The pro-crypto policy promotes the RWA narrative of U.S. stocks, interpreting the opportunities and challenges of tokenized stocks

Abstract: As Trump's policies are being fulfilled one by one, attracting manufacturing backshore through tariffs, actively detonating the stock market bubble and forcing the Federal Reserve to cut interest rates and release water, and then promoting financial innovation and accelerating industrial development through de-regulatory policies, this combination is really changing the market. Among them, the RWA track under the favorable de-regulatory policy has also attracted increasing attention from the crypto industry. This article focuses on the opportunities and challenges of tokenized stocks.

An overview of the history of tokenized stocks

In fact, tokenized stocks are not a new concept, since 2017, the attempt to STO has begun, the so-called STO (Security Token Offering, security token issuance) is a financing method in the field of cryptocurrency, its essence is to digitize the rights and interests of traditional financial securities, put them on the chain, and realize the tokenization of assets through blockchain technology. It combines the compliance of traditional securities with the efficiency of blockchain technology. As an important security class, tokenized stocks are the most interesting application scenario in the STO space.

Before the advent of STOs, the mainstream financing method in the blockchain space was ICO (Initial Coin Offering). The rapid rise of ICOs mainly relies on the convenience of Ethereum smart contracts, but the tokens issued by most projects do not represent real asset rights, and there is a lack of supervision, resulting in frequent fraud and runaways.

In 2017, the U.S. SEC (Securities and Exchange Commission) issued a statement in response to the DAO incident, stating that certain tokens may be securities and should be regulated under the Securities Act of 1933. This was the starting point for the official germination of the STO concept. In 2018, STO became popular as a "compliant ICO" concept and began to attract attention in the industry. However, due to the lack of unified standards, poor liquidity in the secondary market, and high compliance costs, the market has developed slowly.

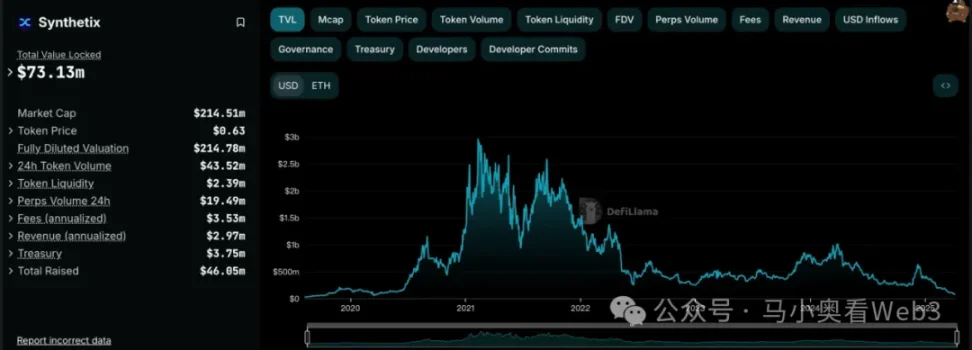

With the advent of the DeFi Summer in 2020, some projects have begun to try to create derivatives pegged to the stock price through smart contracts through decentralized solutions, allowing on-chain investors to directly invest in the traditional stock market without the need for complex KYC processes. This paradigm, often referred to as the synthetic asset model, does not directly own U.S. stocks, and does not require trust in a centralized authority for trading, bypassing expensive regulatory and legal costs. Representative projects include Synthetix and Mirror Protocol in the Terra ecosystem.

In these projects, market makers can provide on-chain synthetic U.S. stocks by providing excess cryptocurrency collateral and providing market liquidity, while traders can gain price exposure to the anchored stocks by trading these underlying stocks directly through the secondary market in the DEX. I still remember that the stock in the U.S. stock market at that time was still Tesla, not Nvidia in the previous cycle. As a result, most of the projects slogan have a selling point of trading TSLA directly on-chain.

However, judging from the final market development, the trading volume of synthetic U.S. stocks on the chain has been unsatisfactory. Taking sTSLA on Synthetix as an example, counting the minting and redemption in the primary market, the total cumulative on-chain transactions are only 798. Later, most of the projects claimed that due to regulatory considerations, they would remove synthetic assets from the U.S. stock market and turn to other business scenarios, but the essential reason is likely to be that they did not find PMFs and could not establish a sustainable business model, because the premise of the establishment of synthetic asset business logic is that there is a large demand for on-chain transactions, attracting market makers to mint assets through the primary market and earn fees for market making in the secondary market, and if there is no such demand, market makers will not only be unable to obtain income through synthetic assets. At the same time, it also has to bear the risk exposure brought by synthetic assets, which is short-anchored to U.S. stocks, so liquidity will also shrink further.

In addition to the synthetic asset model, some well-known CEXs are also experimenting with the ability to trade U.S. stocks for crypto traders through a centralized custody model. This model has a third-party financial institution or exchange that escrows the actual stock and creates a tradable underlying directly in the CEX. The more typical ones are FTX and Binance. FTX launched a tokenized stock trading service on October 29, 2020, partnering with German financial firm CM-Equity AG and Switzerland's Digital Assets AG to allow users in non-US and restricted regions to trade tokens pegged to shares of U.S.-listed companies, such as Facebook, Netflix, Tesla, Amazon, and others. In April 2021, Binance also began offering tokenized stock trading services, with Tesla (TSLA) being the first to list.

However, the regulatory environment at that time was not particularly friendly, and the core sponsor was CEX, which meant that it had formed a direct competition with traditional stock trading platforms, such as Nasdaq, and naturally came under a lot of pressure. FTX saw an all-time high in tokenized stock trading volume in Q4 2021. Among them, the trading volume in October 2021 was $94 million, but after its bankruptcy in November 2022, its tokenized share trading service was discontinued. Binance, on the other hand, announced in July 2021 that it would cease its tokenized stock trading services just three months after launching the business.

Since then, as the market has entered a bear market, the development of the track has also come to a standstill. It wasn't until Trump's election that his de-regulated financial policies brought about a shift in the regulatory environment and renewed interest in tokenized stocks, but at this time it had a new name, RWA. This paradigm emphasizes the introduction of compliant issuers to issue tokens on the chain that are 1:1 secured by real-world assets through a compliant architectural design, and the creation, trading, redemption, and management of the collateral assets are strictly in accordance with regulatory requirements.

The current state of the market for the stock RWA

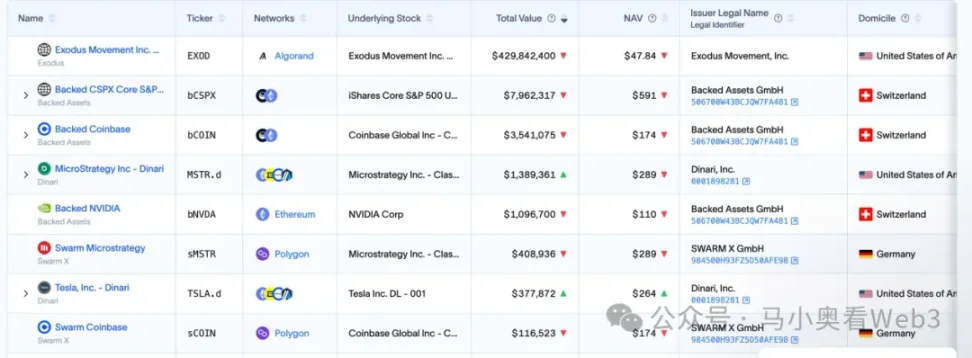

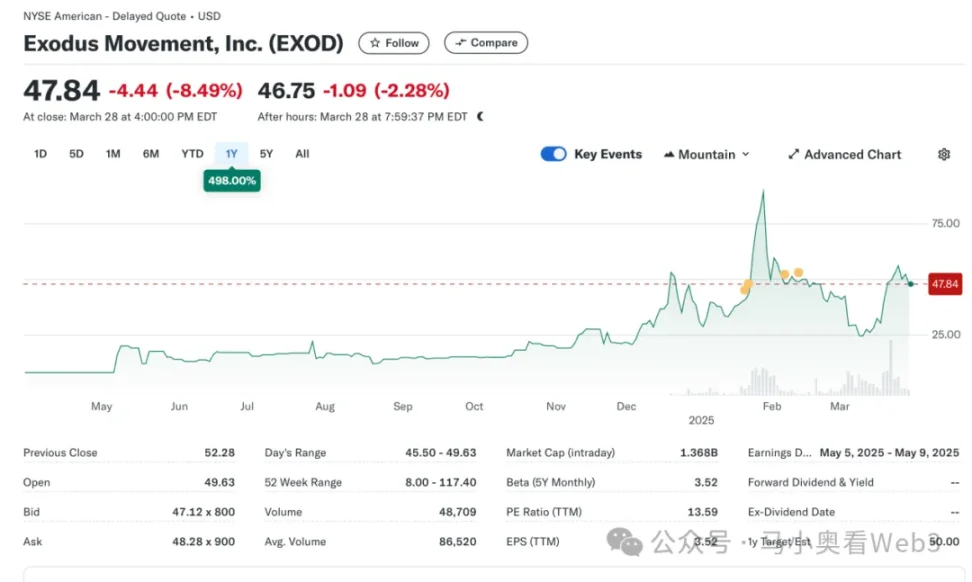

So let's take a look at the current state of the stock RWA market. Overall, the market is still in its early stages and is still dominated by US equities. According to RWA.xyz, the current total issuance in the stock RWA market reached $445.40M, but it is worth noting that $429.84M of that issuance is attributed to an underlying EXOD, which is an on-chain stock issued by Exodus Movement, Inc., a software company focused on developing self-custodial cryptocurrency wallets, which was founded in 2015 and is headquartered in Nebraska, USA. The company's shares are listed on the NYSE America Stock Exchange and allow users to migrate their regular Class A shares to the Algorand blockchain for management, where users can view the price of these on-chain assets directly on the Exodus Wallet, which currently has a total market capitalization of $1.5B.

The company also became the only company in the U.S. to tokenize its common stock on the blockchain. However, it is worth noting that the on-chain EXOD is only an on-chain digital identifier of its stock, and does not contain voting, governance, economic, or other rights, and the token cannot be directly traded and circulated on the chain.

The event is somewhat symbolic, marking a clear shift in the SEC's attitude towards on-chain equity assets, and in fact Exodus' attempt to issue on-chain shares has not been smooth sailing. In May 2024, Exodus filed an application for the tokenization of common shares for the first time, but the initial rejection of the listing plan was due to the fact that the SEC's regulatory policy did not change at that time. But then, in December 2024, after continuous improvements in technical solutions, compliance measures, and information disclosure, Exodus finally received SEC approval and successfully completed the listing of common stock tokenization. The event also sent the company's stock into a cult market with prices reaching all-time highs.

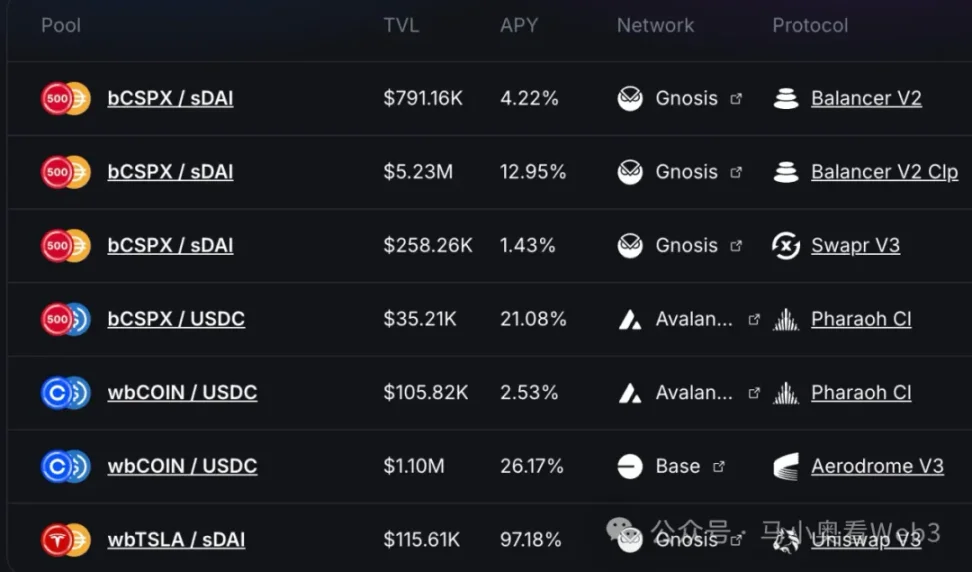

In addition, the remaining approximately $16M of market share is mainly attributed to a project called Backed Finance. This is a Swiss company that operates through a compliant architecture that allows users who meet KYC requirements to mint on-chain stock tokens through its official primary market, pay USDC, and after receiving crypto assets, exchange back to USD, and buy COIN shares in the secondary market, (there may be some delays due to stock market opening hours in the middle), after the purchase is successful, the shares are managed by a Swiss custodian bank, and then 1:1 mint bSTOCK token is sent to users. The redemption process is reversed. The Reserve Asset Security Guarantee is a regular release of Reserve Certificates in partnership with an audit firm called Network Firm. On-chain investors can purchase such on-chain stock assets directly through DEXs such as Balancer. In addition to this, Backed does not provide ownership of the underlying assets or any other additional rights, including voting rights, to holders of stock tokens. And only users who have passed KYC can redeem USDC through the primary market.

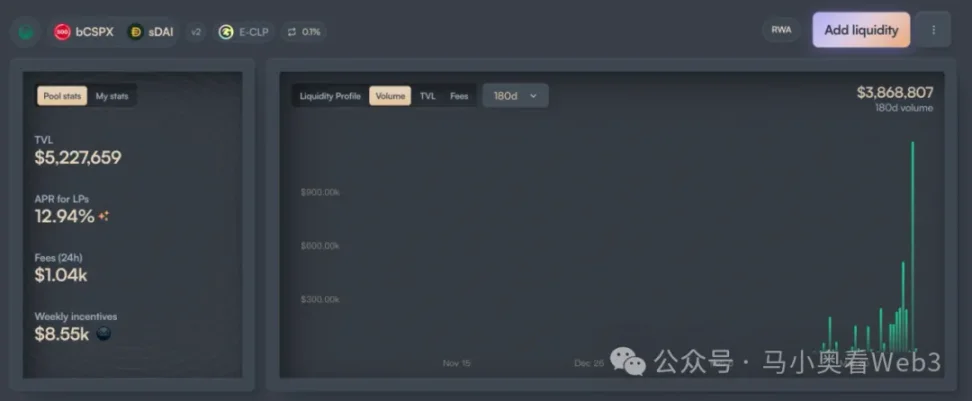

In terms of issuance, the adoption of Backed is mainly focused on two assets, CSPX and COIN, with the former having an issuance of about $10M and the latter around $3M. In terms of on-chain liquidity, it is mainly concentrated on the two chains of Gnosis and Base, of which the liquidity of bCSPX is about $6M, and the liquidity of wbCOIN is about $1M. In terms of transaction volume, it is not very high, taking bCSPX's largest liquidity pool as an example, since its deployment on February 21, 2025, the cumulative transaction volume is about $3.8M, and the cumulative number of transactions is about 400.

Another noteworthy development is the progress of Ondo Finance, where tokenized shares are the core trading target in Ondo Global Markets as Ondo announced its overall strategy for Ondo chain and Ondo Global Markets on February 6, 2025. Perhaps Ondo, with its broader TradFi resources and better technical background, can accelerate the development of this track, but it remains to be seen.

Opportunities and Challenges of Equity RWAs

Let's explore the opportunities and challenges of equity RWAs. Typically, equity RWAs are perceived by the market to have three advantages:

- 7-24 hours trading platform: Due to the technical characteristics of the blockchain, it has the characteristics of running around the clock. This allows the trading of tokenized stocks to be free from the trading time constraints of traditional exchanges, and fully tap the potential trading demand. In the case of Nasdaq, for example, while the ability to provide 24-hour trading services has been implemented through extended pre-market and after-hours trading, regular trading hours are limited to mid-week trading. And if the trading platform is directly developed through the blockchain, round-the-clock transactions will be realized at a lower cost.

- Low-cost access to U.S. assets for non-U.S. users: With the large-scale adoption of payment-based stablecoins, non-U.S. users can directly use stablecoins to trade U.S. assets without having to bear the handling fee costs and time costs caused by cross-border funds. For example, if a Chinese investor invests in U.S. stocks through Tiger Brokers, the cross-border remittance fee is about 0.1% without considering the exchange fee, and the settlement of cross-border remittance usually takes 1-3 business days. If the transaction is carried out through on-chain channels, these two parts of the cost can be avoided.

- Financial innovation potential from composability: With programmability, tokenized stocks will embrace the DeFi ecosystem, giving them stronger on-chain financial innovation potential. For example, on-chain lending and other scenarios.

However, the author believes that the current tokenized stock still faces two uncertainties:

- Speed of Regulatory Policies: Based on the cases of EXOD and Backed Companies, we can know that the current regulatory policies are not yet able to solve the problem of "equal rights for shares", that is, the purchase of tokenized shares and physical shares have the same rights and interests at the legal level, such as governance rights. This restricts many transaction scenarios, such as mergers and acquisitions through the secondary market. And the compliance use scenarios for tokenized stocks are not clear, which also hinders the pace of financial innovation to a certain extent. Therefore, its progress is very dependent on the speed of regulatory policy, and considering that the core policy goal of the current Trump administration is still in the stage of reshoring manufacturing, the timeline is likely to continue to be pushed back.

- Stablecoin Adoption: Historically, the core target users of tokenized stocks are most likely not crypto-native users, but traditional, non-U.S. stock investors. For example, for Chinese investors, compared with conventional official channels of foreign exchange, obtaining stablecoins through the OTC market needs to bear a premium of about 0.3%~1%, which is also much higher than the cost of investing in U.S. stocks through traditional channels.

Therefore, in summary, in the short term, the author believes that there are two market opportunities for equity RWA:

For listed companies, they can issue on-chain stock tokens by referring to the case of EXOD, although there are not many practical use scenarios in the short term, but at least the potential financial innovation ability can be given by investors who are willing to give the company a higher valuation. For example, for some enterprises that can provide on-chain asset management business, this method can be used to transform the identity of investors into product users, and the stocks held by investors into AUM of enterprises, so as to enhance the company's business growth potential.

For tokenized high-dividend U.S. stocks, some yield-based DeFi protocols become potential users. As market sentiment reverses, the yield of most on-chain native real yield scenarios will drop significantly, and yield DeFi protocols like Ethena need to constantly look for other real yield scenarios in order to increase the overall yield and improve market competitiveness. For details, see Ethena for an example of configuring BUIDL. High-dividend stocks, on the other hand, usually belong to mature industries, with stable profit models, abundant cash flow, and can continue to distribute profits to shareholders, and most of them have the characteristics of low volatility, strong resistance to economic cycles, and relatively controllable investment risks. As a result, the launch of some high-dividend blue-chip stocks may lead to adoption of yield-based DeFi protocols.