Too many of you are sleeping on @aave Umbrella!

An updated version of the Safety Module called Umbrella went live to help cover shortfall events.

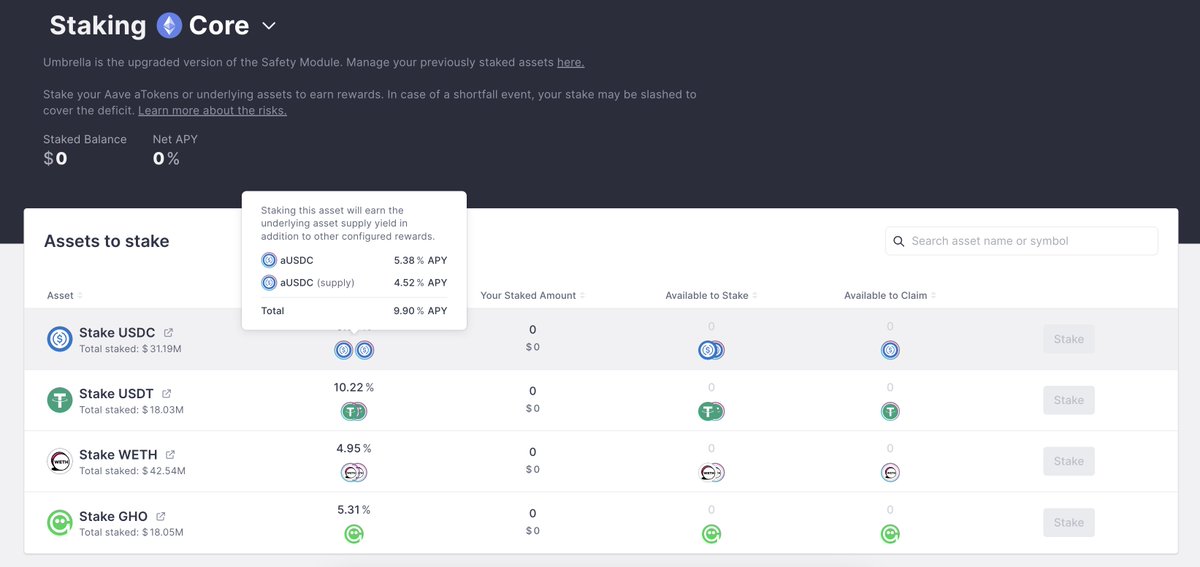

aToken stakers (lenders) can earn:

9.9% APY (aUSDC)

10.2% APY (aUSDT)

4.95% APY (aWETH)

5.3% APY (aGHO)

👻

🧐 Did you know legacy Safety Module has never been slashed?

It's not risk free but worth considering we can earn very competitive yields backed by the underlying aToken yield + rewards.

For example, staked aUSDC = 9.9% APY

4.52% lending + 5.38% staking in Umbrella

Another reason to not fear slashing is thanks to what they call "the deficit offset."

The deficit offset is a protection mechanism where Aave DAO covers first-loss up to a certain amount before any staker funds are slashed.

For example, if staked aUSDT has an offset of 100k USDT, more than 100k USDT of bad debt must accrue before any staked aUSDT gets slashed. Aave DAO steps in to cover losses up to this amount first, providing an added layer of protection for stakers in Umbrella.

I find this fascinating, kinda like a junior tranche for Aave lenders to earn competitive yields, but not quite the risk of what we see in junior tranche rates across the DeFi lending landscape.

A few other key details for Umbrella users:

+ There is a 20-day cooldown period to withdraw.

+ Umbrella currently supports Ethereum Mainnet only, focusing on high-borrow demand assets like USDC, USDT, WETH, and GHO.

+ Umbrella stakers only cover shortfalls for these borrowed assets in Aave V3 Core on Ethereum Mainnet, not other networks but they will expand Umbrella to other Aave instances in the future.

As mentioned earlier, @aave Umbrella stakers (lenders) can earn with these high-demand borrow assets on Ethereum Mainnet:

9.8% APY with aUSDC

10.2% APY with aUSDT

4.95% APY with aWETH

5.3% APY with aGHO

25.6K

131

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.