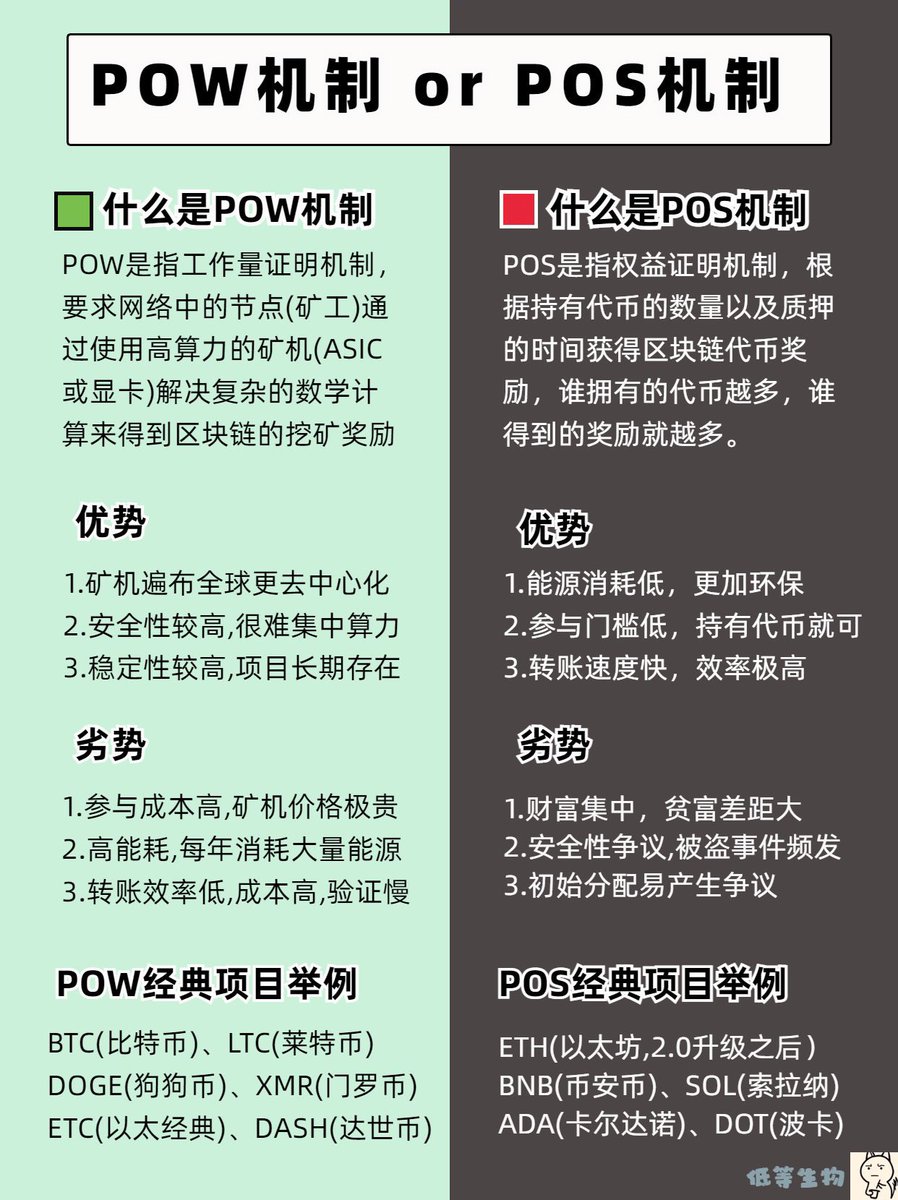

POW is a proof-of-work mechanism, which means that it requires mining rigs to produce coins, and there are very few tokens that still use POW

POS is a proof-of-stake mechanism, by staking tokens is equivalent to mining, the more tokens you own, the greater the return, and now 99.99% of coins are in this mode

Some people say that POW has brought a lot of energy waste and is no longer suitable for this world, in order to improve environmental protection and efficiency, POS is the general trend

Some people say that POW is a coin generated by graphics cards and pure CPU or mining machine mining is more proof that the whole people participate in bookkeeping and the whole people witness. If the founder is gone; The exchange ceased trading; These coins will still have a certain value, because they were produced by the whole people. These coins are priceless in the hearts of every miner.

-

Personally, I think that the POW model is advocated by Satoshi Nakamoto The traditional blockchain model requires a huge cost, and it takes thousands of miners to maintain a blockchain ledger, and it requires a lot of mining machines and energy.

If a new token adopts this model, it will be difficult to survive, not to mention the high cost of mining machines and the high cost of the project party, and it will be difficult for even leeks to generate consensus

Therefore, in the eyes of the project team, POW needs a huge amount of cost, a colourful plot and story, and a large number of mining machines

The POS only takes a few minutes to create a token, and the rest is all done by flickering

Therefore, 99.99% of the projects now are in POS mode

But then again, 0.01% of projects are POW

Let's take a look at what these projects are

1.BTC

Bitcoin is the world's first cryptocurrency, and the highest value of a single currency has already broken through 7W dollars, and one coin and one villa may become a reality. You can only buy an integrated mining machine to mine, which is very expensive and consumes a lot of electricity.

2.DOGE

Dogecoin is the most successful meme, and Bitcoin is the same pow model, and Litecoin is mined with the same mining machine, why 90% of memes are called dog? Because Dogecoin is so famous, even the founder gave up, but was directly taken away by the richest man, and Dogecoin is equivalent to Bitcoin in meme

3.LTC

Litecoin has occupied the second place in market value for many years, and now it has fallen to the altar, and the price of the currency is gone, and the market value has fallen from the second to more than 20th. Litecoin is also Pow like Bit, and Dogecoin uses the same mining machine for mining, after all, it is the second brother, and the dog had to imitate it when he saw it.

4.ETC

In 2016, Ethereum was stolen after the hard fork The new chain is the famous ETH, and ETC is the original chain before the fork, the project emphasises that ETC is the real Ethereum, I feel that most of it is because of money to promote it, ETH has long been changed to POS, and ETC insists on using POW, which is currently generated by graphics card mining, and the cost of electricity is huge.

The first time because of theft, I forked ETC

The second upgrade of the POS forked ETHW again

As for why so many forked coins are generated

I think it's because of money and people's desires, after all, ETH is so successful that it will take a long time to rub it.

5.BCH

Known as the prince coin, Bitmain (mining machine dealer) led by the great work, is produced by the Bitcoin fork, is the most successful one of the countless Bitcoin fork coins, the most glorious time The currency price once replaced Bitcoin to become a brother, giving people a feeling that the prince was about to ascend the throne after a successful rebellion, but there are still more people with positive energy in the currency circle, and they are firmly optimistic about BTC, so BCH failed to rebel, and the price plummeted, falling from 4,000 to several hundred.

BCH advocates the concept of large blocks, which can be regarded as an improved version of Bitcoin, which uses the same mining machine as Bitcoin.

6.BSV

This is a fork of BCH, interesting, BTC forked BCH out, and then the BCH team had infighting, and then forked BSV from BCH, and its founder Satoshi Omoto has always claimed that he is the real Satoshi Nakamoto, and said that BSV is the real Bitcoin. However, it has not received enough recognition so far.

7.XMR

Monero is currently the most well-known privacy coin, but also the CPU mining handle, CPU mining big brother, but also the favourite of hackers, any computer in the Trojan, as long as you write a piece of code for hackers free mining forever, because as long as there is a CPU computer can mine Monero, the most outrageous is Monero's transfer records are completely private, can not find the identity, is overloved by hackers, the hard currency in the dark web, because it is too famous to be banned by some government agencies, It has been delisted from a number of well-known exchanges.

There is a small story, once Bitmain came out with a professional mining machine, which can mine Monero with large computing power, in the past, only the CPU could mine Monero, after this mining machine came out, the CPU was cold, and the Monero team was angry, Lao Tzu CPU mining Dig well You make trouble for me, and directly hard forked the new coin, making the Monero mining machine a scrap metal

Result: To appease the many people who bought the mining rigs

Bitmain has hard-forked a coin XMC (known as Monroe Classic, ETC is called Ethereum Classic) to make these people who bought mining rigs a little blood, and they can dig things anyway, and then they will be gone.

8.DASH

DASH is a well-known old mining coin similar to Monroe, but it is mined by a professional mining machine, and now it has fallen quite badly.

9.ZEC

Zcash is also a privacy coin All transaction records can only be viewed by private key holders, mined by professional mining machines, and now it has fallen very badly.

10.KAS

After ETH was transferred to pos, KAS quickly occupied a part of the computing power and began to skyrocket, which has risen hundreds of times, and was produced by graphics card mining, and the early mining has doubled, and now the market value is 4 billion US dollars.

-

Bitcoin (BTC) market capitalisation: $1,250 billion

Dogecoin (DOGE) market cap: $15.7 billion

Litecoin (LTC) has a market cap of $5 billion

Ethereum Classic (ETC) market capitalisation: $2.8 billion

Bitcoin Cash (BCH) market cap: $6.77 billion

BSV market cap: $968 million

Monero (XMR) market cap: $3.182 billion

Dash (DASH) market cap: $300 million

Zcash (ZEC) market cap: $450 million

KAS market capitalisation: $4 billion

-

Author: An NPC with a story

Please indicate the source ^_^ below

8

181.97K

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.