WHY NOT UNDERESTIMATE THE SIGNIFICANCE OF THE US STABLECOIN GENIUS BILL?

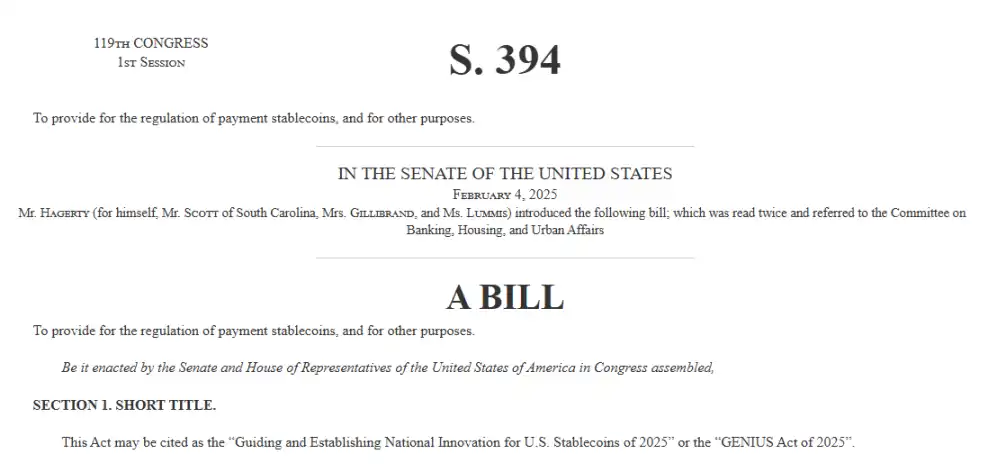

Original title: "Don't underestimate the significance of the U.S. stablecoin "Genius Act"

Original author: 0xTodd, Nothing Research Partner

If the U.S. stablecoin bill "GENIUS Act" is successfully passed, its significance will be very great. I even feel like it's enough to be in the top five of Crypto history.

is abbreviated as GENIUS Act, which literally translates to Genius Act, but it is actually Guiding and Establishing National Innovation for U.S. Stablecoins, which actually translates to "National Innovation for Guiding and Establishing U.S. Dollar Stablecoins".

The proposal is very long, and there are a few points to summarise for you:

· Mandatory 1:1 Sufficient Assets: This includes cash, bank demand deposits, and short-term U.S. Treasury bonds. At the same time, misappropriation and re-pledge are strictly prohibited.

· High-frequency information disclosure: Publish a reserve report at least once a month and introduce external audits.

· Licensing: Once an issuer's stablecoin has a circulating market capitalisation of >$10 billion, it must be transferred to the federal regulatory system within a specified period of time, with bank-grade regulation.

· Introducing custody: The custodian of stablecoins and their reserve assets must be regulated and qualified financial institutions.

· Explicitly defined as a medium of payment: The bill clearly defines stablecoins as a new medium of payment, primarily subject to the banking regulatory system, rather than the securities or commodity regulatory system.

· Zhao'an Existing Stablecoins: A grace period of up to 18 months after the law comes into effect, which is intended to urge issuers of existing stablecoins (such as USDT, USDC, etc.) to obtain licenses or incorporate compliance as soon as possible.

Now that I'm done with the main article, let's talk about the significance of this matter with excitement.

Over the past few years, people have asked, what applications have you made in the crypto industry for 16 years?

In the future, you can confidently talk to others about stablecoins.

First, clearing up concerns is the premiseSome

people have objected to it, and in the past, people had the impression of stablecoins as opaque black boxes. Every few months, FUD is required, either Tether's assets are frozen, or there is a big hole in Circle.

In fact, if you think about it, Tether can easily earn billions of dollars a year just by relying on the interest on those underlying Treasury bonds. Circle also made a profit of $1.7 billion last year.

This is standing and making money, in terms of motives, they don't have any motive to do evil, but they are also the most eager to be compliant.

Now, this opaque black box will become a transparent white box.

In the past, it was nothing more than criticising Tether's money that might have been frozen by the United States, but now it is directly put into the U.S. compliant custodian, and high-frequency information disclosure can be directly assured.

What an advantage it is to not have to worry about running away - I think all Crypto people in particular understand it.

Second, it is very important

the standard stablecoin, which was once almost stolen by CBDC. No matter which country, if there is really a central bank digital currency, it is most likely not built on the blockchain, but at most on some internal alliance chain of the central bank, which is honestly meaningless.

When CBDCs were at their hottest, stablecoins were at their most dangerous.

If CBDC had done this, then the current stablecoin would have been infinitely suppressed to a dark corner, and the blockchain could only play a minimal role.

The remaining half-dead stablecoins even have to learn the standards of central bank digital currencies, and the right to speak in the standards is completely sidelined.

And now, stablecoins have won (and will be).

Instead, everyone should learn the standard of [Blockchain + Token].

Nowadays, many blockchains, in fact, have no meaningful applications on them, except for stablecoin transfers. For example, Aptos, the only scenario I use Aptos is from Binance to OKX transfer.

And now, what does it mean that stablecoins will be legislated?

That's right, blockchain, will become the only standard.

In the future, every stablecoin user will first learn to use a wallet.

As an aside, now I think Ethereum's push for EIP-7702 is really a bit forward-looking. While other chains are swarming to meme, thank you to Ethereum for still insisting on account abstraction.

EIP-7702 is the account abstraction, which can support e.g. ·

Social Account Registration

· Wallet Registration· Pay with local currency GAS·

And so on

this gives a lot of stablecoins to new users in the future, Solved the last mile.

Third, deposits have entered a new era

, and once stablecoins are supported by legislation, deposits and withdrawals will become simpler.

Let's imagine a scenario where there was no way to do it due to the grey nature of stablecoins before, but after the bill is passed, many traditional brokerages can support stablecoins themselves. The money of U.S. stock investors turns into stablecoins in minutes, and then it is directly stuffed into Coinbase in a second, believe it or not.