chennvshi

chennvshi

2Following

129Followers

(1) Mainly do BTC contracts

(2) Each open position comes with a take-profit and stop-loss + moving take-profit

(3) Mainly grasp the medium and long-term trend of BTC, (smart copy is recommended)

(4) Note that ❗ when filling in the copy amount, remember to close the copied position

Show original

Overview

Futures trades

Spot trades

Bot trades

Performance

Ongoing orders

History

Copy traders

Trading performance

Days w/ profit131Days w/ loss138

Win rate

48.70%Profit/Loss ratio

0.96:1Average position value

3,721.25Lead trader overview

Days leading trades

272Lead trade assets (USDT)

10,340.29AUM

100.00Current copy trader PnL (USDT)

-159.98Copy traders1/50

Profit-sharing ratio

10%Copy traders

Cumulative total89

Change in last 7 days

--(+0.00%)

a

a1725236892+40.74

2

206***@qq.com+37.27

1

132***@163.com+30.98

4

+30.58

5

+21.84

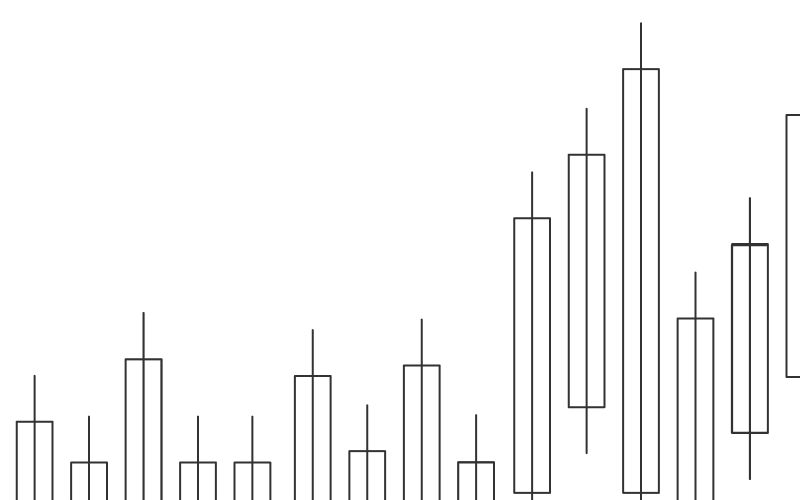

Weekly PnL

PnL%

PnL

PnL%

PnL%

PnL

Crypto preferences