SOL is one of the best coins for long-term investment? Deciphering the multiple engines of Solana's ecological value explosion

Author: FLOW

Compilation: Tim, PANews

Since the end of January, the crypto market has been in a downward trend, mainly affected by macro uncertainty and weak sentiment. Recently, however, we have observed a new round of upward momentum in the market.

While it's still early days, there are signs that we may be at an inflection point in the development of cryptocurrency. This trend sparked me to write a piece about the current state of Solana's ecosystem.

For me, Solana remains one of the most powerful layer-1 blockchains on the market. It is the fastest-growing ecosystem in the crypto space, and is one of the few public chains that truly has the advantage of organic growth, and has even surpassed Ethereum in many on-chain metrics.

Without further ado, let's get started.

What will be discussed next:

- Network status

- On-chain activity

- ecosystem

- SOL price analysis

Solana network status

At the beginning of the analysis, let's put aside the price factor for a moment and focus on the fundamentals. It's important to point out here that Solana, as a blockchain network, seems to be at its strongest stage of development in its history.

Solana network stability

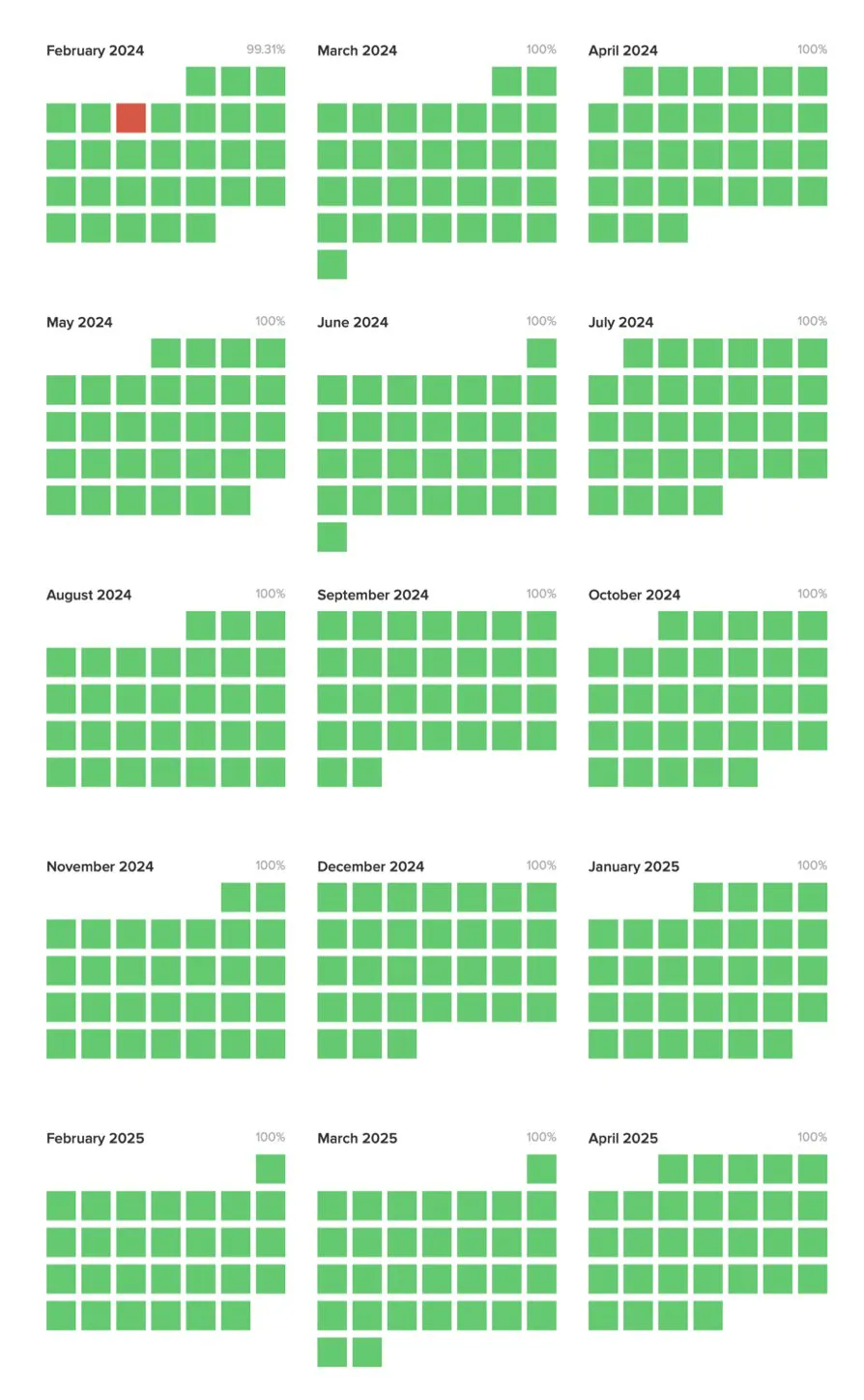

In its early days, Solana was criticized for network outages and unstable operations. However, this seems to be a thing of the past. The network has not experienced a single outage since February 2024.

The Lindy Effect is a powerful force in the crypto space, and it is an important indicator of trust and reliability. I think that's a key reason why Ethereum has so far been favored by large institutions: since its mainnet launch in 2015, the network has maintained a record of zero downtime.

Although Solana is still a little lacking in this area, its data performance is still encouraging. As uptime increases, so does trust and reliability, which is critical.

Degree of decentralization

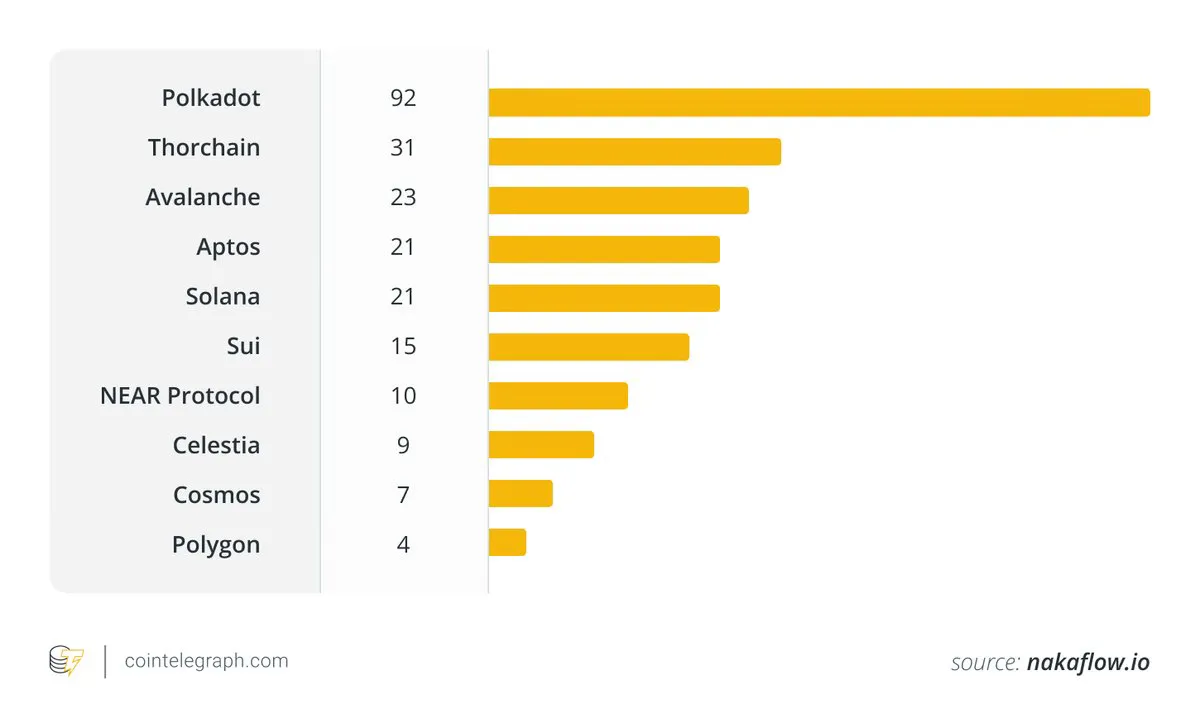

Blockchain is guided by decentralization, a feature that distributes power and decision-making across nodes, making the network resilient. A simple measure of decentralization is the Satoshi coefficient, with higher values representing more decentralization of the system. According to the latest data from CoinTelegraph, Solana stands out with a Satoshi coefficient of 21.

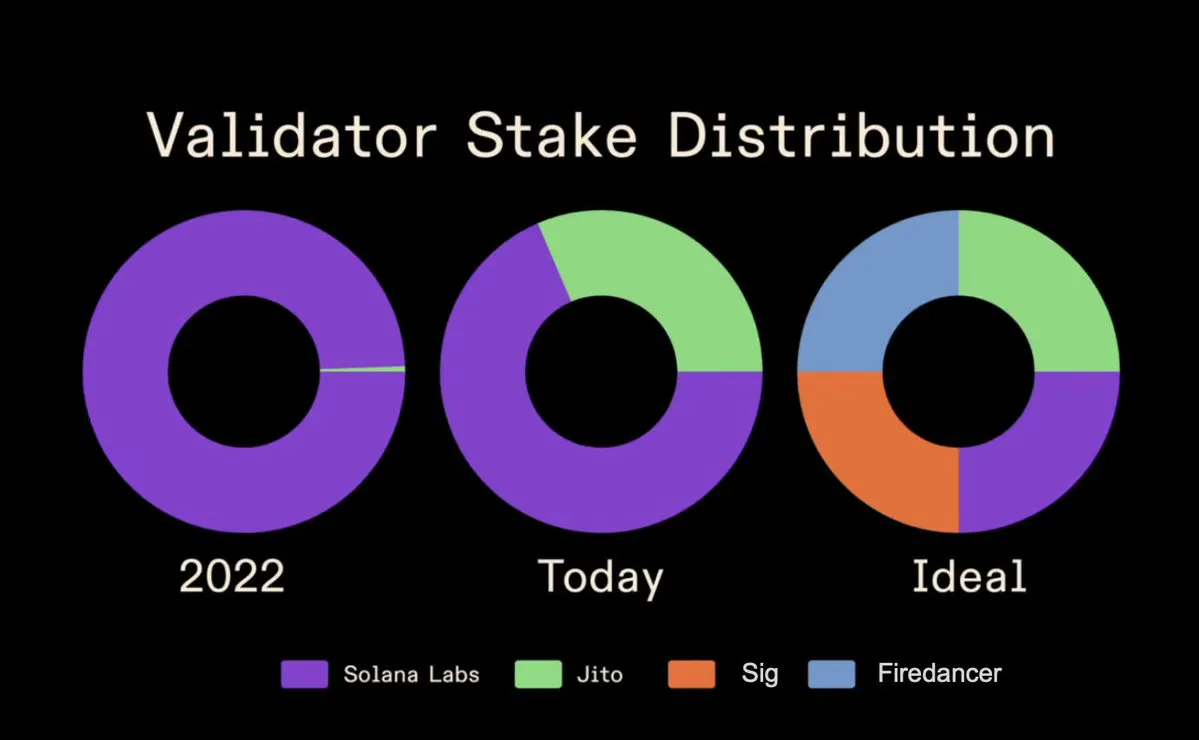

Another key metric of decentralization is client diversity. Having multiple validator clients reduces the risk of a single point of failure, which is critical to the mature development of blockchains. At present, only Ethereum has achieved the coexistence of multiple independent validator clients. At this stage, Solana has only one validator client, which is provided by Solana Labs (although the Jito Labs version is a fork in nature and not a standalone implementation). However, two separate clients are in the works: Firedancer by Jump Crypto and Sig by Syndica. Once live, these clients will significantly increase the decentralization of the Solana network by moving away from a single codebase and introducing true client diversity.

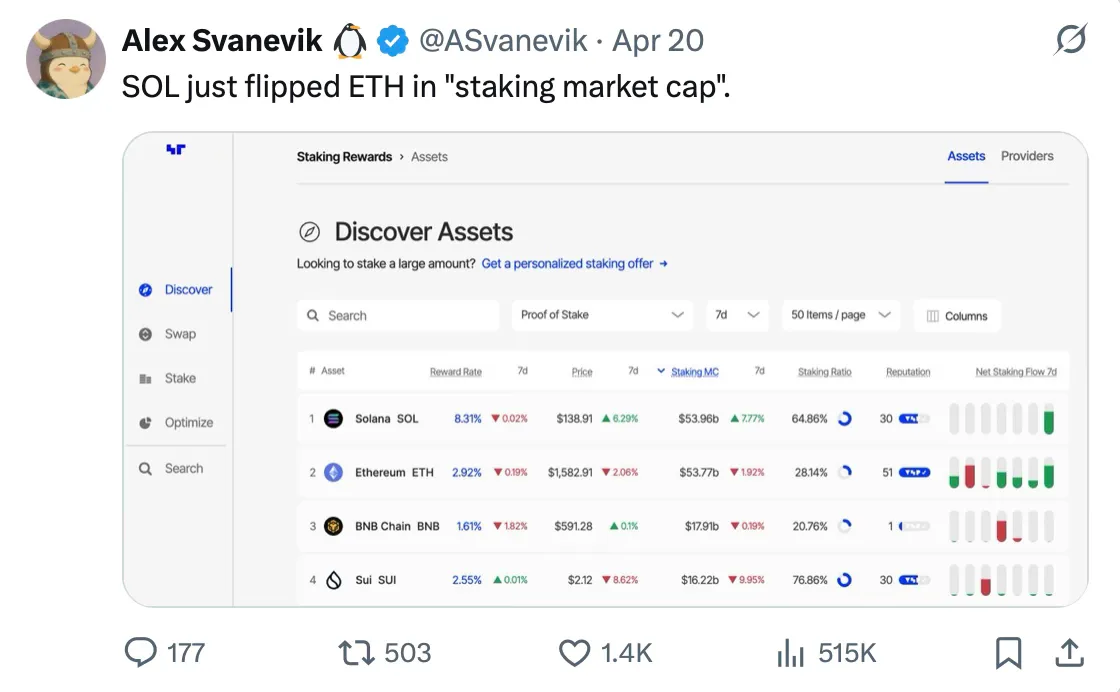

SOL staking market capitalization

Solana also recently surpassed Ethereum to become the No. 1 blockchain by staking market capitalization. On the face of it, this shows that Solana is currently leading the way in terms of economic security. This value will be especially important after the slashing mechanism is enabled on the mainnet.

(PS: I know that there is a lot of controversy on the topic of "economic security" and a lot of simplification, but for the sake of this article, I will consider the stake market value as a valid indicator.) )

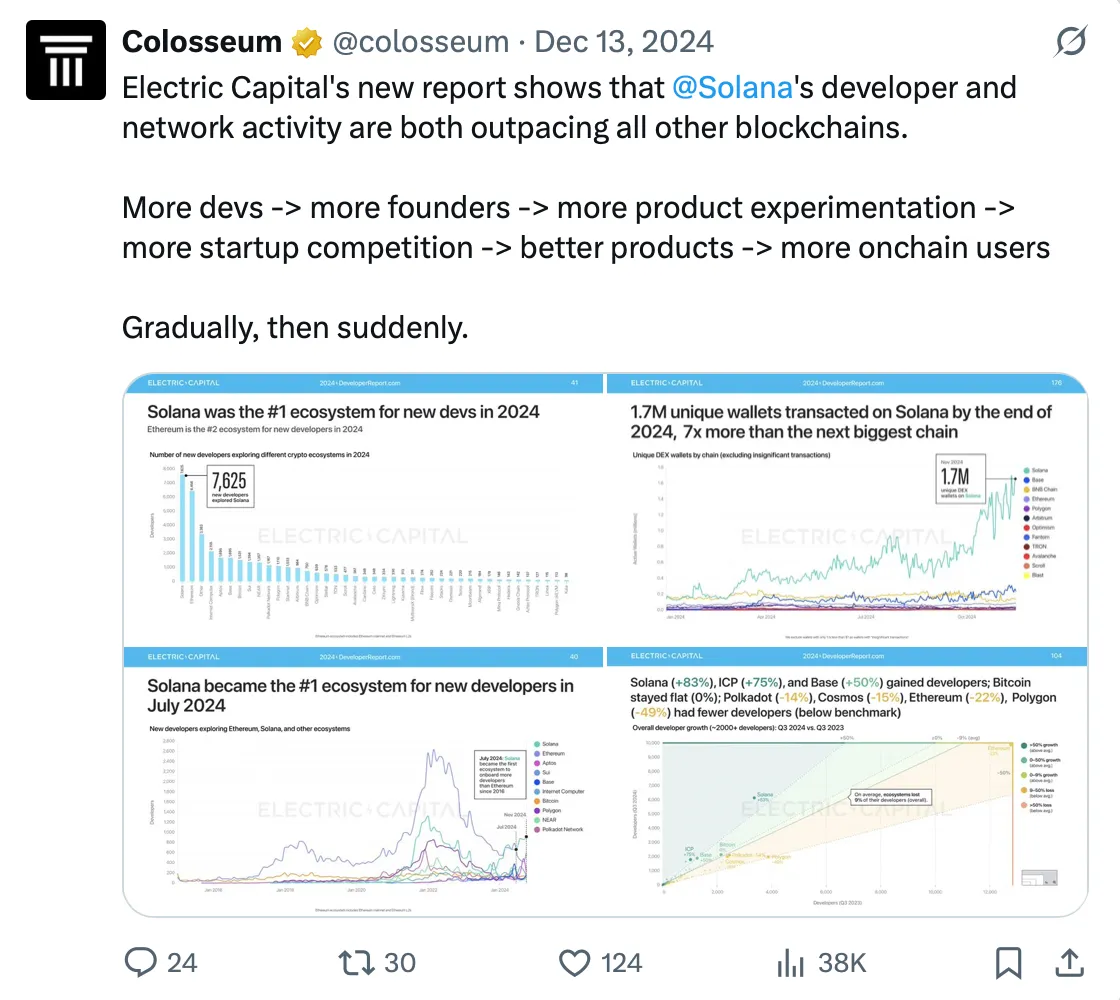

Developer activity

Developer activity is another important metric to look at. At the end of the day, it's the level of developer activity that is building the future of blockchain. According to the latest report from Electric Capital, Solana has become the go-to ecosystem for new developers in 2024.

Last but not least, new initiatives aimed at improving Solana's performance at the communications layer, such as DoubleZero, are emerging, another important vertical to keep an eye on in the future.

On-chain activity

Since the beginning of 2024, on-chain activity has been on a significant long-term upward trend, with numerous new projects emerging and the DeFi ecosystem booming. This can be confirmed by different indicators.

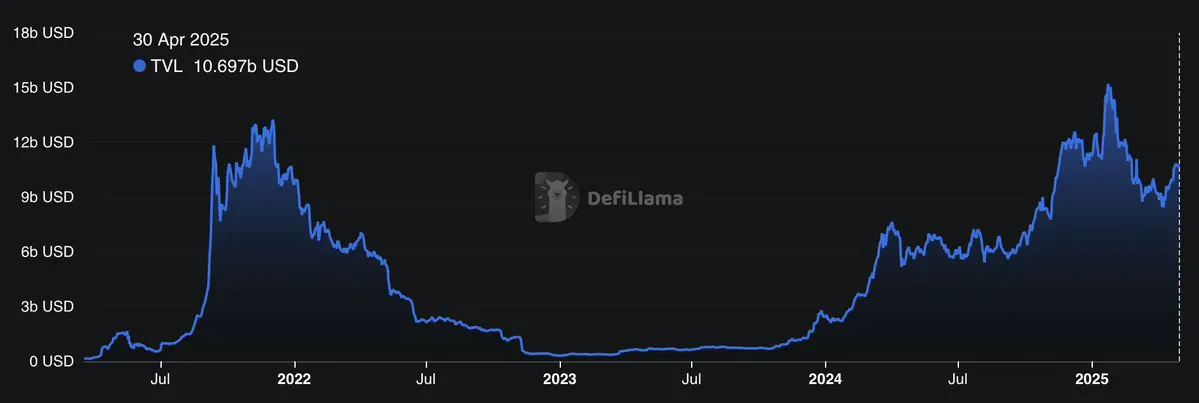

TVL

TVL climbed from less than $1 billion at the end of 2023 to an all-time high of more than $15 billion in early 2025. Although TVL has since retreated slightly, it has remained stable around $10 billion and has shown strong market resilience.

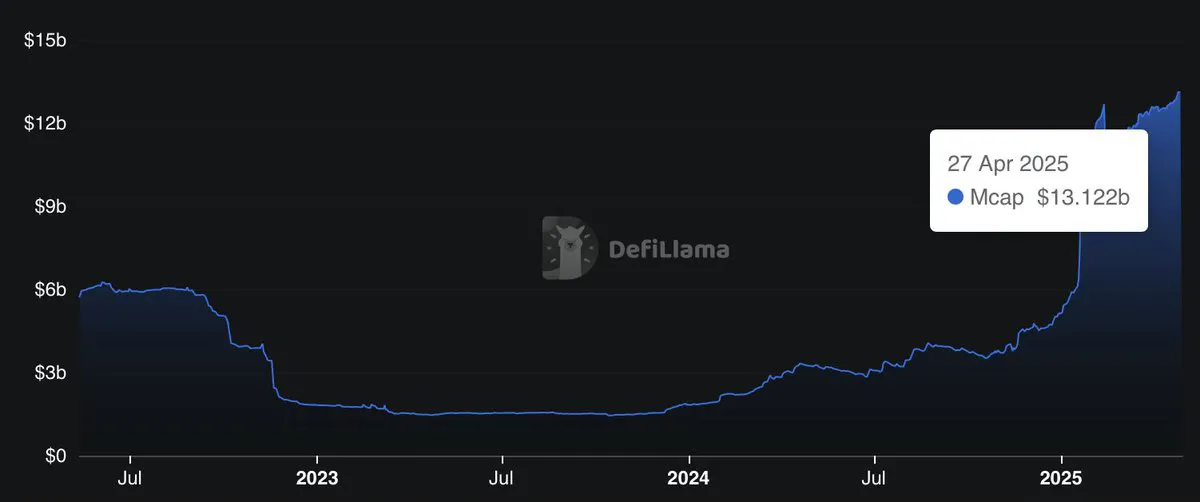

Stablecoin market capitalization

Solana has also seen strong growth in stablecoin inflows over the past year. As of this writing, the stablecoin market cap on Solana has reached an all-time high of $13.2 billion. This is a clear indication of the continued growth of people's adoption and trust in the web.

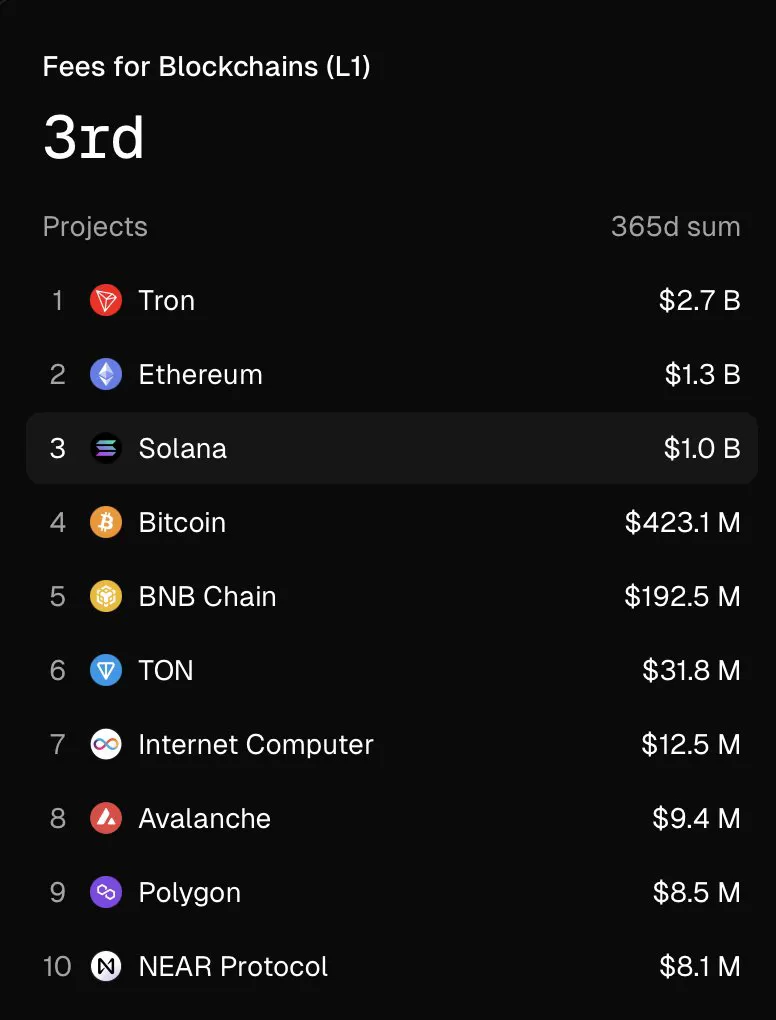

Transaction fees

Judging from last year's total fee ranking, Solana ranked as the third largest L1 blockchain in terms of transaction fees, and the gap with Ethereum is very small, which once again confirms the high activity and strong market demand of the network.

ecosystem

Opponents may say that Solana's success is due solely to the Pump.fun and Memecoin mania, but I think this argument ignores the more important reason: Solana is the fastest-growing ecosystem in the entire crypto space, and its momentum is increasingly coming from real-world use cases.

In fact, I think we can even assert that the benefits of the Meme coin mania happening on the Solana blockchain actually outweigh the disadvantages in the long run. This phenomenon acts as a carrot bait that has allowed the Phantom Wallet to fit into millions of phones around the world. This approach effectively solves the "cold start dilemma" that all emerging networks face, that is, how to break through the bottleneck of the initial user base.

Building on the success of its existing user base, Solana is well-positioned to support more applications with real value and continue to drive its growth.

DeFi is maturing day by day

The DeFi ecosystem on Solana is maturing. As mentioned earlier, Solana has now become the second largest Layer 1 blockchain by TVL, and is one of the few public chains that can break the historical TVL peak in 2025 and continue the growth momentum of the previous cycle. This performance reflects both the high stickiness of users and its real market appeal.

The first wave of DeFi on Solana in 2021 was largely experimental in nature and driven by market hype. Today, its growth appears to be more sustainable, with a stronger foundation and a clearer market fit.

Protocols that I think are worth mentioning include Jito, Kamino, Marinade, Radium, or Jupiter.

In order to show the speed of Solana's development, the official released some updates for the month of May on X:

In addition, we are witnessing the emergence of a new wave of DeFi primitives, among which are notable:

- Real yield platforms such as RateX, Exponent Finance, Sandglass, or Pye Finance

- Liquidity re-staking through Kyros

- A new stablecoin base protocol that works with Perena, Global Dollar, or KAST Card

- Yield aggregators such as Lulo and Carrot

- Switchboard-based oracles

There are many similar examples.

Solana also continues to attract existing protocols, with the most recent example being 1inch, which has just gone live on mainnet.

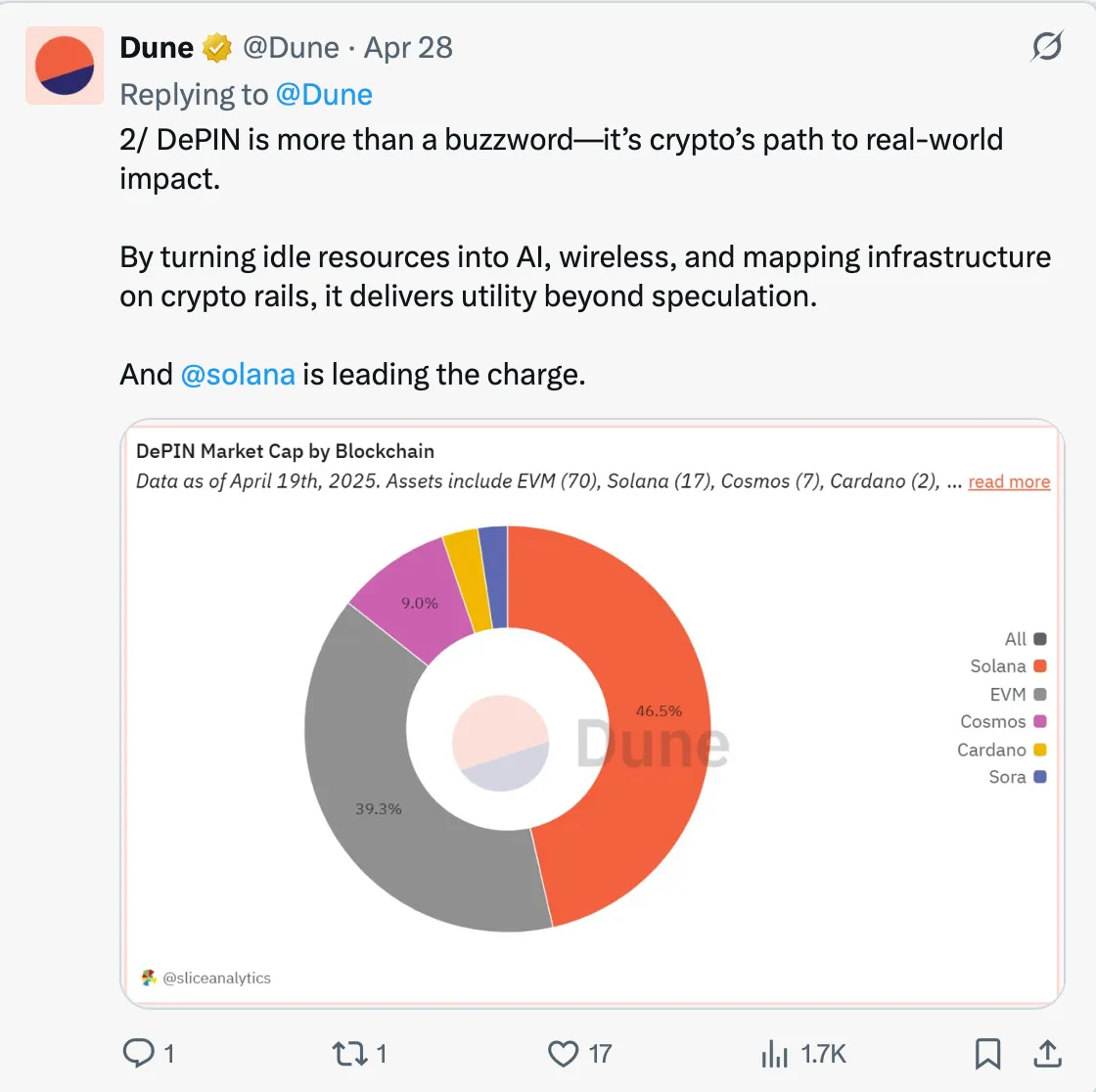

The rise of DePIN

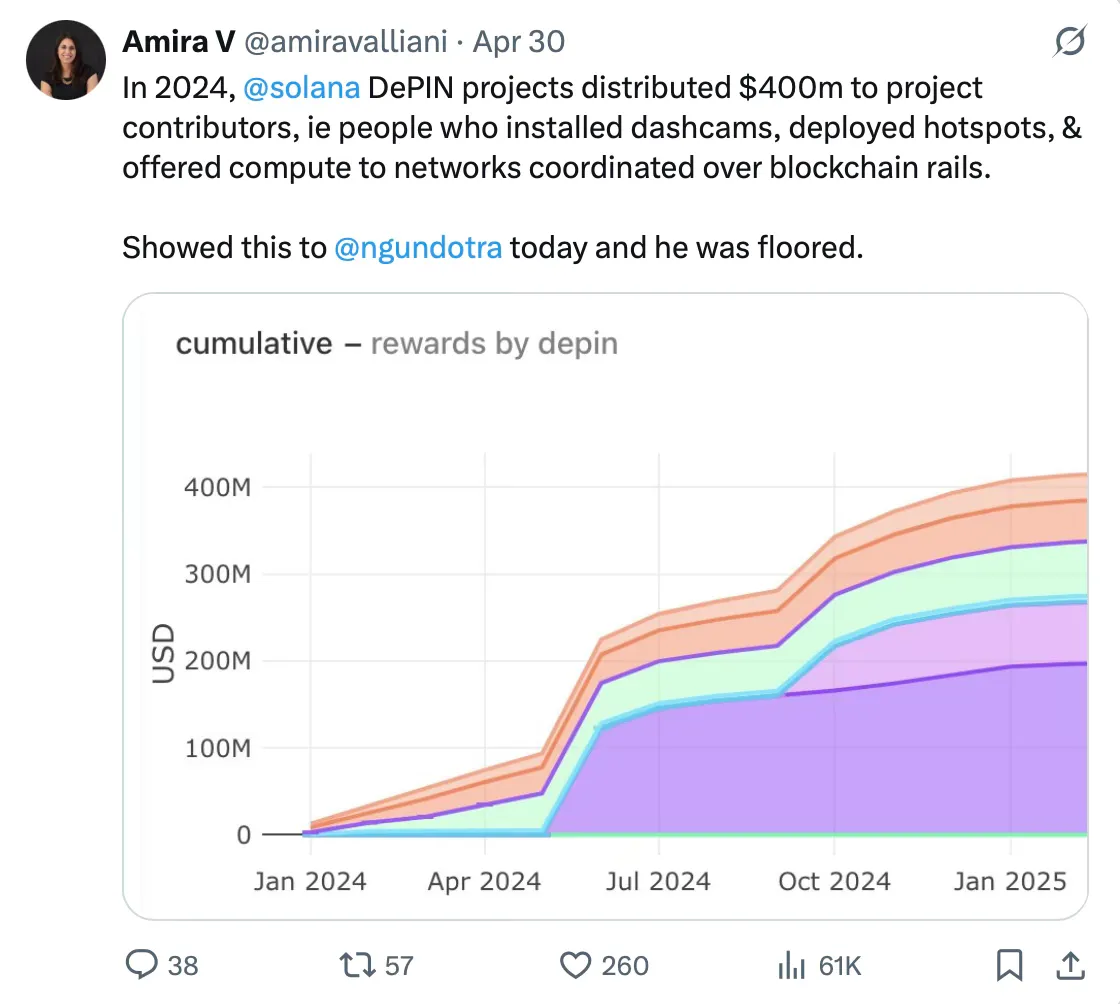

In addition to DeFi, we have also witnessed the rise of DePINs. According to Dune data, 46.5% of the total market capitalization of DePIN is currently concentrated on the Solana blockchain, and top projects such as Helium, Hivemapper, and Render have been incubated.

They have allocated more than $400 million to those involved in these projects, which is a very large amount.

Breakthroughs in consumer applications

Although it's still in the early stages of the crypto space, there's a strong push that's trying to break into consumer applications. It's a challenging track that takes a lot of time and trial and error to break through, but seeing talent like Nikita Bier join Solana as a consultant gives me optimism.

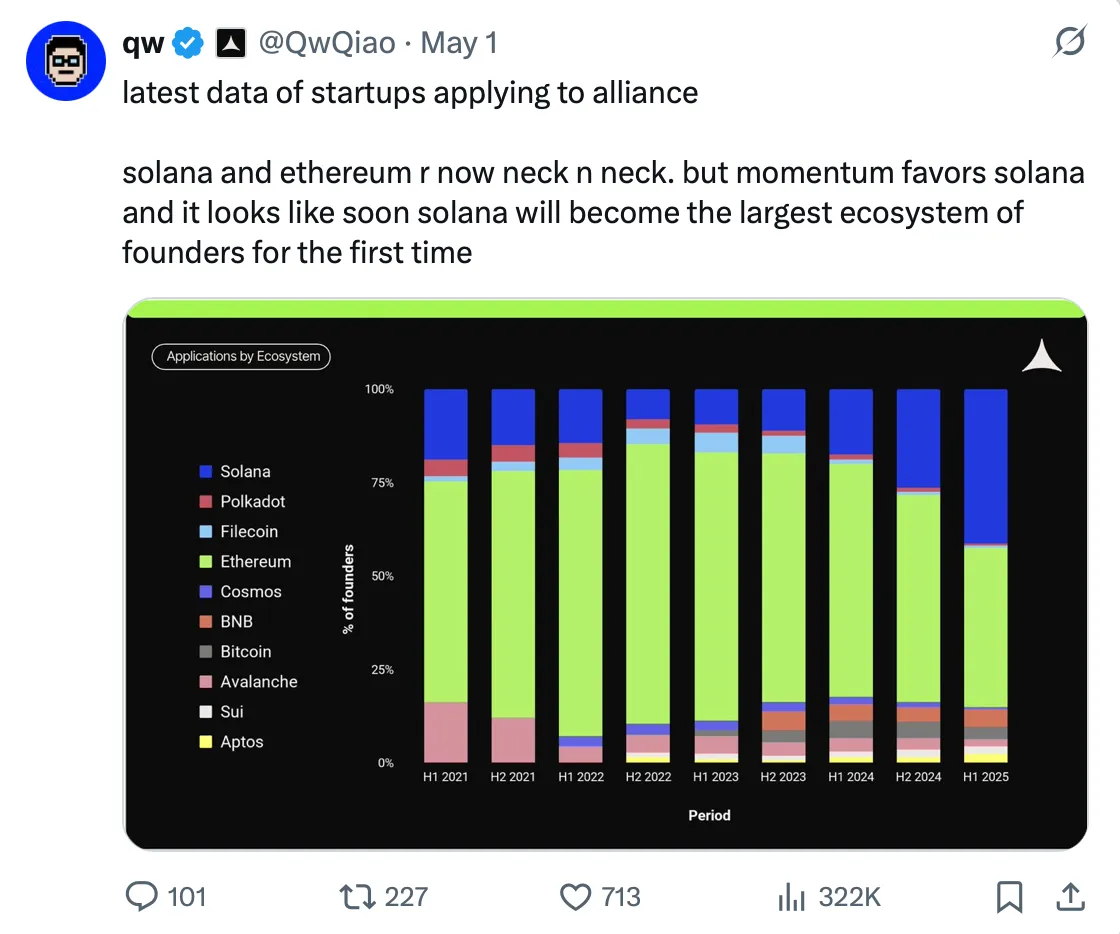

At the moment, crypto developers can't find a better platform than Solana. This blockchain network is attracting top talent and offers the most supportive initiatives: an active ecosystem fund, intensive hackathons, and a strong developer culture where startups are truly alive. The data also confirms this prosperity: according to Qw Qiao, Solana is about to surpass other platforms for the first time and become the blockchain ecosystem with the largest number of Alliance founders.

This leads me to believe that of the many layer-1 blockchains, Solana is most likely to be the birthplace of the first breakthrough crypto consumer applications. If this scenario comes to fruition, it will be a big plus for the network. Further developments deserve close attention.

Strong community

So far, we've explored a number of metrics and tangible elements used to evaluate networks. But I would say that Solana's greatest strength is precisely intangible: its community.

It's often said that communities that have lived through the darkest moments, like the FTX crash, will eventually come back to life and become resilient, and I think that's part of the story. Another key factor is the Superteam community, which has excelled in nurturing talent and maintaining momentum, always breathing life into the ecosystem.

In my opinion, this is one of the secrets of Solana's success, and it is simply impossible to replicate. No other blockchain project in the crypto space has this kind of culture.

Institutions are admitting

Institutional interest in blockchain networks is also accelerating. A recent example is the BlackRock BUIDL Fund, which expanded its operations to Solana after Ethereum. There are many more similar cases, but I think it's enough to say that traditional finance is gaining confidence in on-chain infrastructure.

In addition, Solana is likely to be the next crypto asset to receive spot ETF approval in the United States. According to the current forecast of the Polymarket platform, the probability of its approval in 2025 is 77%. The adoption of the ETF will further the official recognition of SOL as an investable asset, while strengthening Solana's position as a market network with high trust and integrity. This regulatory recognition is expected to open up new avenues for institutional and retail investors to participate and attract more incremental capital into the Solana ecosystem.

SOL price analysis

Looking at the price action, SOL experienced its first hype boom between 2020 and 2021. But like most emerging protocols, the infrastructure was not yet complete and the ecosystem was not yet mature. As the crypto market entered a bear market in 2022, the heat quickly subsided. The impact of the FTX exchange crash is even worse, and many people believe that Solana has become a "dead project".

Unlike most of the agreements that have been a difficult recovery, Solana has made a comeback with a stronger stance. After about a year and a half of sideways, SOL broke through the price range for the first time and opened the first surge in a new bull market. In fact, it became one of the few Layer 1 protocols to hit an all-time high since 2021, and this time it has a real and strong ecosystem behind it.

As it stands, SOL has rebounded strongly to around $170 after plunging nearly 67% from its all-time high in January. While there may be some signs of overbought in the short term, the outlook is explosive in the medium to long term.

In mainstream L1, SOL also shows significant relative strength. The current SOL/ETH exchange rate has formed a definite upward trend and is approaching all-time highs.

What's next?

Of course, we can't predict where the price will go right now. Instead, what we can do is establish a framework to better evaluate investment opportunities from a risk-versus-return perspective. A simple heuristic that I like to use is to compare the fundamental change of an asset from one point in time A to another point in time B with the change in price.

At the moment, what I'm seeing is that you can now buy SOL at the same price that the market did during the frenzy of 2021. At the time, Solana was just a dream, with no product-market fit and the DeFi ecosystem was just getting started. Today, the network has a bright future, becoming the fastest-growing blockchain in the cryptocurrency space, with real users, real-world use cases, and growing institutional interest.

In addition, I also believe that the market structure is evolving, and in this evolution, the underlying network will continue to be the area where most of the market value continues to accumulate.

From that perspective, here's my thinking:

The value of crypto networks will continue to grow as more applications and projects continue to be developed on the crypto network, coupled with a friendly regulatory environment and rising adoption rates. Ultimately, all investors around the world will want a piece of the pie.

In addition to Bitcoin, I think the Layer 1 blockchains will still be the core carriers of value precipitation (they are the operating system of the crypto world).

Based on all the reasons we've mentioned earlier, I think Solana is in a very strong position in a layer 1 blockchain.

Therefore, I believe that SOL remains one of the excellent investment opportunities for those who have been following cryptocurrencies for a long time.

Finally, I'll leave you with this one thing: most people still underestimate Solana, and that's a good thing.