MartingaleMastery

MartingaleMastery

1Following

34Followers

Strategy classification:

1. The long-term strategy was tested and survived and arbitraged in the BTC crash of May and November '21 and April '24. Earn a steady revenue with these strategies.

2. The short-term strategy (< 30 days) is based on the recent cryptocurrency, stock market and economic environment, maintaining a low drawdown while maximizing gains. These strategies are riskier than the long term, and I will turn on/off them in a timely manner depending on the marketplace conditions.

Control Risks:

During the testing period, > 30% margin to maintain the survival of the bot.

Personally, I take the safe route and use a higher margin. Margin Conversion:

10X Leverage: 100% of the initial investment

Don't use "Auto-conversion margin". I personally tested that it will be flattened when there is a lot of volatility.

If you have any questions, please contact us by email:

humble.sculls.0r@icloud.com

Show original

Overview

Futures trades

Spot trades

Bot trades

Performance

Ongoing orders

History

Copy traders

Trading performance

Days w/ profit173Days w/ loss159

Win rate

52.11%Profit/Loss ratio

2.59:1Average position value

1,325.40Lead trader overview

Days leading trades

342Lead trade assets (USDT)

47,233.74AUM

5,173.87Current copy trader PnL (USDT)

2,308.86Copy traders3/50

Profit-sharing ratio

8%Copy traders

Cumulative total23

Change in last 7 days

2(+9.52%)

+1,748.32

+478.85

+1.29

4

+0.91

5

+0.42

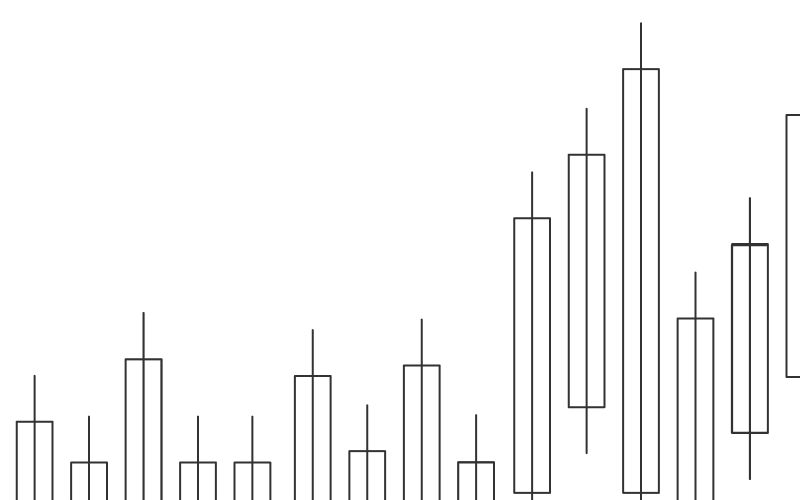

Weekly PnL

PnL%

PnL

PnL%

PnL%

PnL

Crypto preferences