Real Yield on Saga: Liquidity Rewards Now Live with @merkl_xyz.

FYI: Merkl, backed by a16z, is a platform designed to directly distribute incentives based on on-chain activity.

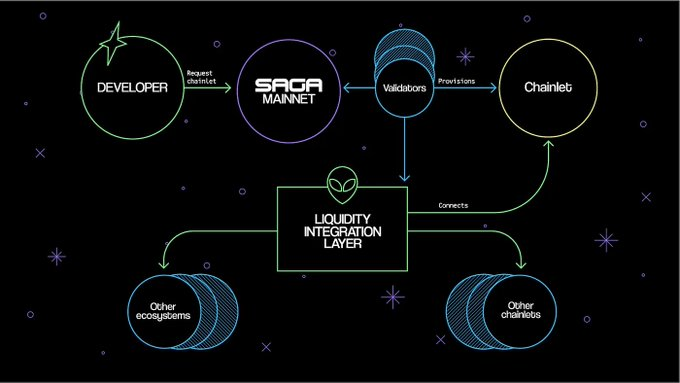

In case you missed the launch of Liquidity Integration Layer (LIL) on Saga, feel free to visit my previous writings below.

In short, LIL opens a new era of DeFi within the Saga ecosystem.

Remember the juicy yields from Staking Vault 2.0 on Saga?

+ Liquidity pairs remain the same

+ Higher APY

+ All tracked by dashboards on Merkl

Sounds cool, right? Let's get you set up with this major update.

▸ Why @merkl_xyz?

Big obstacles that keep users hesitate to join Liquidity Pools:

+ Too complicated progress

+ Unclear OR too long rewards distribution

+ Inefficiency of capital use

➜ Thus, Merkl is truly a perfect sidekick by automating incentive delivery based on precise LP positions and time-weighted liquidity.

Applied to @Sagaxyz__, "While effective, managing this reward infrastructure internally came with its share of challenges - from allocating internal resources to building and maintaining the system.

As the program scaled, it became clear that a more flexible, feature-rich, and future-proof solution was needed." - commented by Merkl.

Partnering with Merkl, Saga gains access to:

+ a useful UI to launch and manage incentive campaigns

+ advanced features to customize the campaigns

+ a streamlined reward distribution system for both stakers and LPers

+ over 10,000 daily DeFi users exploring reward opportunities on the Merkl app

▸ Getting used to the UI

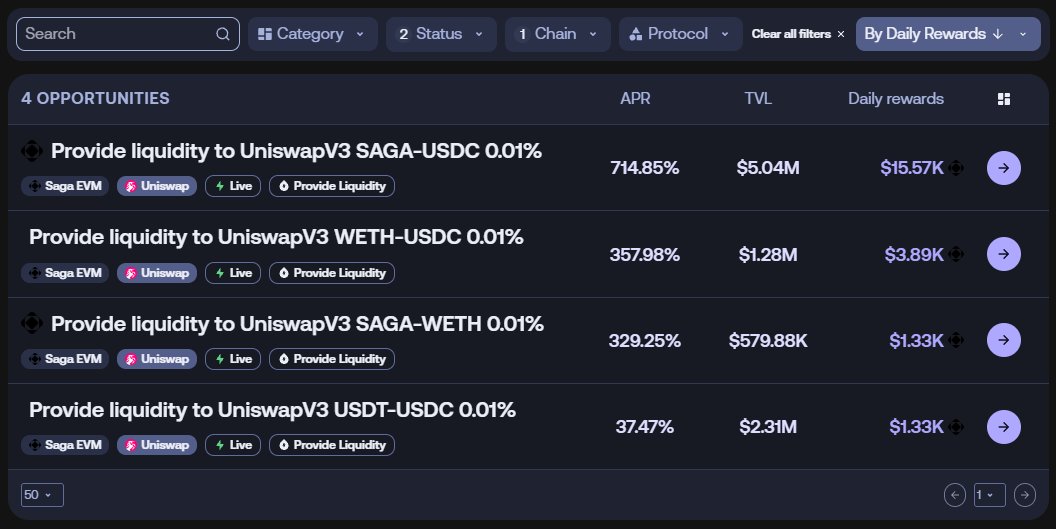

On the Merkl app page, choose Saga EVM from the category.

And now you're able to see all the available pools on Saga, currently including:

+ SAGA/USDC

+ WETH/USDC

+ SAGA/WETH

+ USDT/USDC

Note that the APRs are dynamic.

APRs will vary based on pool activity, total liquidity, and reward allocations. Early LPs are best positioned to benefit from higher initial returns.

There are also additional metrics to help you make decisions:

+ TVL of the pools

+ Daily rewards calculated based on $1,000 provided

Clear and clean UI.

It's easy to understand that with a massive APR of over 700%, the pair SAGA/USDC has been receiving the largest traction of nearly $5m.

Once you're done researching, it's time to get started.

The LPing process still takes place on Saga's OKU Trade.

▸ For newbies on Saga's LIL

It's the most appropriate time to start learning how to LP on Saga.

Preparation: Some USDC or SAGA tokens on the Saga mainnet.

Recommended wallet: Keplr.

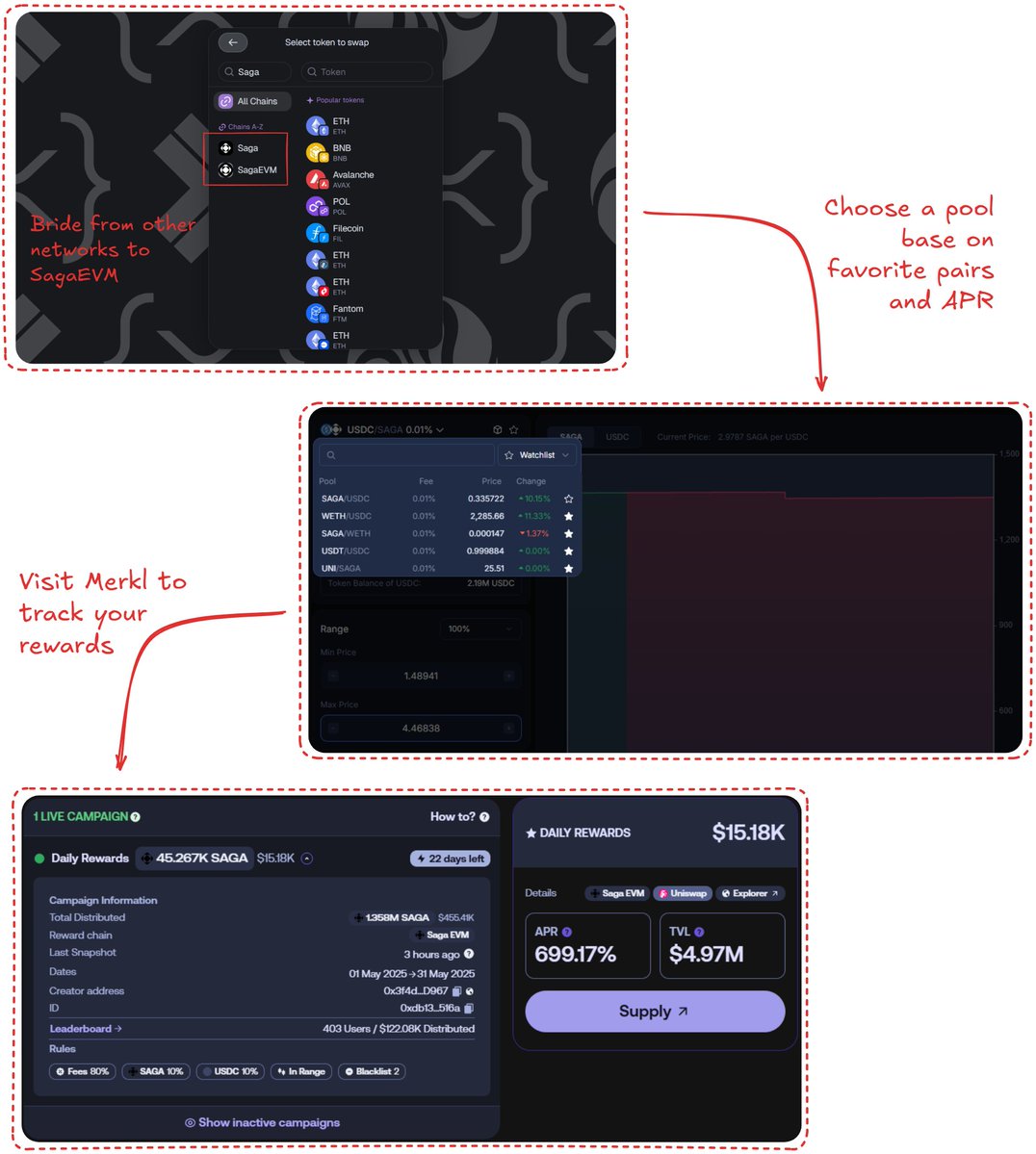

1. Bridge Funds to SagaEVM

(Important note: LPs only operate on SagaEVM, which is different from Saga Mainnet. Be cautious before use).

+ You can use Squid Router or the Bridge function on Oku to move assets from another EVM chain or Saga mainnet to the SagaEVM.

+ You can directly bridge the required assets into SagaEVM or swap for them on Oku.

2. Provide Liquidity via Oku:

+ Visit the Uniswap V3 > Position Manager tab

+ Select a supported LP pair, provided in the list above

+ Choose your liquidity range (from 0.1% to 100%), a higher range means a larger amount of your liquidity to be deployed.

For example, if you choose the SAGA/USDC pair and set a 100% range at the current price of $0.33:

➜ the min-max price of SAGA can be from $0.167 to $0.503

+ Click Deploy Position and you're all set.

3. Track and Claim Rewards on Merkl

And now, the most exciting part, you will see your progress through Merkl.

+ Estimated rewards will be automatically calculated based on how much liquidity you provide and how effectively it supports the market

+ Claim rewards at any time you want

No staking required. No vesting schedules. Just pure on-chain yield.

281

23.55K

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.