Standard Chartered Bank Report: Solana Is Becoming a "Meme Chain" and Stuck in Growth Difficulties?

Words: Adrian ZmudzinskiCompiled

by Tim, PANewsAccording

to a recent report by Standard Chartered Bank, Solana, a Layer1 blockchain, may be evolving into a "single-function platform" focused solely on generating and trading meme coins.

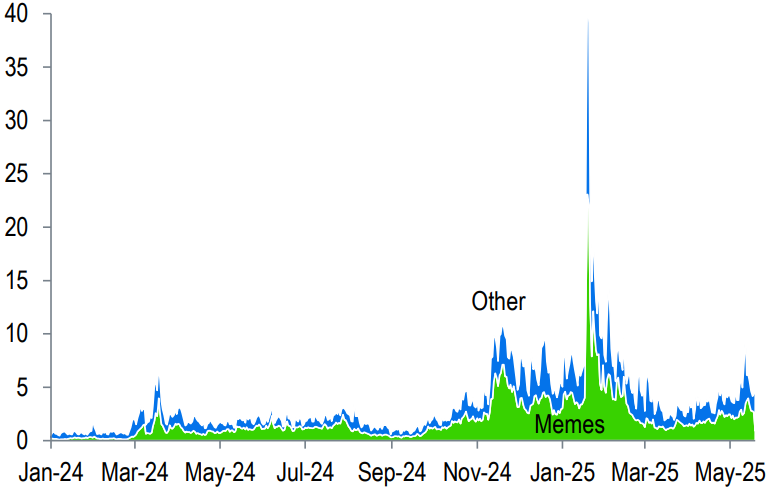

According to the May 27 research report, Solana's dominance in the high-volume, low-transaction cost public blockchain space is due to its design architecture for fast and low-cost transaction confirmations, and this technological advantage has had an unintended consequence: so far, this has been largely focused on meme coin transactions, which account for the majority of activity on Solana (measured in terms of "GDP", i.e., app revenue).

Standard Chartered said the meme coin boom was a stress test of Solana's scalability, but the volatile and speculative nature of the asset also had drawbacks. With the decline in meme coin trading volumes, the bank warned that Solana may struggle to maintain its momentum.

Meme Mania Passes

Its PeakThe report notes that Solana-based meme mania has passed its peak and that declining usage and "cheap" trading are not an ideal combination. The bank suggested that Solana should expand into other areas that require high-volume, low-cost, and fast transaction processing, such as emerging areas such as financial settlements, decentralized cloud computing, or real-time data exchange, which require efficient processing of large volumes of transactions, which are highly compatible with the high-throughput nature of its blockchain.

Solana decentralized exchange trading volume. Source: Standard Chartered According

to the report, these areas may include high-throughput financial applications and traditional consumer applications such as social media. However, the bank pointed out that it could take years for such apps to scale up, and this will have serious consequences for Solana, as its market competitiveness, developer ecosystem and platform credibility could be hit hard if it does not progress as expected, and its valuation could also face significant correction pressure.

"As a result, we expect Solana to underperform Ethereum in the next two to three years before catching up, at least in terms of actual value."