Little-ReFi-Rhino

L

Little-ReFi-RhinoAPI

0Following

224Followers

Please read the following strategy introduction before copying! If you can't last for half a month, don't copy!

It doesn't take a few days to double here, there are only stable monthly gains and low drawdowns.

Monthization 20%-50%, maximum drawdown less than 20%.

The program splits into small trades, so our slippage is the same, and the profit is the same.

Latest optimization: Removed some small-capitalization coins (some time ago, a certain security frequently delisted coins), and improved stability

Strategy Explanation: Hedging by counting the correlation of multiple trading pairs. So there will be more than a dozen positions hedged at the same time. Risk exposure is severely limited.

There is a correlation between currency pairs, don't do it yourself! Don't do it yourself!

Most of the time, the income is in a state of volatility and slow rise, and there will be a wave of explosive rise in 1-2 weeks, please hold firmly.

Fearless of the ups and downs of the market, stable income.

Please follow the order for at least half a month, don't chase the rise and fall, and take you to make stable profits.

Show original

Overview

Futures trades

Performance

Ongoing orders

History

Copy traders

Trading performance

Days w/ profit50Days w/ loss33

Win rate

60.24%Profit/Loss ratio

1.50:1Average position value

230.52Lead trader overview

Days leading trades

83Lead trade assets (USDT)

146,394.48AUM

50,639.04Current copy trader PnL (USDT)

3,314.38Copy traders16/50

Profit-sharing ratio

10%Copy traders

Cumulative total58

Change in last 7 days

9(+18.37%)

5

544***0982+711.15

3

395***@qq.com+642.43

晴

晴天gg+468.05

4

+408.71

5

烟

烟火过境2+358.88

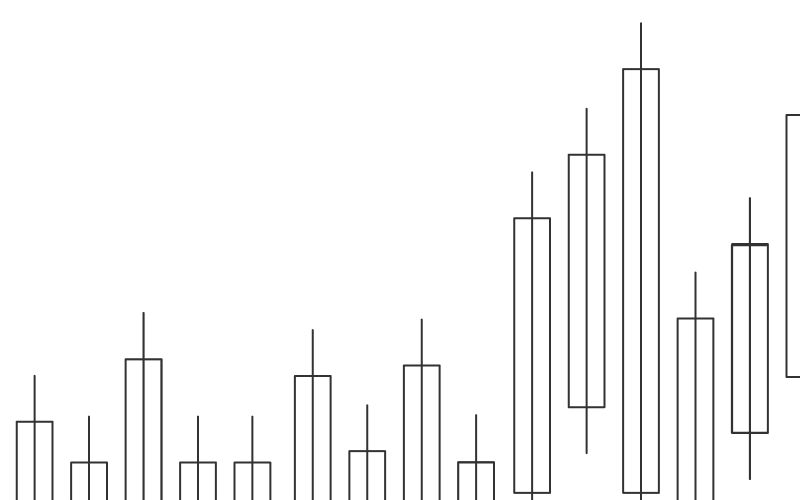

Weekly PnL

PnL%

PnL

PnL%

PnL%

PnL

Crypto preferences