love octave, but this type of charting/reasoning is why nobody takes the industry seriously.

interop enables borderless near instant transfers of any type of asset (dollar, commodity, meme) for mere cents.

that we are debating whether interop is solved is ridiculous. and it is especially ridiculous when we are comparing interop with interop.

- compare interop UX to a single chain (ethereum/bitcoin) and you will find that it is better.

- compare interop UX to any traditional rail and you will find it mindblowingly better.

now, is interop 100% efficient? no. of course not.

but if we continue spending time talking about how broken and not solved our tech is when it is 10000x better than what exists in the real world, then what are we doing?

be confident in the tech you are building and tell people why it is awesome.

stop debating semantics and go onboard more assets and users.

interop is solved.

Is Interop Solved?

It is an overview of the evolution of cross-chain transaction speed over the past 3 years using Jumper as a case study.

The question of interoperability can be approached from many angles: the execution efficiency, their security (how often a bridge fails), and their execution speed.

Here, I’m focusing on the third aspect:

I analyzed the median transaction time for users over the past three years, based on the bridging solutions used on @JumperExchange (and Transferto before that).

To do this, I looked at data from around ten bridges, across five typical route types:

➡️EVM L2 to EVM L2 (Arbitrum, Base, Optimism)

➡️Ethereum Mainnet to EVM L2

➡️EVM L2 to Ethereum Mainnet

➡️Solana from and to EVM (Ethereum, Base, Optimism, Arbitrum)

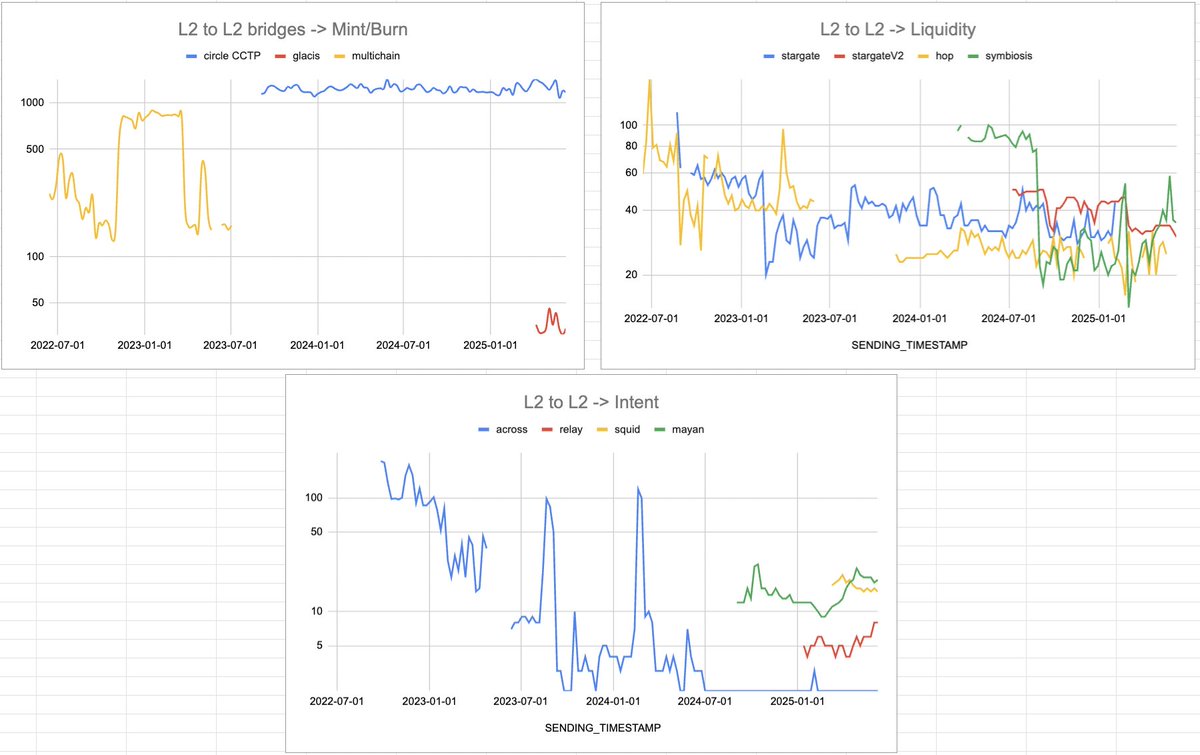

1. L2 → L2 (Arbitrum, Base, Optimism)

➡️ Mint/Burn bridges

@circle CCTP V1 has remained stable over time: ~18 min

@glacislabs , which recently launched and aggregates several standards, brings this down to ~25–30s

➡️ Intent bridges

@AcrossProtocol is the standout here: it went from 100s to 10s in 2023 and from 10s → <3s in just a year in 2024.

@MayanFinance , @squidrouter , and @RelayProtocol launched more recently and show median times of 15–25s, but haven't improved further since their launch

➡️ Liquidity bridges

@HopProtocol dropped from 60–70s → 30s

@StargateFinance from 70s → 35–40s

Same pattern for @symbiosis_fi

No major improvement have been made since July 2024.

2. Mainnet → L2

This is where slowness starts to bite.

➡️ Mint/Burn bridges

Same trend as L2→L2: Circle and Glacis are stable, but Glacis sees more volatility and slower times in this direction

➡️ Liquidity bridges

Improvements across the board

Stargate: 260s → <200s

Symbiosis: <80s in the past 3 months

Hop: Less recent data, but same downward trend

➡️ Intent bridges

Slower here due to Ethereum finality constraints

Across/Relay: ~5–25s

Squid: ~40s

Intent is still faster — but constrained by Ethereum finality

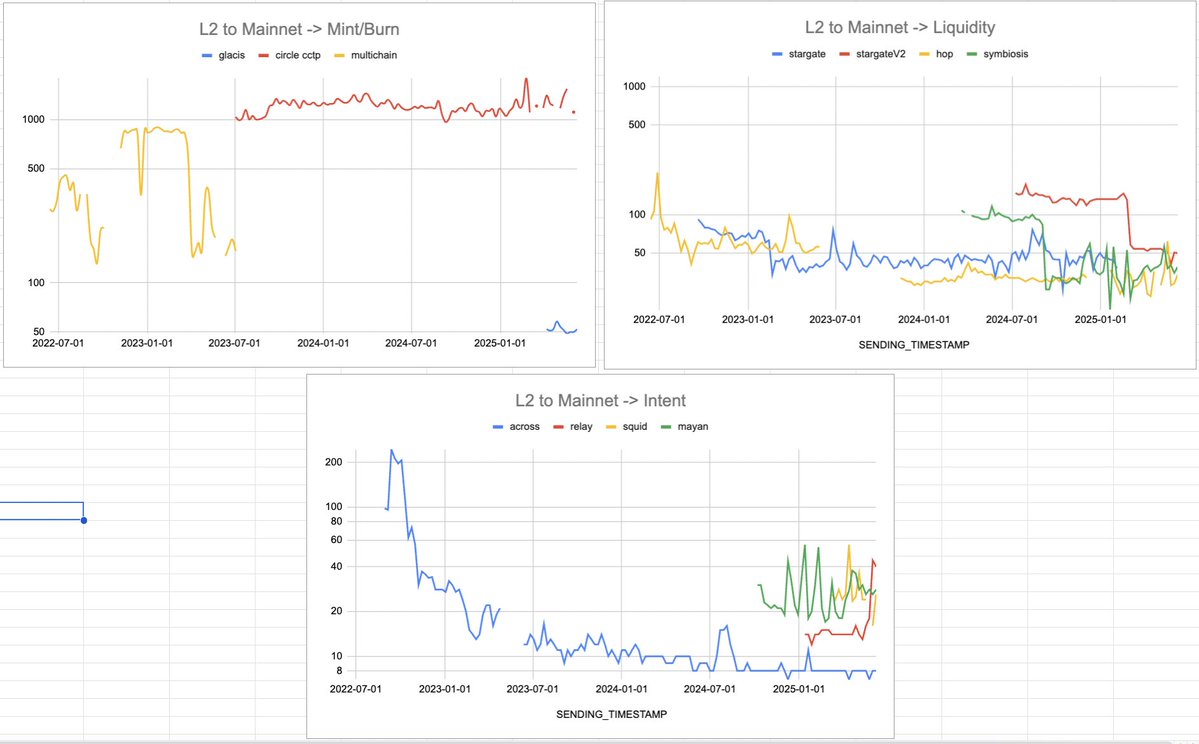

3. L2 → Mainnet

This direction is faster than the opposite.

➡️ Mint/Burn

Absolutely no change for Circle

Glacis is 4–5x faster compared to Mainnet → L2

➡️ Liquidity bridges

Strong improvements from 2022 and 2024, interestingly performance still seems to improve in the last months.

Hop: 100s → 30s

Stargate: 100s → 40–50s

Symbiosis: 100s → 45s

➡️ Intent bridges

Across again leads: 100s → <7s

Squid, Mayan: 20–40s

Relay is the odd one out — recent uptick to 30s+

4. EVM ↔️ Solana

EVM → Solana

Surprisingly, bridging to Solana is faster than bridging from Mainnet to an EVM L2 and similar to bridging from an L2 to Mainnet.

Relay: ~5s

Mayan: ~25s

Slight increase over time, but still very fast overall

Solana → EVM

Mayan and Relay show quite similar performance.

Allbridge is a surprise here: 10x faster in this direction vs. EVM → Solana

My Takeaways

From a speed standpoint, interop isn’t fully solved — and we've been plateauing for about a year. In my view, we’ll only get there once top-90th percentile cross-chain transactions consistently settle in under 2 seconds.

It might be the case for intent-bridge soon but we're far from here for other bridge type.

1⃣ Across all routes, we observe a general decline in transaction times from 2022 to 2024. However, this trend becomes less apparent from mid-2024 onward.

2⃣ The decrease in transaction time is often driven by the launch of new bridges or new versions of existing bridges, rather than improvements to existing ones—except in the case of Across, Hop, or Symbiosis.

In some cases, we even observe a slight deterioration in performance after the launch of a new bridge (e.g., on certain routes or with Stargate).

Once a new bridge is live, we even observe time performance getting a bit poorer from time to time (relay on specific routes) or Stargate.

3⃣ Intent-based bridges are consistently the fastest option across all routes.

4⃣ By aggregating multiple mint/burn bridge standards, Glacis demonstrates that acceptable transaction times can still be achieved with this type of bridge.

5⃣ L2-to-L2 routes are by far the fastest, followed by L2-to-Mainnet, EVM-to-Solana, and finally Mainnet-to-L2.

In the current landscape, it remains challenging to build a ‘chain abstraction’ tool that integrates Ethereum Mainnet, as users are likely to encounter noticeable latency.

4

3.17K

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.