Dismantling Hyperliquid's Top Whale Operation: The High Leverage Art of "50x Brother".

Original author: Frank, PANews

As the market picks up, the whale operation on Hyperliquid has once again triggered onlookers in the market.

Known as the "giant whales", these mysterious giants, with their strong financial strength, unique trading strategies and accurate grasp of the pulse of the market, have set off ripples in the platform, and their every move is not only a magnifying glass of market sentiment, but also provides us with a window to observe how top traders gamble.

Analyze their different trading methods, risk appetite and success or failure logic. Here, PANews seeks to uncover the corners of their wealth code and explore the lessons learned by the average investor.

Short-term sniper @qwatio: The event-driven and high-leverage art of "50x brother"

The trader is an industry OG who has been tweeting about Bitcoin since 2014 and looks like a loyal Bitcoin fan. For some unknown reason, @qwatio chose to disappear from social media in 2015. Until March 2025, when the highly leveraged shorting of Bitcoin sparked heated discussions on social media due to a profit of more than $9 million, on-chain investigator ZachXBT said that its source of funds was related to hackers, and @qwatio chose to publish his identity in response to the question.

@qwatio trading style is characterized by high risk and high return, often using 50 times leverage, and has a keen ability to capture the market. For example, before and after the Fed's interest rate decision on March 20, 2025, he first went short when the price of BTC was $84, 566, closed his position after the price fell to $82, 000 and made a profit of $81, 500, and then went long at $82, 200 and the price rebounded to $85, 000, making an additional profit of $921, 000, achieving a total gain of 164%. Therefore, it is also called "Hyperliquid 5 0X brother" by social media.

From his trading strategy, @qwatio is good at capturing event-driven and ephemeral opportunities, as well as showing a unique market eye. The battle for fame mentioned above is to use the expectation of the Fed's interest rate decision to infer that the market will have a short opportunity to repeatedly manipulate and make huge profits in the swing. At the same time, he can also make a decisive move in times of extreme panic in the market. When Ethereum fell to around 1500, the market was bearish on Ethereum. @qwatio chose to buy 3,715 Ethereum for $5.5 million (average price 1493.5) and sold it at $2,502, making a profit of $3.74 million.

On May 12, the results of the US-China trade negotiations were announced, and the market will usher in a wave of volatility as foreseeable. @qwatio chose to short Bitcoin at $104094 and subsequently made a profit of $1.18 million.

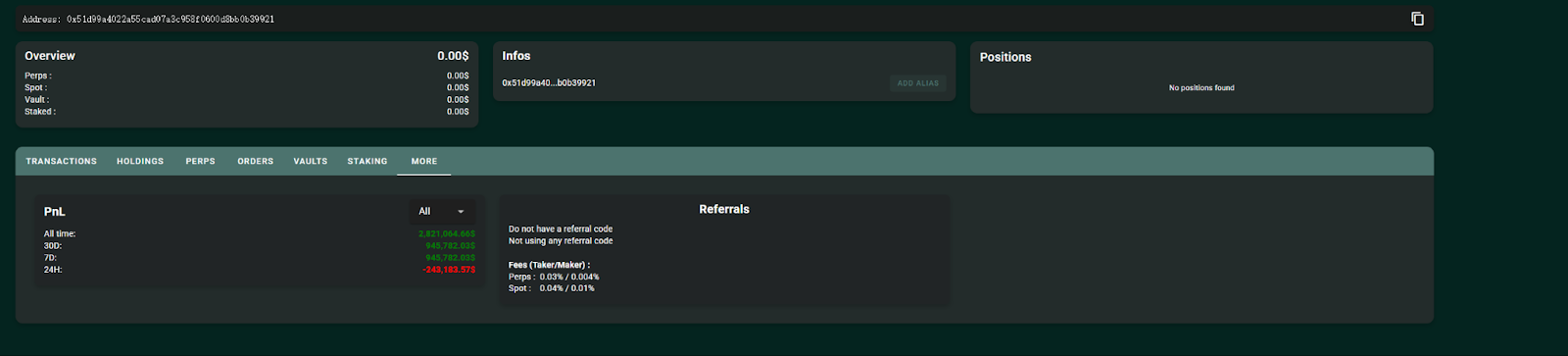

As of May 13, @qwatio made about $2.82 million on Hyperliquid. In summary, the operations of @qwatio are not very frequent, and only 3 ~ 4 operations are carried out in 2 months. However, each operation can accurately predict a short-term trend, and the artist is bold, and the liquidation is only within a few corners. However, this style is not suitable for the average user to imitate, and he often loses money in the operation of several altcat tokens.

Legends and controversies coexist: James Wynn's MEME coin hunting and big money operation

James Wynn has been active in Hyperliquid since March 2025, and in terms of operation style, James Wynn prefers relatively large cycles (days), and in addition to mainstream tokens, James Wynn also prefers to play in TRUMP, Fartcoin, PEPE, etc BET ON MEME-THEMED TOKENS. And the high volatility of the MEME token also seems to have become the main source of his profits.

Based on the positions he still held on May 13, the open interest brought to him by the long PEPE order reached $23 million. Far more than other mainstream tokens like BTC.

However, James Wynn is obviously more conservative in terms of the use of leverage, and he seems to like to set different leverage multipliers for different volatility rates. For example, BTC opens a position with 40x leverage, while PEPE opens with only 10x leverage.

In addition to this, James Wynn has set up the largest user vault on Hyperliquid (Moon Capital), but unlike his personal precision, this vault is currently not very effective. Open a long position on BTC at 103533, and as of May 13, the position yielded about a 10% loss. The loss was about $960,000. Over the past month, the overall yield of this vault has been -8%. Even so, it attracted $10 million in deposits, but $9.2 million of that was James Wynn's own.