Market Playbook for the Second Half of 2025: Can Bitcoin Continue to Reach New Highs? Is there still a chance for copycat season this year?

source:

1.How long will this phased market last?

I remember the other day when we talked about the bull market, we mentioned in the article: from a longer time perspective, such as the beginning of the third quarter of this year, we may experience a new decline or consolidation.

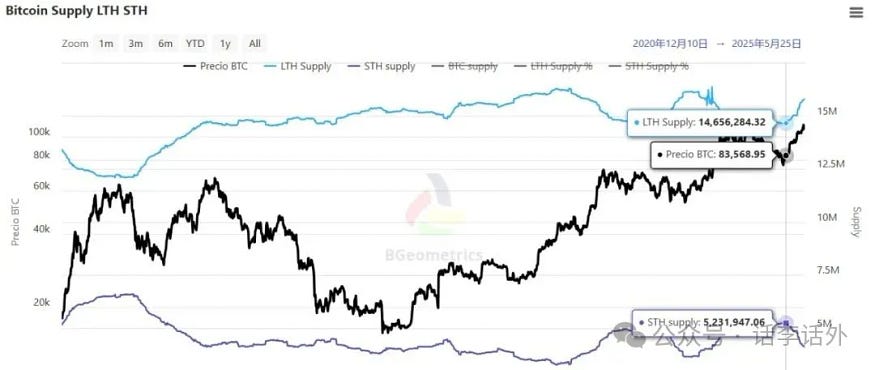

For example, we can continue to observe the Bitcoin Supply LTH and STH indicators that as the price of Bitcoin has recently begun to rise again, STH (i.e., short-term holders, investors who have held Bitcoin assets for less than 155 days) are no longer keen to buy (hoard) Bitcoin, but choose to continue to sell their Bitcoin. This is shown in the figure below.

Contrary to STH Supply, LTH Supply is still growing in stages, and the rise in the price of Bitcoin this time should be mainly driven by whales (including institutions). However, as the price of Bitcoin continues to rise, the demand for LTH usually begins to slow down slowly, which will also lead to the return of STH sentiment, but often at this time, the potential selling pressure in the market will rise again, which is a more typical signal that the price of Bitcoin is back close to the top of the phased cycle.

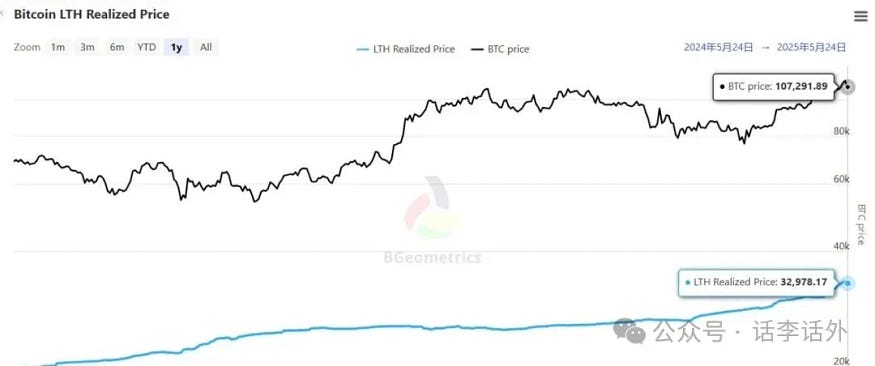

Combined with the Bitcoin Realized Price indicator, the actual cost price of STH is currently around $94,600, as shown in the chart below.

while the actual cost price of LTH (long-term holders) averages around $33,000, as shown in the chart below.

This means that the vicinity of $94,600 is a relatively important short-term support level, but there still seems to be a lot of room for the current price relative to LTH, and it looks like STH and LTH in the current market stage There are still clear differences in the behaviour of the two types of investors.

In short, the market still has some upside potential (long-term holders continue to buy chips), and we will continue to be bullish on the next trend, but if we extrapolate (speculate) from the perspective of time, we may need to remain relatively cautious in the third quarter of this year, and the fourth quarter does not rule out that the market will usher in a phased sharp correction again (we will give a playbook below).

2. The "playbook" of the market situation in the second half of the yearRemember

in an earlier article, we shared that our target for Bitcoin in this bull cycle is $10-120,000, as shown in the chart below. And judging by the current results, this goal has been achieved, and it does not seem impossible to reach or exceed $120,000 in the next step (say in June).

However, we have shared a point of view many times in previous articles, that market opportunities often exist at the same time as risk sharing.

Continuing with our Supply LTH and STH indicators above, if the price of Bitcoin can make another new high and break above $120,000 in June, then short-term holders may continue FOMO, while long-term holders may take the opportunity to start selling Bitcoin again.

At the same time, if we further combine some macro factors and consider comprehensively, the market in the second half of this year is destined to become extraordinary, and it is likely to experience relatively large fluctuations. Specific to macro factors, we have already listed and analysed in previous articles:

for example, in response to the Fed's interest rate cut expectations, although many analysts previously believed that the Fed may cut interest rates in June this year, but based on the current latest situation, the probability of a rate cut in June is actually very low.

For example, according to public data, as of May 2025, the total debt of the United States has reached $36.2 trillion, of which $28.9 trillion is publicly held and $7.31 trillion is held internally. In the current high interest rate environment, there will be higher costs associated with continuing to refinance debt issues, which may also have an impact on global markets, including crypto markets.

Another example is the issue of US tariff policy and geopolitical conflicts...... Wait a minute.

Therefore, if Bitcoin reaches new all-time highs and enters consolidation in June, then the price of some altcoins may continue to be speculated, but we do not think that a full-fledged copycat market will start at this stage, and the current bull market as a whole is still a bull market for Bitcoin as a whole. If your risk appetite is not that high, or if you are just doing short-term copycat swing trading, then then (before the end of June) may be a good opportunity for you to take a profit.

As we move into July, global macro factors may change further, such as the expiration of the 90-day deadline given by Trump before the tariff issue (the 90-day suspension of reciprocal tariffs imposed by Trump on multiple countries announced on April 9), the Federal Reserve may also give some new and clearer direction on interest rates and other policies, and so on.

Considering all the new uncertainties, and even some unknown black swan events cannot be ruled out, we will remain cautious about the overall market performance from the beginning of the third quarter, and bitcoin has risen a lot since April, perhaps, the crypto market will face a new round of phased small corrections or shocks from this period.

And this situation may continue for 1-2 months, if bitcoin can really break through $120,000 and reach $130,000 before that, then if there is a small correction during this period, the correction may be around 10-20%, that is, bitcoin may fall back to around $104,000 and move sideways.

As retail investors' sentiment falls into pessimism or wait-and-see again, we may see some positive news in the market again, and the market's sentiment pit will also quietly find some changes, and this period (July-August) is also the most likely window of opportunity for a new round of altcoins, especially for things like AI, RWA, Staking, Stablecoins (here refers to stablecoin-related projects, see our March 28, Concepts such as DeFi and Memes may continue to be hyped around stablecoins in historical articles such as May 8.

But here we still keep the point in the previous article unchanged, there are too many altcoins in this cycle, which will lead to serious dilution of liquidity, and there is no altcat season market like the full explosion of previous bull market cycles, if you don't want to miss out on possible opportunities, then start to try to pay attention to those projects that have good fundamentals, good tokenomics (not a lot unlocked), and fit the popular narrative.

Of course, if you don't have the time and energy to do project research, but you don't want to miss out on possible copycat opportunities, then the easiest way is still to take a position that you can afford to risk and buy top projects such as ETH and SOL in stages, maybe they can have a 1-2 times performance opportunity this year.

If the above-mentioned copycat season really arrives, then as people fall into the bull market carnival again, possible risks will come at any time, and this round of so-called copycat season we don't think it will last long, when the time enters October, as we mentioned above, the market may usher in a phased sharp correction again. Bitcoin could fall to around $94,600, while altcoins could face a retracement of at least 20–30%, with many people once again stuck at the top of the mountain.

But history is always like this, repeating stage after stage, as the probability of the start of the market in the fourth quarter falls, retail investors will once again choose to hand over their chips, and whales may continue to choose to absorb chips after a period of profits, and will prepare for a new round of speculation.

The fourth quarter of this year is theoretically the last bulltail opportunity for this cycle (2022–2025), and as the market enters a consolidation market again in October-November, retail sentiment falls to the bottom again, and we may be able to see some new market tailwinds again, and perhaps at the same time we can see some new narratives start to hype (most likely it will still focus on new areas such as AI and RWA, and at the same time, it will not rule out old areas such as GameFi).

If it goes well, before the end of the year or postponed to the first quarter of next year (2026), we will once again usher in a small wave of good market, but we don't know how much Bitcoin will eventually rise, and we don't know if it will rise to the $150,000 that many people expect now.

Theoretically, starting from 2026, we will face a new round of cycle reincarnation, especially those altcoins without long-term fundamentals will also enter a new cycle, and then the bear market may fall without even knowing the mother, so if you still want to keep some positions for a long time before the end of the year, then the safest currency is to keep only BTC and USDC.

Unless, some new changes continue to take place in the market, then the existing 4-year cycle may be broken, and Bitcoin will lead the crypto market into a new supercycle (see our thoughts on the topic of change in the article of January 17 for details).

However, it is also necessary to remind here that the market situation is unpredictable, and the above "script" is just a possible guess of the market in the second half of the year, in which the timing and price description may be wrong, not investment advice, DYOR.