Low-Custody-Okra

L

Low-Custody-Okra

2Following

0Followers

From the stock K-line to the futures leverage, to the day and night fluctuations of spot gold and silver, I have practiced a "sense of disk" and "discipline" in the traditional financial field - I have also carried orders after blowing up positions, and finally learned to engrave "risk control" into every open position. In the past three years, I have switched to virtual currency contracts, from BTC to ETH, witnessing the madness and rationality of the crypto market, and I also understand the game of "trend" and "emotion" better.

Trading for me is a dual cultivation of data and mentality: do not chase hot spots, only believe in logic; Don't bet on luck, just probability. Now I still maintain the habit of daily review and iterative strategy, after all, the market is always changing, but "fear of risk."

Adhere to the daily review of transaction records, iterate the two-factor model of "volatility filtering + capital flow monitoring", and control the maximum drawdown within 12% in the past year. Always take "survive to win" as the iron law, refuse high-leverage gambling, and focus on sustainable compound interest

Show original

Overview

Futures trades

Performance

Ongoing orders

History

Copy traders

Trading performance

Days w/ profit1Days w/ loss2

Win rate

33.33%Profit/Loss ratio

0.95:1Average position value

13,959.10Lead trader overview

Days leading trades

3Lead trade assets (USDT)

27.32AUM

0.00Current copy trader PnL (USDT)

0.00Copy traders0/50

Profit-sharing ratio

5%Copy traders

Cumulative total0

Change in last 7 days

--

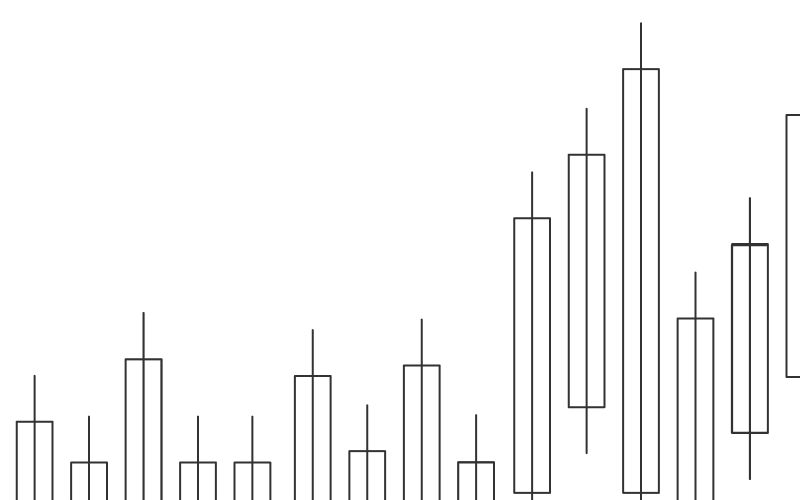

Weekly PnL

PnL%

PnL

PnL%

PnL%

PnL

Crypto preferences