From Virtuals to FARTCOIN, how to lay out the next wave of DeAI?

Original title: The AI Dispatch #16 - Virtual Genesis Launches, Robotics, We're Back/It's so over

Original author: @castle_labs

Original compilation: zhouzhou, BlockBeats

Editor's note: This article discusses the market dynamics of AI tokens, specifically the performance of some tokens such as $AVA, $FARTCOIN, and $PROMPT. The authors mention that the AI token market is still full of uncertainty and investment risks are high. Still, developers and market participants are driving innovation, especially with Coinbase likely to join some of the leading AI tokens. The Virtuals and Genesis launches are important developments that have received a lot of attention.

The following is the original content (the original content has been edited for ease of reading and comprehension):

Dear readers, I hope you enjoy the rally of these green candlesticks. Now, it's all over! We're so grateful, aren't we? The price bounced back a little and returned to the support level, and we started to worry again. Doesn't it mean that the AI is back after a few green candles? Aren't you dead now? Aren't we going straight up anymore?

As usual, things are far more complicated than they seem. Personally, I feel like the entry point is better now than last week, but worse than a month ago.

Unless you're playing long-term holding (that feels like asking for trouble?). Otherwise there are always some interesting developments in the market.

Among these developments, priority should be given to developers who have been working hard over the past few months.

Definitely not like $ZEREBRO. If you missed the news, obviously, the developers have left.

Many speculate that the main developer announced the end of the event on his own during a live stream?

Others thought the video was fake, and it was all just to create some hype.

Dead or alive, I think we can still draw a few lessons from this situation:

Never give up on yourself: Mental health is a priority. If you're in a difficult situation, talk to a friend, you're not alone.

Investing in any AI token, even the most established ones, is riskier than investing in other areas. Most projects are only a few months in place at most. As a result, holding these tokens for a long time will expose users to much higher risks than in more established areas.

Trading AI tokens, in fact, is still mostly a narrative game. While betting on fundamentals, such as upcoming catalysts and upgrades, is still a good strategy, a short-term strategy may reduce the impact of external risks.

In addition, the industry as a whole is still not detached from the impact of the broader market.

Looking forward to the next wave.

The most watched tokens in the market

What's the focus this week?

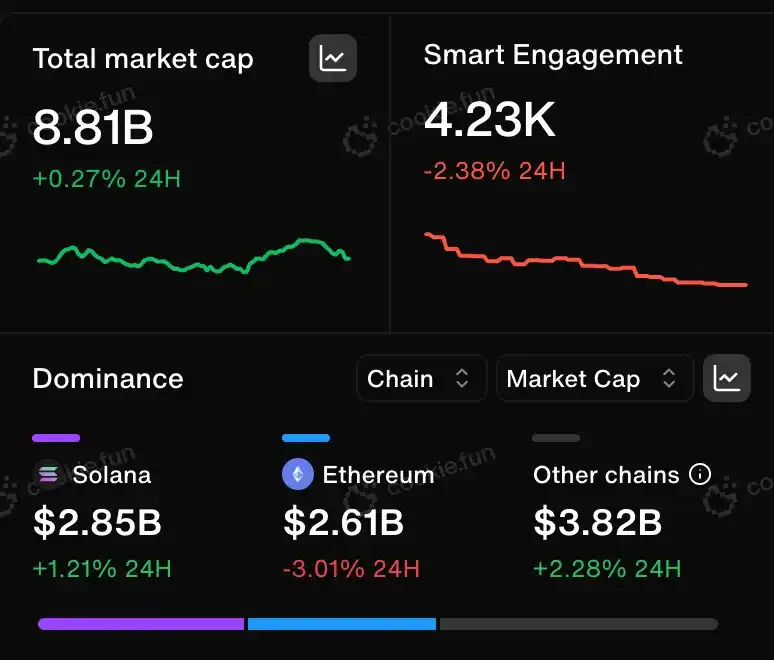

The total market capitalization is still hovering above $8 billion, having experienced a strong rally last week, rising from $4-5 billion to $7-8 billion.

Solana ($2.8 billion), Ethereum ($2.61 billion), and Base ($2.5 billion) are getting closer in terms of market dominance, and their market capitalizations are very similar.

Personally, I think one possible differentiator is the possibility that Coinbase will wake up and eventually list some of the leading AI tokens.

Inevitably, the first to list will be Virtuals, and there may be other major tokens from the ecosystem after that, such as AIXBT and Vader.

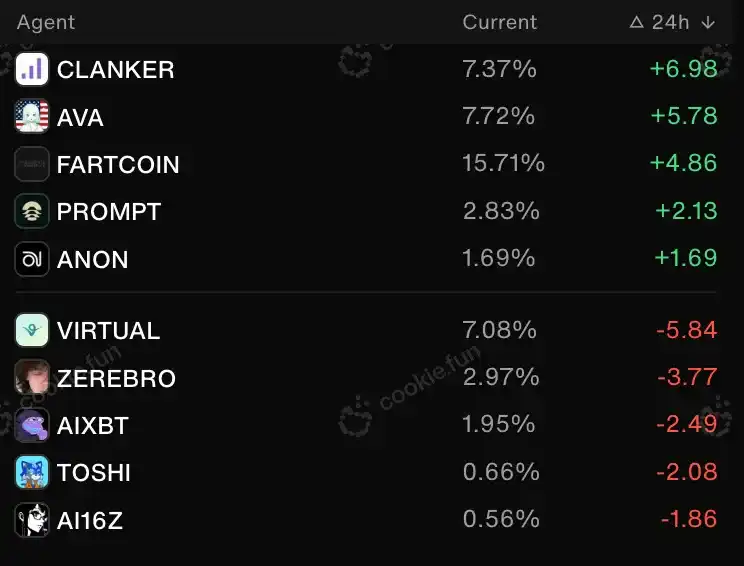

Winner of the week:

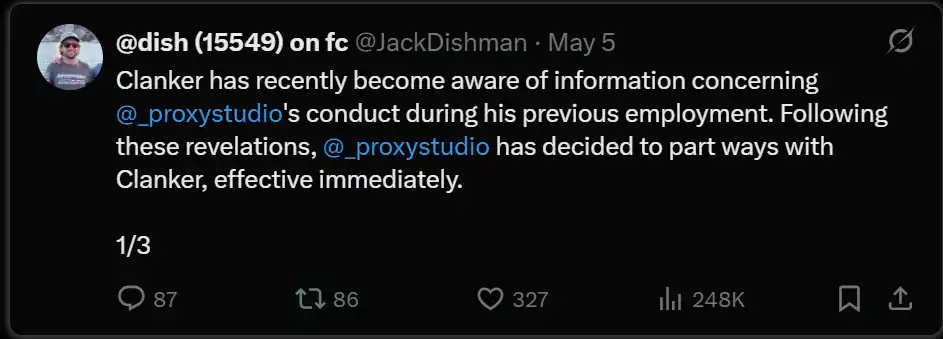

$CLANKER: Unfortunately, mainly due to some dramatic events.

$CLANKER: Unfortunately, mainly due to some dramatic events.

$AVA Keep moving. Here are some of the new developments:

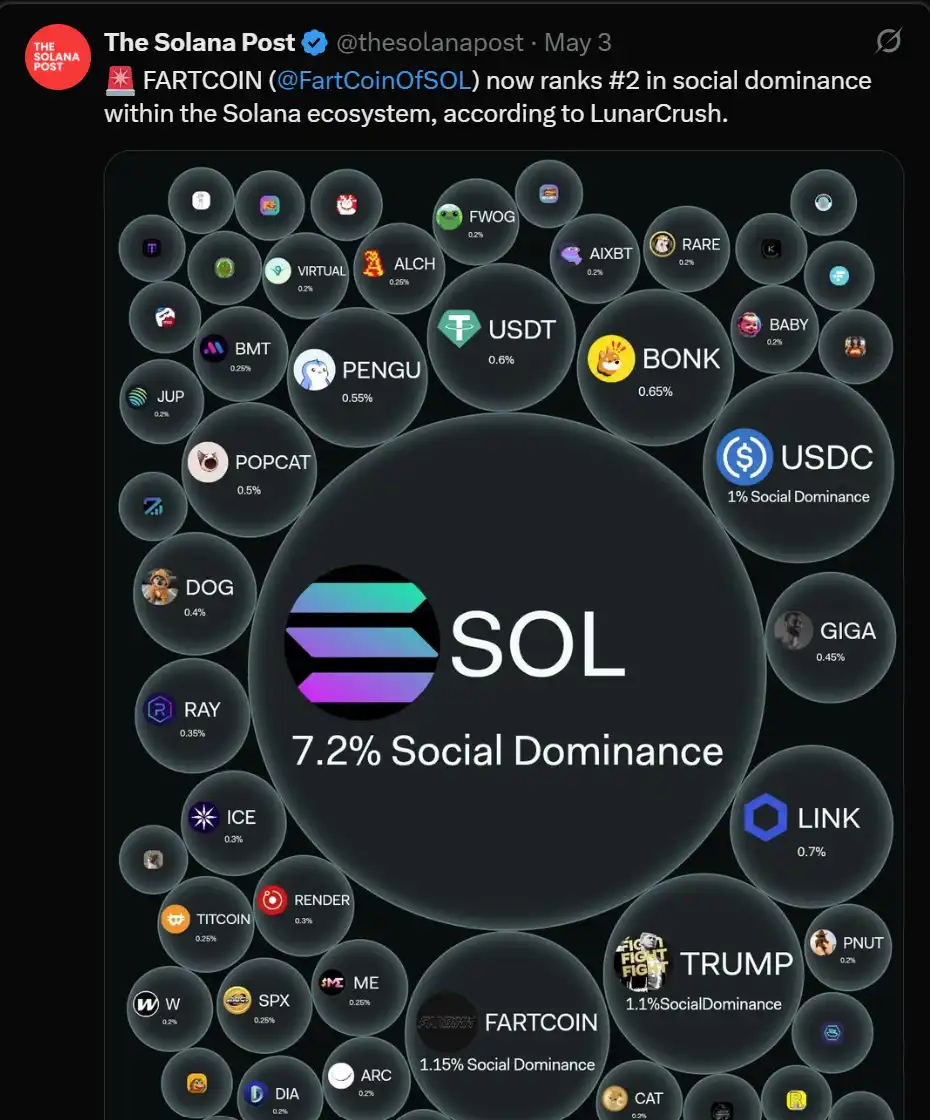

$FARTCOIN is a beta version of the AI token. Good performance in smart money flows:

And in terms of social following:

$PROMPT: After TGE, @AIWayfinder has gained more attention for new developments, such as the newly added token detail page:

$ANON:@HeyAnonai continues to focus on DeFai with a new integration with @yearnfi:

Although the @virtuals_io ranking is among the coins that have fallen in attention, this should mainly be interpreted as a re-evaluation after last week's craze.

Spotlight on Virtuals

After the release of Virgen Points and Genesis, the Virtuals ecosystem seems to have found a new response, kick-starting the flywheel effect in its ecosystem.

One of the main criticisms of Virtuals is that token sales are often snapped up, making it difficult for regular users to participate. This issue has been partially resolved by tweaking the Virgen points mechanism to make it an eligibility criterion for the Genesis offering.

$BIOS had outperformed the initial contribution by as much as 50 times when Genesis was launched, and the new launch was solid this week.

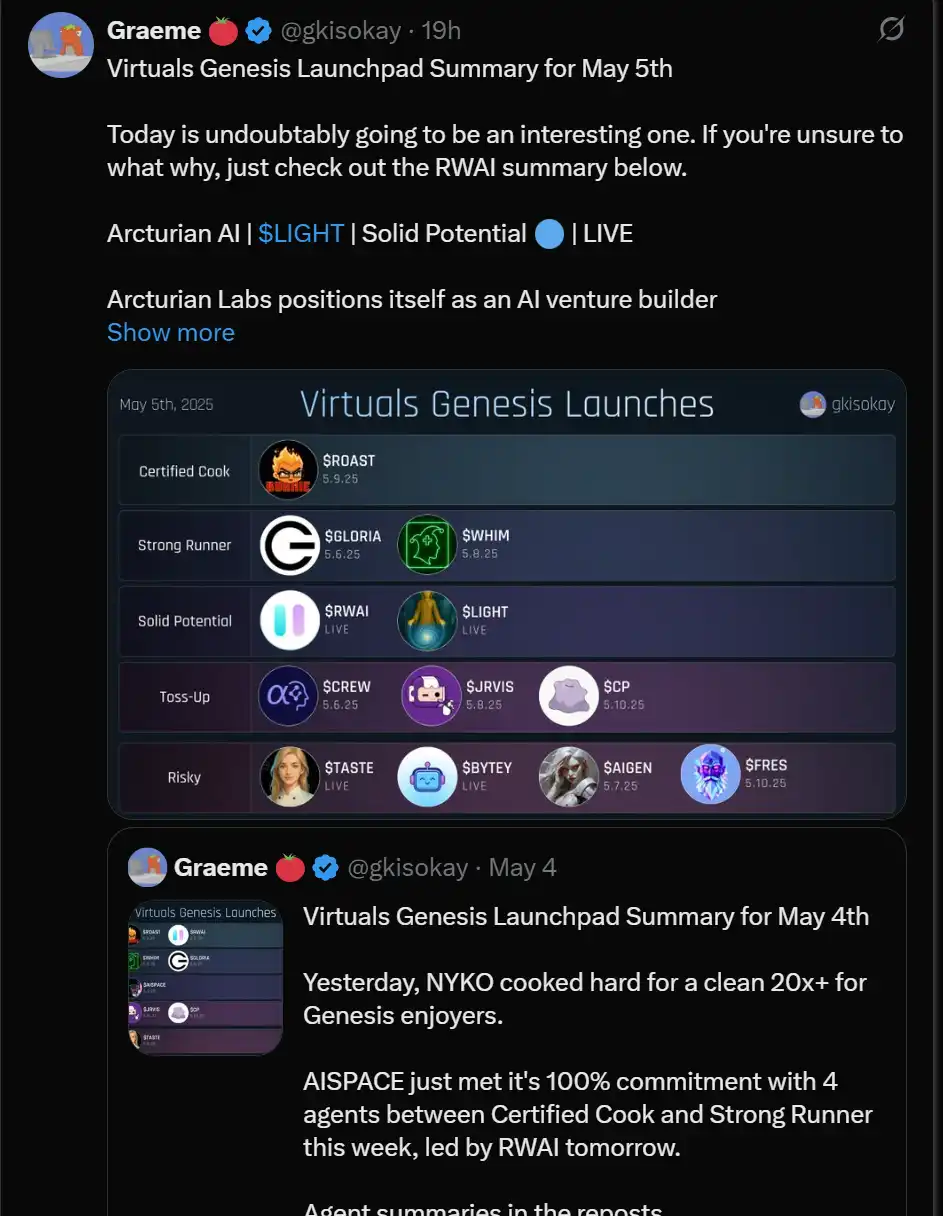

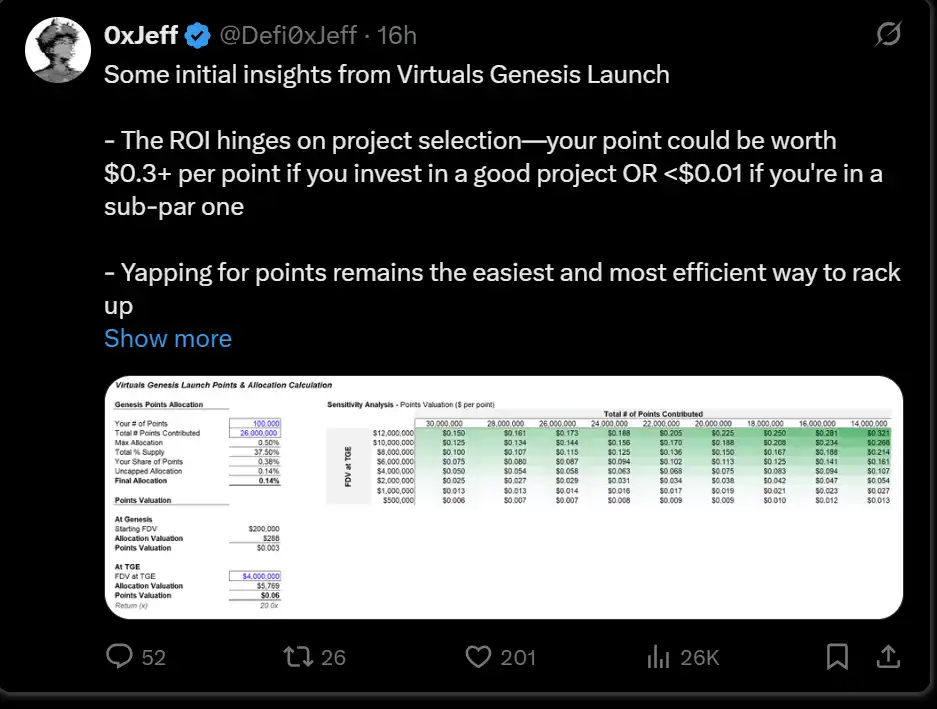

If you haven't gotten to the bottom of the Genesis launch, I highly recommend doing so, as this is one of the most important developments that have happened recently.

Here's a detailed summary of the Genesis offering to help you get started:

More about the Genesis offering:

This week's focus is on updates and readings

@jinglingcookies provides a great introduction to robotics:

@Rewkang Robotics:

AI has been one of the main topics discussed at Token 2049:

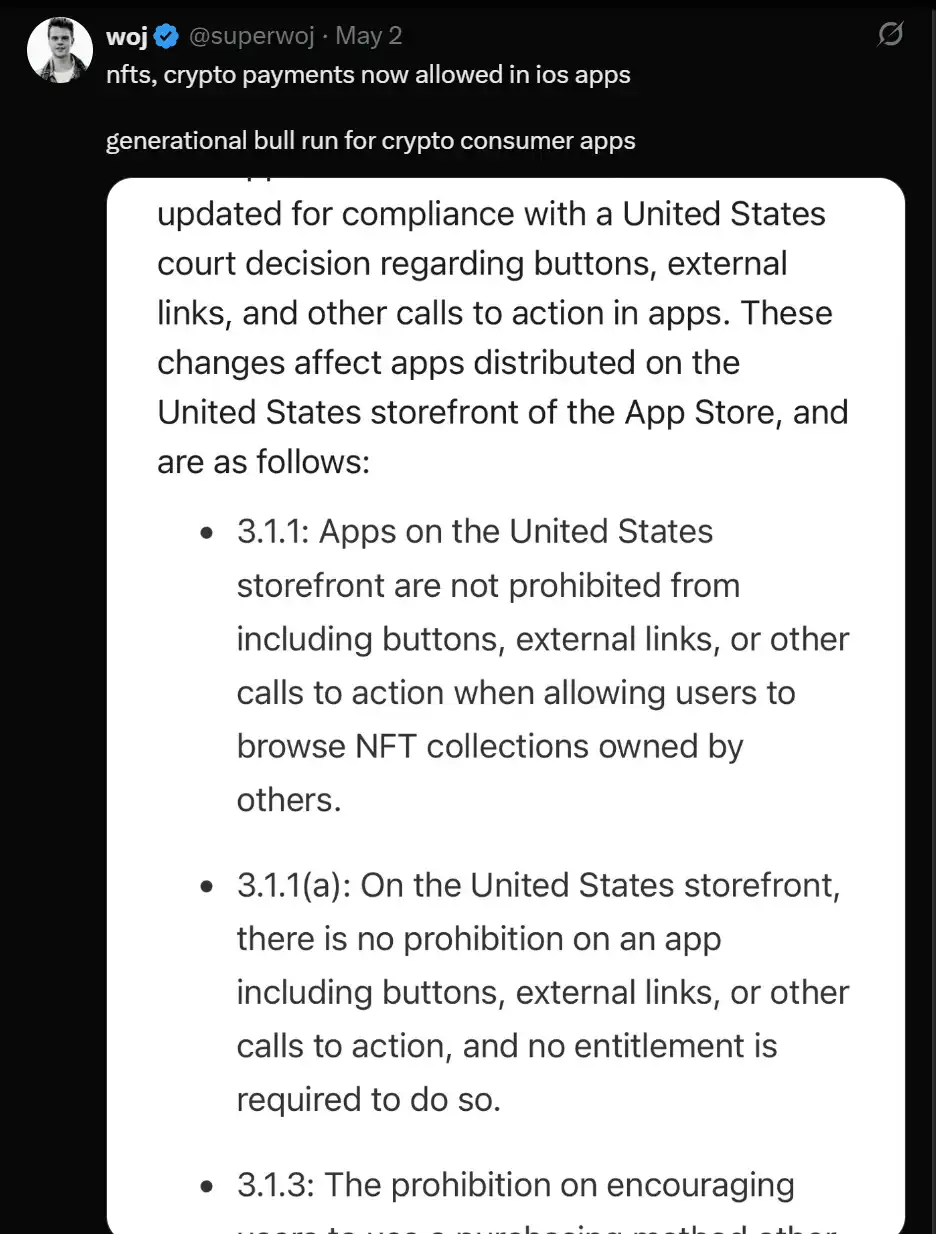

The iOS App Store now allows crypto payments – is this a major unlock for AI-brokered consumer apps?

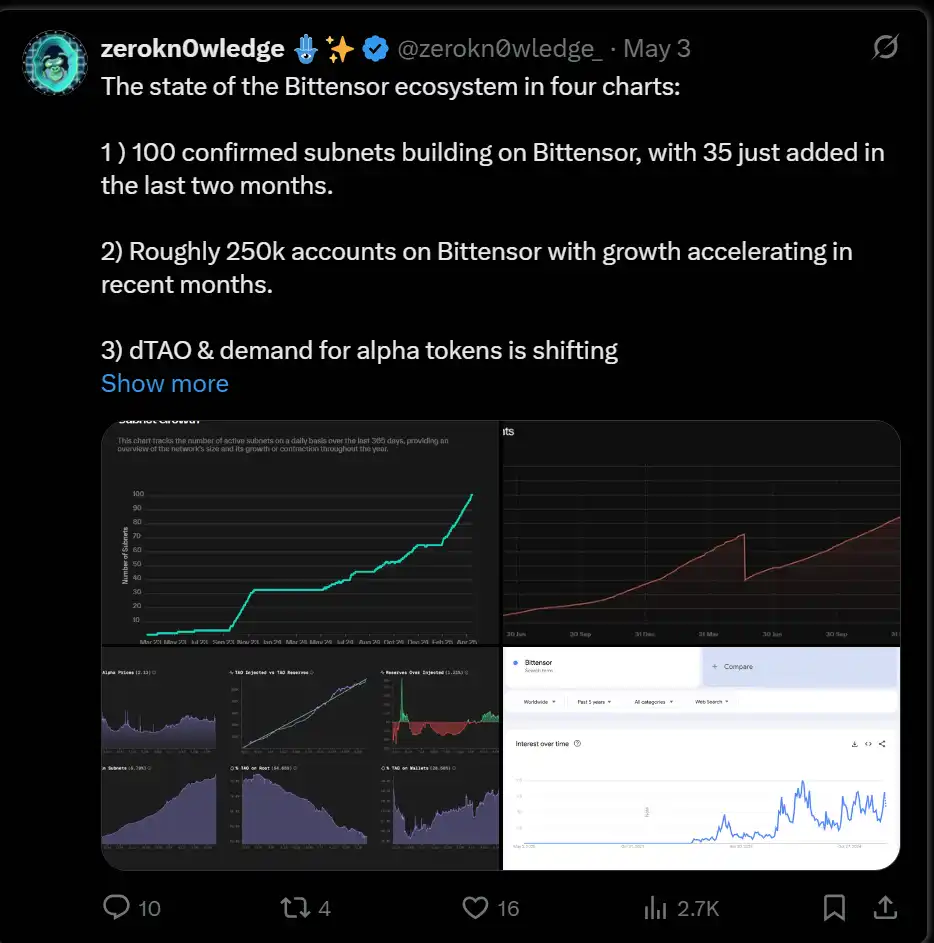

Status of Bittensor:

Bittensor Summit:

How to interpret $TAO metrics:

@0x Capx, an AI-focused @arbitrum chain:

Excellent Surrogate:

@sandraaleow Top 10 AI Tools :

Key trends in AI:

0xprismatic on @Meta and AI:

Link to original article