The pro-crypto policy promotes the RWA narrative of U.S. stocks, interpreting the opportunities and challenges of tokenised stocks

Abstract: As Trump's policies are being fulfilled one by one, attracting manufacturing backshore through tariffs, actively detonating the stock market bubble and forcing the Federal Reserve to cut interest rates and release water, and then promoting financial innovation and accelerating industrial development through de-regulatory policies, this combination is really changing the market. Among them, the RWA track under the favourable de-regulatory policy has also attracted increasing attention from the crypto industry. This article focuses on the opportunities and challenges of tokenised stocks.

In

fact, tokenised stocks are not a new concept, since 2017, the attempt at STO has begun, the so-called STO (Security Token Offering, security token issuance) is a financing method in the field of cryptocurrency, its essence is to digitise the rights and interests of traditional financial securities, put them on the chain, and realise the tokenization of assets through blockchain technology. It combines the compliance of traditional securities with the efficiency of blockchain technology. As an important security class, tokenised stocks are the most interesting application scenario in the STO space.

Before the advent of STOs, the mainstream financing method in the blockchain space was ICO (Initial Coin Offering). The rapid rise of ICOs mainly relies on the convenience of Ethereum smart contracts, but the tokens issued by most projects do not represent real asset rights, and there is a lack of supervision, resulting in frequent fraud and runaways.

In 2017, the U.S. SEC (Securities and Exchange Commission) issued a statement in response to the DAO incident, stating that certain tokens may be securities and should be regulated under the Securities Act of 1933. This was the starting point for the official germination of the STO concept. In 2018, STO became popular as a "compliant ICO" concept and began to attract attention in the industry. However, due to the lack of unified standards, poor liquidity in the secondary market, and high compliance costs, the market has developed slowly.

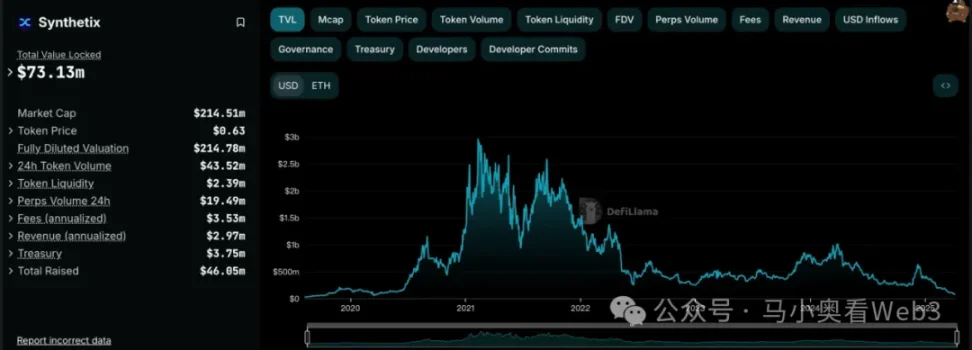

With the advent of the DeFi Summer in 2020, some projects have begun to try to create derivatives pegged to the stock price through smart contracts through decentralised solutions, allowing on-chain investors to directly invest in the traditional stock market without the need for complex KYC processes. This paradigm, often referred to as the synthetic asset model, does not directly own U.S. stocks, and does not require trust in a centralised authority for trading, bypassing expensive regulatory and legal costs. Representative projects include Synthetix and Mirror Protocol in the Terra ecosystem.

In these projects, market makers can provide on-chain synthetic U.S. stocks by providing excess cryptocurrency collateral and providing market liquidity, while traders can gain price exposure to the anchored stocks by trading these underlying stocks directly through the secondary market in the DEX. I still remember that the stock in the U.S. stock market at that time was still Tesla, not Nvidia in the previous cycle. As a result, most of the projects slogan have a selling point of trading TSLA directly on-chain.

However, judging from the final market development, the trading volume of synthetic US stocks on the chain has been unsatisfactory. Taking sTSLA on Synthetix as an example, counting the minting and redemption in the primary market, the total cumulative on-chain transactions are only 798. Later, most of the projects claimed that due to regulatory considerations, they would remove synthetic assets from the U.S. stock market and turn to other business scenarios, but the essential reason is likely to be that they did not find PMFs and could not establish a sustainable business model, because the premise of the establishment of synthetic asset business logic is that there is a large demand for on-chain transactions, attracting market makers to mint assets through the primary market and earn fees for market making in the secondary market, and if there is no such demand, market makers will not only be unable to obtain income through synthetic assets. At the same time, it also has to bear the risk exposure brought by synthetic assets, which is short-anchored to U.S. stocks, so liquidity will also shrink further.

In addition to the synthetic asset model, some well-known CEXs are also experimenting with the ability to trade U.S. stocks for crypto traders through a centralised custody model. This model has a third-party financial institution or exchange that escrows the actual stock and creates a tradable underlying directly in the CEX. The more typical ones are FTX and Binance. FTX launched a tokenised stock trading service on October 29, 2020, partnering with German financial firm CM-Equity AG and Switzerland's Digital Assets AG to allow users in non-US and restricted regions to trade tokens pegged to shares of U.S.-listed companies, such as Facebook, Netflix, Tesla, Amazon, and others. In April 2021, Binance also began offering tokenised stock trading services, with Tesla (TSLA) being the first to list.

However, the regulatory environment at that time was not particularly friendly, and the core sponsor was CEX, which meant that it had formed a direct competition with traditional stock trading platforms, such as Nasdaq, and naturally came under a lot of pressure. FTX saw an all-time high in tokenised stock trading volume in Q4 2021. Among them, the trading volume in October 2021 was $94 million, but after its bankruptcy in November 2022, its tokenised share trading service was discontinued. Binance, on the other hand, announced in July 2021 that it would cease its tokenised stock trading services just three months after launching the business.

Since then, as the market has entered a bear market, the development of the track has also come to a standstill. It wasn't until Trump's election that his de-regulated financial policies brought about a shift in the regulatory environment and renewed interest in tokenised stocks, but at this time it had a new name, RWA. This paradigm emphasises the introduction of compliant issuers to issue tokens on the chain that are 1:1 secured by real-world assets through a compliant architectural design, and the creation, trading, redemption, and management of the collateral assets are strictly in accordance with regulatory requirements.

The current market status of the stock RWA

, so let's introduce the current market status of the stock RWA. Overall, the market is still in its early stages and is still dominated by US equities. According to RWA.xyz, the current total issuance in the stock RWA market reached $445.40M, but it is worth noting that $429.84M of that issuance is attributed to an underlying EXOD, which is an on-chain stock issued by Exodus Movement, Inc., a software company focused on developing self-custodial cryptocurrency wallets, which was founded in 2015 and is headquartered in Nebraska, USA. The company's shares are listed on the NYSE America Stock Exchange and allow users to migrate their regular Class A shares to the Algorand blockchain for management, where users can view the price of these on-chain assets directly on the Exodus Wallet, which currently has a total market capitalisation of $1.5B.