Top

Ranking

Favorites

Trending tokens

Latest news

Trending topics

Latest feed

Disclaimer: The content on this page is provided by third parties. See T&Cs.

base getting some runners. sol got a couple the last few days. allocated some funds into sonic. waiting for a big runner to hit.

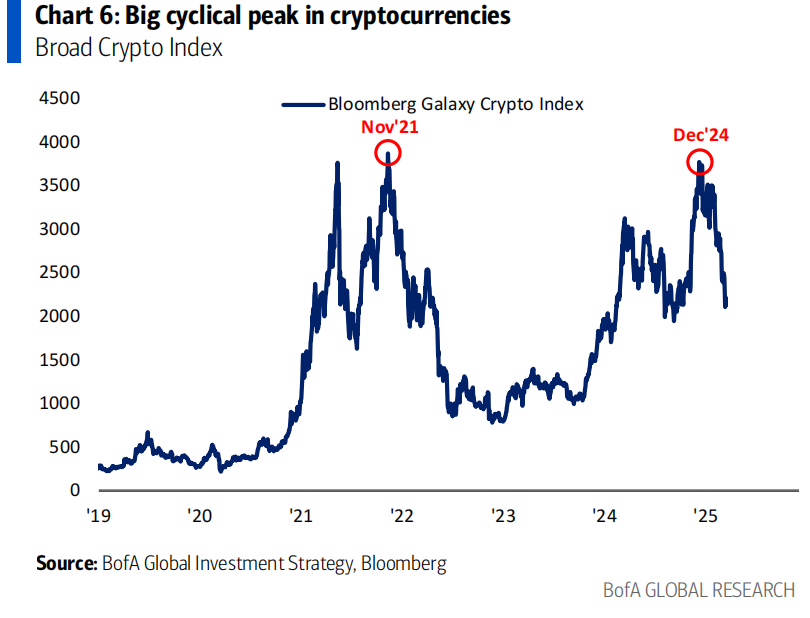

Looking at the Bloomberg Galaxy Crypto Index (BGCI), this peak didn't even surpass that of 2021, as market funds are highly concentrated in top and tail assets (Bitcoin and meme coins, the latter not included in the index). Meanwhile, other mainstream cryptocurrencies that were widely participated in the past (such as Ethereum, Polkadot, etc., which have low weights in the index) have shown weak performance or even declined. Most retail investors and investors have not benefited as broadly as before, so this chart clearly illustrates the poor wealth effect of this bull market.

REGULATORY PIVOT: SEC EVALUATING XRP COMMODITY STATUS

The SEC is weighing whether XRP functions more as a commodity than a security—using Ethereum's classification as a benchmark.

This regulatory reassessment occurs during ongoing settlement negotiations following Ripple's $125 million fine and injunction against institutional XRP sales.

Ripple's legal team argues that evolving regulatory approaches should mitigate penalties for past actions.

XRP's market position remains complex; despite recent underperformance, its fully diluted valuation now exceeds Ethereum's.

Source: CryptoPotato

Which will happen first?

$BTC $200K

$SOL $1K

$XRP $10

$ETH $10

$FET $13

$RENDER $34

$TAO $4K

$SUI $15

Comment your thoughts below 👇

Recap of the last 10 days in crypto :

- Trump signed the SBR EO on March 6, then the Crypto Summit was a nothingburger on March 7. Moderate news selling on $BTC from $90k to $86k.

- Significant dump on March 9-10 to a BTC low at $77k in a context of a very weak stock market. We are completely reliant on tradfi, and they are having red days one after another.

- The market is truly narrative-less besides that, we are driven by macro / tariff / Trump headlines.

- ETHBTC can't stop dying, it's down to new lows at 0.0224

- $HYPE has been suffering and is down -50% in three weeks. There was FUD about an HL whale trying to exploit HLP

- The AI agent sector has been destroyed (even more).

- Very rare pockets of strength : new coins (IP, LAYER), TIA, random pumps, etc.

New communities added, BOB-powered Bitcoin DeFi is expanding.

Check your eligibility for our exclusive program. 🎁

➡️

Instructions below. 👇

The Case for Token Buybacks🫰

Supporters see them as a strong market signal, while critics call these strategies poorly adopted from TradFi. Who's right?

Here’s what you need to know about both sides of the debate — and some fresh alternatives.👇

~~ Analysis by @davewardonline ~~

Many protocols and users see buybacks as direct signals of long-term alignment, revenue stability, and growth potential, so let’s look at the main arguments supporting the practice.

1. 💰 Confidence in Product-Market Fit

Those supporting token buybacks argue that these programs reflect a commitment to sustainability and revenue growth.

By repurchasing tokens, teams signal faith in their protocol’s moat and long-term prospects, which can bolster market confidence and position the protocol as the primary owner of its token, potentially granting it more control over price dynamics.

Buybacks are especially lauded when the protocol is already profitable: @aave's proposal to funnel part of its revenue into purchasing its own tokens is widely seen as a decisive show of strength, in contrast to competitors that spend heavily on liquidity mining, which typically proves to be highly inflationary for a protocol’s token and usually only nets modest adoption.

Indeed, if your favorite protocol isn’t buying its own token, why would you?

2. ☀️ Season of Fundamentals

Buyback programs can dovetail neatly with a broader pivot to fundamentals.

Over the past year and especially now amid the market’s downturn, more investors have gravitated toward protocols with real revenue and stable liquidity.

A buyback can buttress this “fundamentals season” narrative by shrinking the circulating supply and indicating steady earnings. Once again, though, this perception only really comes when a protocol has achieved substantial revenue, making Aave’s decision more attractive than Arbitrum’s in this case.

The Argument Against Buybacks

On the other hand, buyback critics argue that the mechanism proves “cosmetic” and can simply create exit liquidity for large holders and that other tactics better accomplish the same goal.

1. 💸 Invest in Expansion

Critics argue that allocating treasury funds to buybacks diverts capital from more productive pursuits — expanding product offerings, increasing liquidity across diverse assets (i.e., buying $BTC instead of a native token), allocating treasury assets to DeFi for high yields, or forging strategic partnerships. These initiatives are often seen as delivering more tangible, long-term benefits that bolster a protocol’s market standing and provide it a more substantial basis to do “buybacks” or revamp its tokenomics in the future.

2. 🙅♂️ Crypto is Not TradFi

Although buybacks are common in equities — where companies often use extra cash or cheap debt to repurchase undervalued shares — crypto projects come with different dynamics.

Tokens frequently remain locked up for founders and early investors, so a buyback can end up absorbing tokens, and at the same time, insiders cash out, zeroing out its effect. Additionally, the constant vesting of tokens can undermine the impact of any buyback, while big announcements about token repurchases sometimes serve merely to signal a sell-off point for insiders, providing minimal value to long-term holders.

3. 🤔 Better Alternatives Exist

Some opponents recommend bypassing open-market repurchases altogether and looking to other mechanisms to provide a lift to the token price.

• Buying Unvested Supply: CT anon @lazyvillager1 suggests using treasury funds to buy out unvested allocations from early investors, then remove those tokens from circulation. This strategy would mitigate insider selling in public markets and reduce the overall vesting supply in one fell swoop. Investors would receive returns while the public market would be spared their price.

• veTokenomics: Others, like @fiddyresearch (a researcher at Lido Finance and formerly of Curve Finance), advocate token lock mechanisms, like the veModel, which reward users for locking up tokens to build long-term governance and liquidity. This system comes with mixed results, though, when looking at veTokens like $CRV or $CVX’s price performance.

When Buybacks Make Sense

Overall, from these analyses of the pros and cons of buybacks, a picture becomes clear of when buybacks may serve to be a part of a protocol’s tokenomics.

When the entire token supply is in circulation or entirely vested, buybacks can function similarly to an equity buyback, working to establish a floor for price and amass “undervalued” shares. Through this framework, Projects like @JupiterExchange and @HyperliquidX have a unique edge given their lack of outside funding, meaning they have no VC-vested tokens to unlock. Thus, these projects instituting buybacks have different implications, given their control over their supply as well as their market maturity.

In parallel, once a project has established a solid competitive edge and covered growth avenues — expanding product lines or exploring new markets — a measured buyback can serve as a way to return capital to token holders. If timed well and not coming premature, it can boost market confidence and reinforce the protocol’s standing if it has the revenue and dominance to develop an impactful buyback program.

⚡️ TOP GAINERS OF THE DAY!

$PELL $RARE $OBT $BMT $CSIX $HEI $IOST $WEMiX $GRASS

$CARNEY

3yDbqoDqRvN4HkaZmXsvmK5MbLgu2FKwakWsHa5Qpump

The new Prime Minister of Canada has taken office, named after this.

Released at 12k in the group, peaked at 120k, another 10X!!!

The group car launched by the group leader, currently live streaming to help brothers make money

:

#FilecoinNews 105 is hot off the press!

☄️ F3 reaches 80% participation

📰 @DefiantNews secures its archives on Filecoin

👨💻 Join the Filecoin AI Blueprints Hackathon w/ @encodeclub

🔐 @humanode_io brings biometric Sybil resistance to FilecoinDive in:

Trending investments

You may also like