灰太狼安全自有资金

灰太狼安全自有资金

1Following

10Followers

1. futures transaction only open a position with 10% of all funds at a time.

2. Wide stop loss (generally the stop loss is placed outside 2% of the new high/new low, if the opening position is placed farther away from the new high/new low, the stop loss margin may be larger).

3. Buddhist billing, and strive for stable profits.

4. Keeping the principal and staying alive is the first thing.

Show original

Overview

Futures trades

Spot trades

Bot trades

Performance

Ongoing orders

History

Copy traders

Trading performance

Days w/ profit120Days w/ loss133

Win rate

47.43%Profit/Loss ratio

0.21:1Average position value

4,522.27Lead trader overview

Days leading trades

608Lead trade assets (USDT)

3,697.52AUM

0.00Current copy trader PnL (USDT)

0.00Copy traders0/50

Profit-sharing ratio

2%Copy traders

Cumulative total0

Change in last 7 days

--

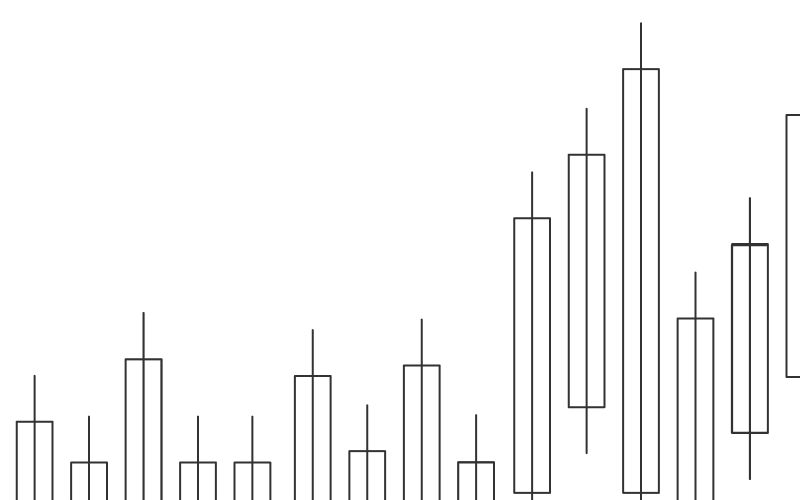

Weekly PnL

PnL%

PnL

PnL%

PnL%

PnL

Crypto preferences