Meme issuance entered the Warring States Period: LaunchLab Day Graduation 198 tokens forced Pump.fun to profit creators

Author: Azuma (@azuma_eth)

On May 13, on-chain data analyst Adam posted Dune panel data on X showing that in the past 24 hours, the number of graduation tokens in the past 24 hours of Raydium's token issuance platform LaunchLab (including third-party issuance platforms built on LaunchLab such as Letsbonk.Fun) was 198, surpassing the number of Pump.fun by 171.

Adam commented that for the first time in history, Pump.fun was in real competition.

Historical grievances

Pump.fun has a long-standing feud with Raydium.

In the early design of the Pump.fun, the token issuance needs to go through two stages: "internal disk" and "external disk" - after the token issuance, it will first enter the "internal disk" trading stage, which should rely on the pump.fun protocol's own Bonding Curve for matching, and when the trading volume reaches $69,000, it will enter the "external disk" trading stage, at which time the liquidity will be migrated to Raydium, and the pool will be built on the DEX and continue to open for trading.

However, on March 21, Pump.fun announced the launch of its self-built AMM DEX product PumpSwap, and since then Pump.fun liquidity of tokens will no longer migrate to Raydium when entering the "external market", but will be directed to PumpSwap - this move directly cuts off the diversion path of Pump.fun to Raydium, thereby reducing the latter's trading volume and fee income.

In response, Raydium announced on April 16 that it had officially launched LaunchLab, a token issuance platform that allows users to quickly issue tokens through the platform and automatically migrate to Raydium AMMs once the tokens reach a certain size (85 SOL). Obviously, this is Raydium's direct counterattack to the menacing Pump.fun.

Odaily Note: For more information, please refer to Data Anatomy How Rely on Raydium Pump.fun? and Raydium Strikes Back at Pump.fun, Who Will Have the Last Laugh in the Meme Season Comeback? 》。

LaunchLab's "Killer Move"

While LaunchLab is similar to Pump.fun in terms of token issuance capabilities, its biggest feature is not the issuance itself — LaunchLab's architecture supports third-party integrations, which enables external teams and platforms to create and manage their own launch environments within the LaunchLab ecosystem. In other words, third parties can rely on LaunchLab's underlying technology (with the focus on liquidity pools remaining in LaunchLab and Raydium) to launch separate token launch frontends.

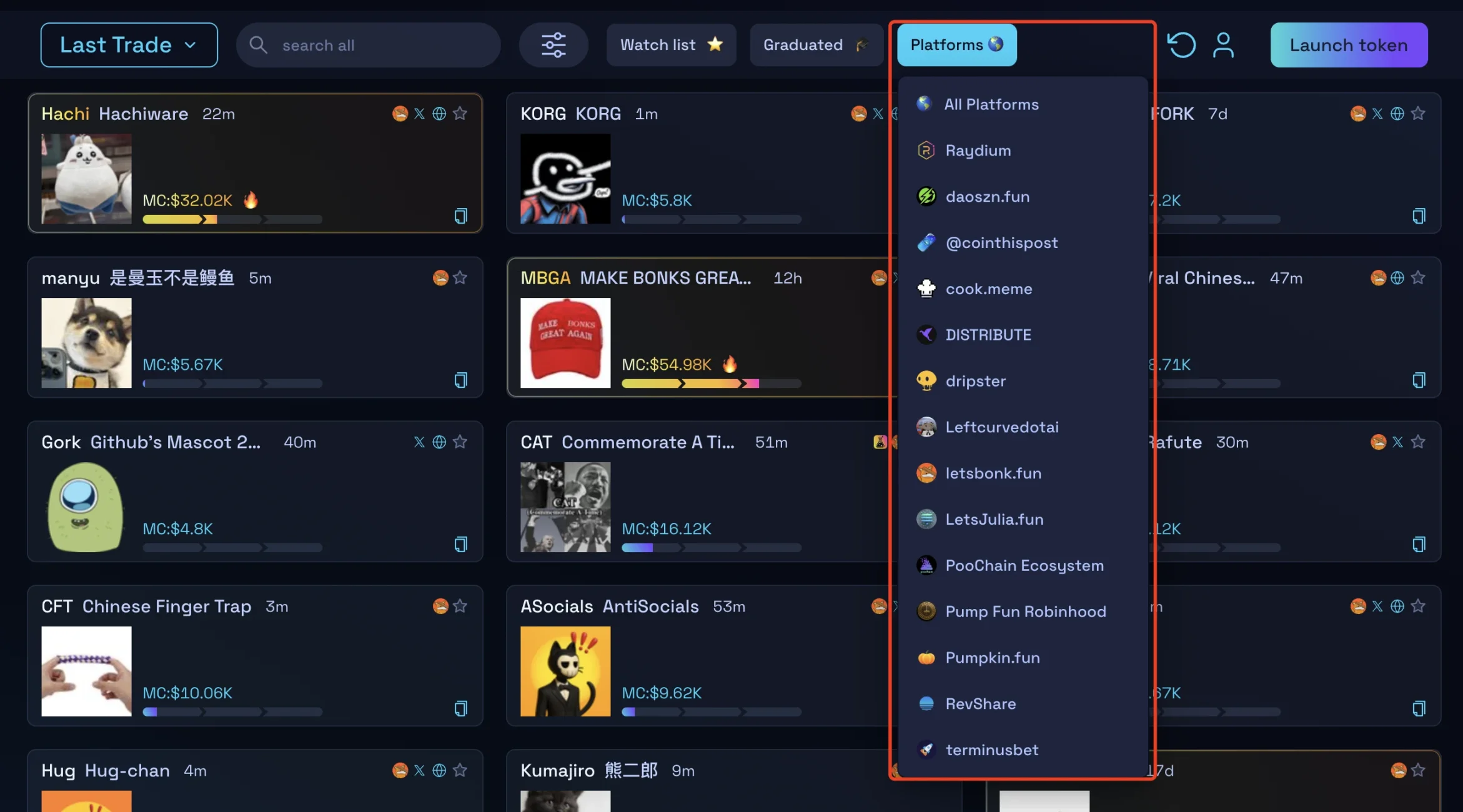

According to the official interface of LaunchLab, there are currently more than 10 third-party token issuance platforms built on LaunchLab, including the recently popular Bonk community token issuance platform Letsbonk.Fun - In fact, most of the tokens graduated in the current LaunchLab ecosystem are from Letsbonk.Fun (see "New Platforms for Issuing Coins Letsbonk.fun has become the latest top brand on the platform? 》)。

In short, LaunchLab's strategy is to use third-party platforms such as Letsbonk.Fun to besiege Pump.fun with a "wolf pack" strategy, and the current trend shows that this strategy is beginning to pay off.

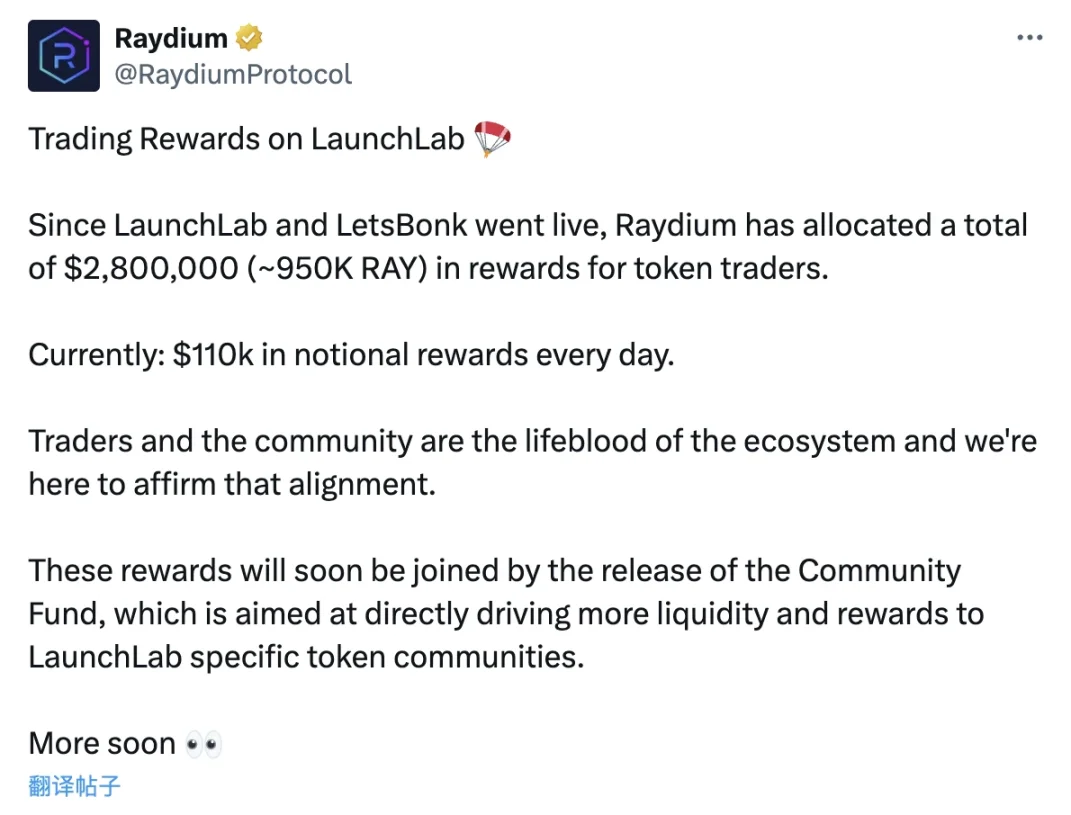

In addition, Raydium also launched the incentive program one step ahead of Pump.fun to provide incentives for issuance and trading on LaunchLab and related third-party platforms.

According to the latest official disclosure, as of today, Raydium has distributed about $2.8 million (about 950,000 RAY) in rewards to traders above LaunchLab and Letsbonk.Fun, and the current incentive size released every day is about $110,000.

Pump.fun was forced to respond

Or feel the menacing threat of the "wolves" of the LaunchLab system, Pump.fun is finally forced to spit out part of the cake in order to attract more users to retain - yesterday evening, Pump.fun has announced that it will launch a "creator revenue sharing" mechanism, token creators will receive 50% of the transaction revenue share of the PumpSwap platform. From now on, after any user creates a token, as long as the token generates transactions, the creator can continue to receive income. Officials said that the mechanism aims to incentivize more high-quality project parties to participate in ecological construction.

At the same time, there was another hiccup last night, when Pump.fun's X page briefly blocked Letsbonk.Fun founder Tom and some of the Raydium contributors, but it is unknown what happened......

Can the meme distribution track usher in a reshuffle?

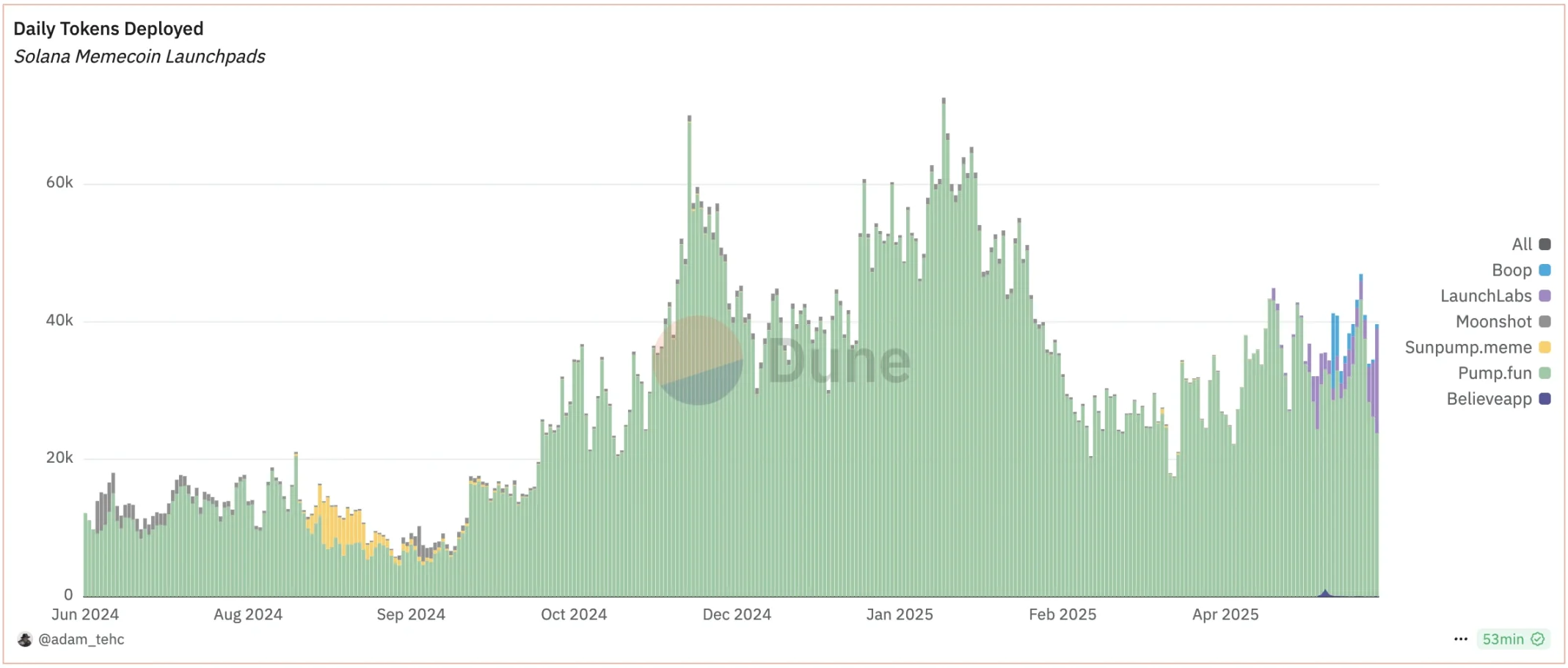

As shown in the chart below, for most of the time starting in mid-2024, Pump.fun (green) has dominated the Solana ecosystem in terms of meme distribution, and it is only recently that emerging publishing platforms such as LaunchLab (purple part) and Boop (blue part) have begun to gradually occupy a certain market share.

Competition is not a bad thing for the average user in any market, because more intense competition often forces vested interests to spit out more profits and provide a better user experience – such as the recent JD.com vs. Meituan.

From the perspective of ordinary users, perhaps we should expect LaunchLab to continue to make efforts and see more new players like LaunchLab appear.