4 billion valuation coin, Pump.fun is it a market savior or a liquidity killer?

Original title: "Attack on Pump.fun 4 Billion Valuation Coins, but the Depleted Market is Waiting for a Savior"

Original Source: Deep Tide TechFlow

Meme continues, but the market's enthusiasm seems to have reached the end of its strength. While there are memes being launched every day, how long has it been since you've seen a new phenomenal golden dog compared to last year?

Meme can't, but that doesn't seem to affect the Meme launch platform's all the way. On June 4, Blockworks reported that Pump.fun plans to issue a coin, raise $1 billion at a fully diluted valuation (FDV) of $4 billion, and sell about 25% of the token. The coin issuance is open to public and private investors, and it is rumored that it may be accompanied by an airdrop, and the token may be called "$PUMP", but the specific details have not yet surfaced.

Although Pump.fun officials have not responded to confirm the authenticity of this coin issuance plan, as a comparison, Circle, the issuer behind the stablecoin USDC, is seeking an IPO on the US stock market, and its public valuation is only $7.2 billion.

At the moment, the market's reaction to this news is starting to diverge. As soon as the news came out, the ALON (same name as Pump founder @a1lon_9) token on the Pump.fun rose by 102% at one point, and the logic of pure gambling continued.

Some people are optimistic about the Pump.fun's ability to absorb gold, and expect the token to bring dividends or governance dividends; Others scoffed, believing that the $4 billion valuation was outrageous and could not hide the intention of "cutting leeks". Frenzy and exhaustion coexist, opportunities and risks are intertwined. If this meme launchpad, which is closest to trading, closest to gambling, and closest to volatility, really issued coins, will it be the savior of the depleted market, or the last cut that will never look back?

answer may lie in its valuation logic and market pulse.

Attack on Pump.fun, is it worth 4 billion?

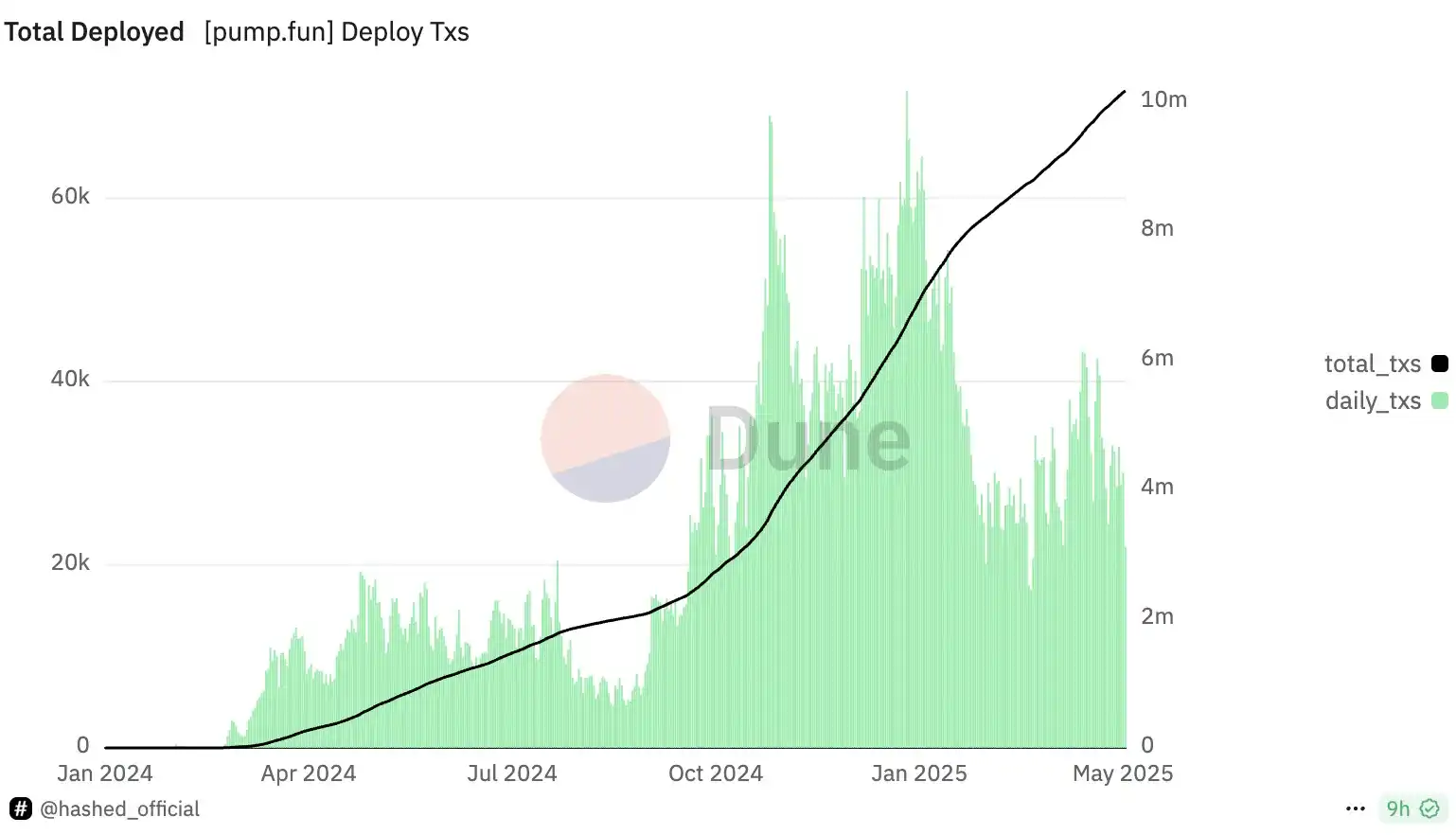

If it is really according to the coin issuance plan disclosed by Blockworks, PUMP's FDV is around $4 billion, is it worth this price? We may be able to explore the valuation logic with some data. According to public data, as of May this year, Pump.fun's annual revenue totaled 296 million. If it is estimated according to the same conditions, the annualized income is about 710 million (296.1 million ÷ 5× 12).

According to this revenue situation, from the perspective of traditional valuation methods, the price-to-sales ratio (P/S, valuation of 4 billion divided by annual revenue) is 5.63, which means that the market pays $5.63 per dollar of revenue, which is often used by traditional markets to measure growth, and DeFi projects such as Uniswap have similar values. If the PUMP token has the right to income dividends, let's say the token can share half of the revenue (350 million) and the price-to-earnings ratio (P/E, valuation divided by profit) is about 11.4, which is lower than the average for US technology stocks.

But the problem is that meme-related businesses don't really eat the traditional valuation set, and the valuation of meme launchpads is certainly related to revenue, but FOMO and market sentiment changes are even more significant.

Circle has a stable and compliant USDC business with an IPO valuation of $7.2 billion; However, Pump.fun 4 billion valuation corresponds to the No. 1 meme launch pad in the circle, and the valuation is more than half of Cicle's, which is indeed a bit unreasonable. Also, Pump.fun's income isn't too stable. At its worst, it was only about $110,000 a day.

from a monthly income of more than 100 million on November 2024, to a highlight of a daily income of 14 million on January 2, 2025, and then to a daily income of 110,700 on March 9 this year... The platform's revenue fluctuates nearly 100 times, highlighting the cyclical nature of the meme market.