The founder of Telegram regained his freedom, and TON officially announced a $400 million financing, and the development dilemma may welcome a turnaround

By Nancy, PANews

Once upon a time, the TON ecosystem rose rapidly in the frenzy of "traffic is value" with the powerful traffic blessing of Telegram. However, as the traffic dividend gradually faded, the curtain of reality was torn open, and the growth engine of the TON ecosystem began to slow down. With a single narrative logic, an imbalance in resource allocation, the impact of external events, and fluctuations in market cycles, the TON ecosystem has fallen into a painful period.

At present, TON may usher in a turnaround after the ebb of traffic, with the participation of top venture capitalists in the financing of 400 million US dollars, and the frequent news of good news after the exclusive binding with Telegram, bringing new growth expectations to TON.

Received $400 million in financing and exclusive Telegram traffic

On March 20, the Open Network Foundation (TON Foundation) announced a funding round of more than $400 million, with investors including Sequoia Capital, Ribbit Capital, Benchmark, Kingsway, Vy Capital, Draper Associates, and Libertus Capital and SkyBridge and many other well-known venture capital institutions. It is reported that this financing was not completed in the traditional form of equity or cash, but in the form of the purchase of TON tokens, which is seen by the outside world as a recognition of TON's growth potential.

According to public information, TON has completed six rounds of financing before this, mostly in the form of over-the-counter (OTC) transactions. In terms of investment scale, the last round of publicly disclosed financing was $30 million, and this time the fundraising capacity has been greatly improved, and the financing scale of $400 million has set a new historical investment record for TON. What's more, this round of financing has attracted the participation of a number of top Western VCs, whose capital backgrounds are very deep, and their track record has also added more imagination to the TON narrative.

For example, Ribbit Capital, a venture capital focused on fintech and crypto, has successfully bet on industry giants such as Revolut, Nubank, Coinbase, and Robinhood; Benchmark has invested in well-known companies such as eBay and Instagram with a precise vision; Sequoia Capital's investment footprint is also very broad, covering star projects such as Stripe, Nubank, Klarna, Fireblocks and StarkWare.

For TON, this round of financing is of much more significance than the funds themselves, and the collective support of Western traditional capital releases a signal that TON is recognized by the mainstream, especially considering the uncertainty brought by Telegram's past development due to regulatory pressures.

In addition to gaining the endorsement of capital, TON also ushered in good news at the ecological level. Although TON and Telegram have separated from each other in the past due to regulatory difficulties, the two sides are now deeply bound again, and in January this year, Pavel Durov publicly made it clear that TON will become Telegram's exclusive blockchain partner. As an exclusive partnership, all Telegram applets must be migrated to the TON ecosystem, and the TON token will also become a payment-exclusive asset for all Telegram chat services.

Telegram's strong traffic support will bring more room for TON to grow. According to Pavel Durov's latest disclosure, Telegram now has more than 1 billion monthly active users, making it the world's second-largest messaging app (excluding China's unique WeChat). User activity is also on the rise, with an average of 21 times per user opening Telegram per day and using it for 41 minutes per day. At the same time, Telegram's revenue has grown significantly, reaching a profit of $547 million in 2024. Not only that, Telegram is also continuing to polish its products, and the platform continues to optimize the product experience, such as recently announcing the launch of the third major update of the year, enhancing the video function and AI sticker search, and plans to introduce trading and earning functions in self-custody crypto wallets, and will also launch a loyalty program for TON holders to further promote the popularity of the TON ecosystem.

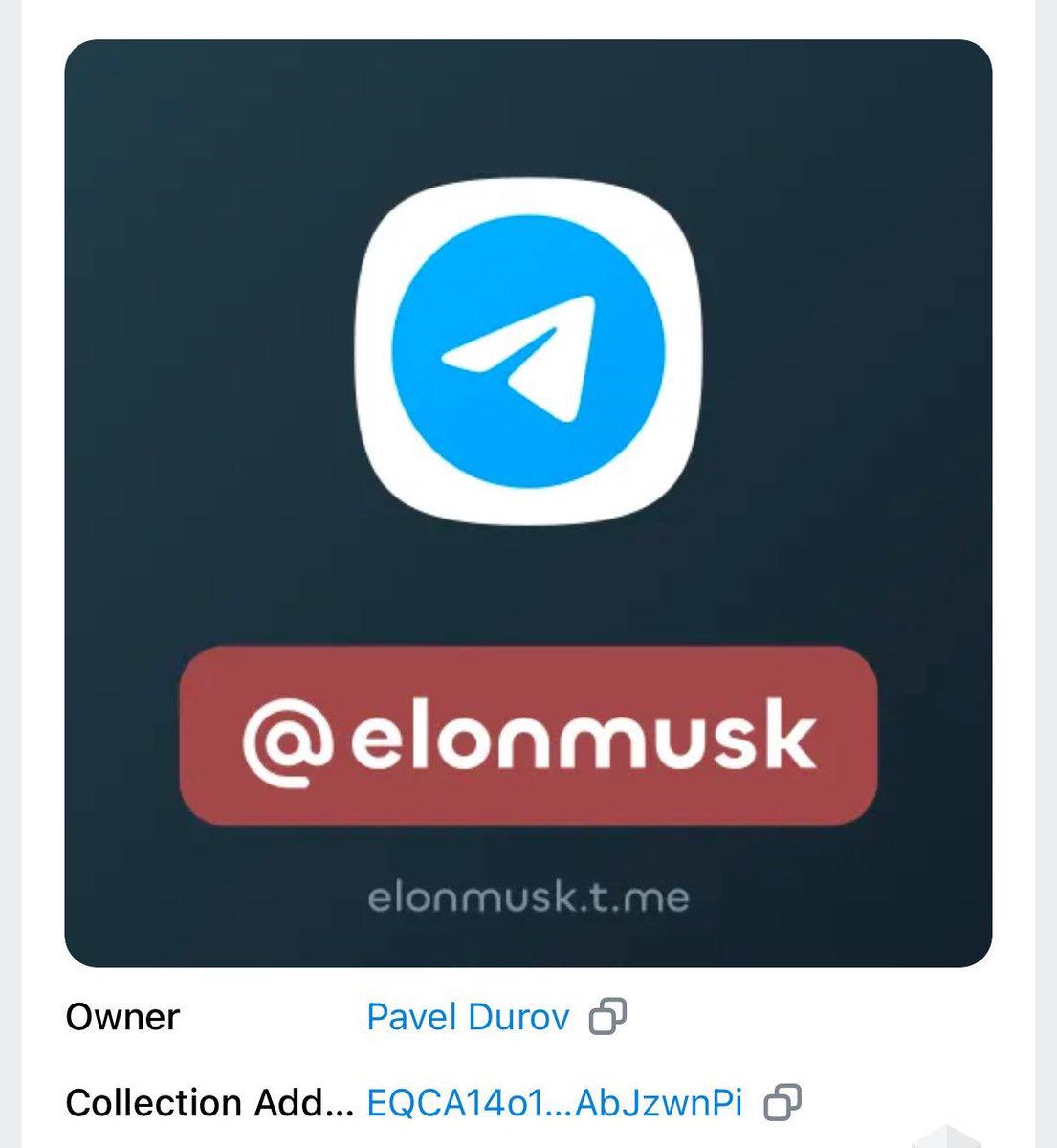

The recent return of Pavel Durov has also injected new confidence and vitality into TON. Durov is seen as a core promoter of TON, and his personal situation has a direct impact on community confidence and the pace of ecological development. In August last year, he was arrested in France for allegedly failing to adequately regulate illegal content on Telegram, which briefly frustrated market confidence, causing TVL and coin prices to plummet. However, the recent adjustment of the conditions of judicial supervision by the French authorities to allow him to return to his long-term residence in Dubai has led to a resurgence in the TON community. Durov has made a lot of moves since his return, such as spending 5,000 TON to acquire the "elonmusk" username on Telegram, and the AI bot Grok developed by xAI is now available on Telegram for free to Premium subscribers.

Strong financial support, endorsement from top VCs, deep ties to the Telegram ecosystem, and the return of Durov have all contributed to the market's high optimism about the TON narrative.

The ecological boom has ebbed and flowed, and multiple dilemmas need to be solved urgently

However, at this stage, the TON ecosystem is still facing severe challenges. In the past year, a number of key indicators of the TON ecosystem have shown a significant downward trend, and have gradually entered a cooling period from the prosperity of the past.

Artemis data shows that over the past year, the TON token has fallen by more than 54.8% from its peak, and its market capitalization has shrunk significantly from its peak of $25.2 billion. At the same time, the total value locked (TVL) of the TON ecosystem has also suffered a significant decline, from a high of over $770 million to $170 million today, a drop of 77.9%.

The decline in on-chain activity further highlights the plight of the TON ecosystem. According to Artemis data, the number of daily active addresses of TON has plummeted from a peak of 2.5 million to the current 137,000, a fraction of the total, a drop of more than 94.5%. At the same time, the daily trading volume has also slipped from a peak of $2.3 billion to the current $320 million, a drop of 86.1%. The sharp decline in these figures clearly outlines the decline in economic vitality within the TON ecosystem, with user engagement and transaction activity shrinking significantly.

The current state of the TON ecosystem is a combination of multiple factors. On the one hand, TON was highly dependent on Mini Programs and Mini Games in the Telegram ecosystem in the early days, and quickly attracted a lot of traffic with the huge user base of the social platform. However, this growth model based on short-term popularity is difficult to sustain after the wealth creation effect weakens and user freshness fades, and it loses its key driving force. In particular, in the early days, many users were attracted through mechanisms such as "Tap To Earn", but in the end, they failed to effectively transform into long-term and stable ecological participants, which led to the rapid depletion of traffic dividends.

On the other hand, TON's ecological narrative mainly revolves around Telegram's social attributes and mini games, and compared with other public chains, its layout in diversified tracks such as DeFi, AI and DePIN is obviously insufficient, and its competitiveness is relatively weak. Judging from DeFiLlama's tracking of TON's TVL distribution, in the past month, only the liquid staking protocol Tonstakers has a TVL of more than 100 million US dollars, and there are only 13 projects with a TVL scale of one million to ten million US dollars, which highlights the high concentration of TON ecological projects and the shortcomings in diversified development. Not only that, TON's technology development threshold is high, and its unique programming language and architecture design are not developer-friendly, resulting in slow progress in project development in the ecosystem, making it difficult to attract more high-quality teams to settle in, further limiting the diversity and innovation capabilities of the ecosystem.

In addition, the imbalance in the distribution of resources within the TON ecosystem also exacerbates its predicament. As mentioned earlier, TON's marketing and resource investment are also mostly focused on Telegram mini games, including Catizen, Notcoin, and Hamster Kombat, which achieved great success through Telegram's viral spread in the early days of launch, but similar phenomena have not been successfully replicated in other TON tracks. At the same time, due to the concentration of large resources on a small number of leading applications, it is difficult for other small and medium-sized projects to share the attention of users and investors due to the lack of market exposure and narrative support. This imbalance not only leads to the development of the TON ecosystem being too homogeneous, but also weakens its ability to resist risks. Coupled with changes in the overall market environment and external competitive pressures, TON's predicament has been further exacerbated.

In short, whether TON can start a new growth curve depends not only on the continuous empowerment of external traffic, but also on achieving substantial breakthroughs in ecological diversification, technological innovation and resource integration.