Tether's $152B Edge: Can it Last?

Born as Realcoin in 2014, $USDT pioneered tokenized dollars - enabling faster, cheaper, and more flexible USD movement on-chain.

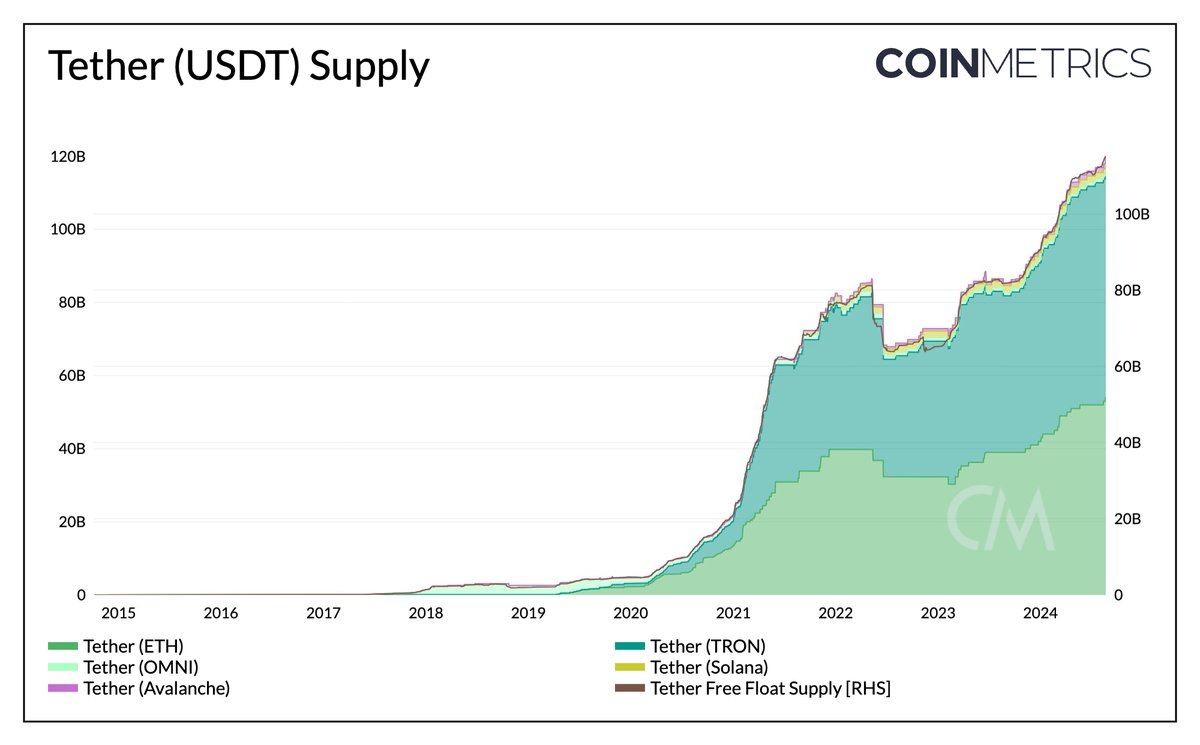

- First issued on Omni, now spans Ethereum, Tron, Solana, and more

- Powers $152B+ in supply, driving deep USD liquidity where traditional rails fall short

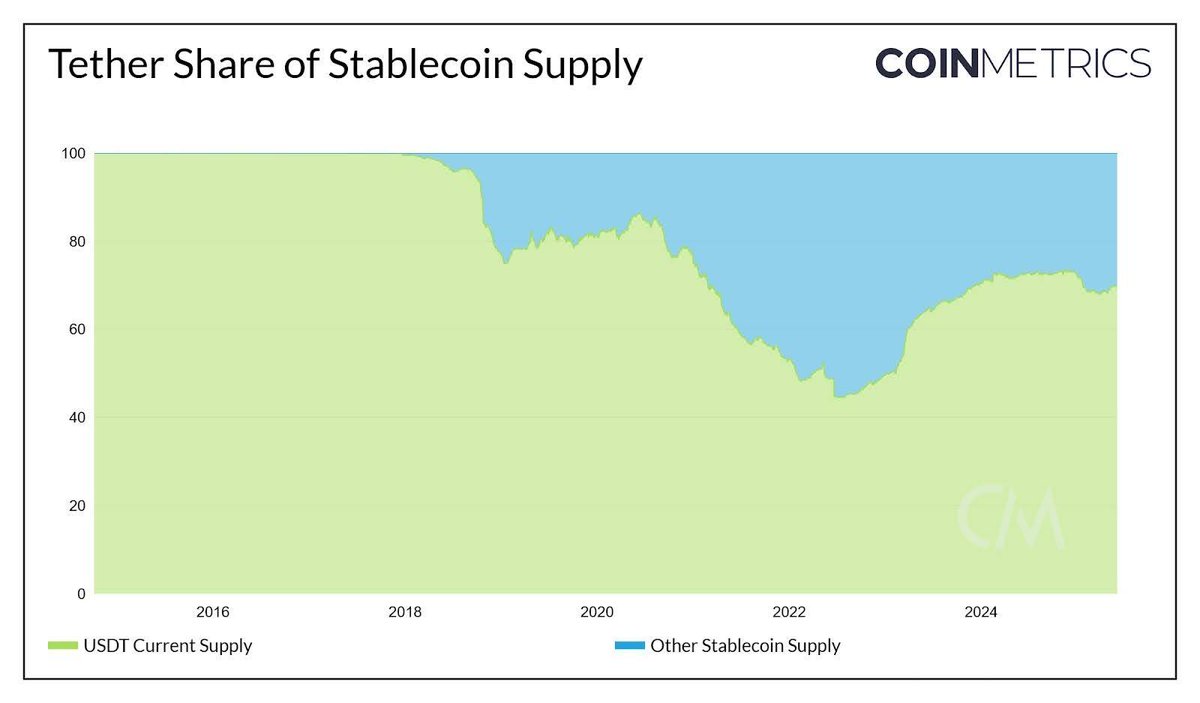

- Commands ~69% of all fiat-backed stablecoins despite new competitors

$USDT dominance in 2 charts:

1. Relentless Supply Growth → $USDT supply now tops $152B

2. Stablecoin Market Share → Still holding ~69% despite waves of new entrants

But with evolving regulations and new stablecoin models emerging, can @Tether_to’s peg resilience and transparency sustain its edge?

See how $USDT’s supply and market share have evolved → See the Full @coinmetrics Analyst Report by @HCDuschang and the Coin Metrics Team Linked in Replies.

Check out the full @coinmetrics Tether Analyst Spotlight Report:

7

1.78K

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.