If RWA adoption on @Aptos hits the $1B mark by 2025…

A 3–5x in RWA TVL could easily reflect in a strong upward revaluation of $APT, especially if utility + staking + fees align.

Let’s watch this closely. 🧐

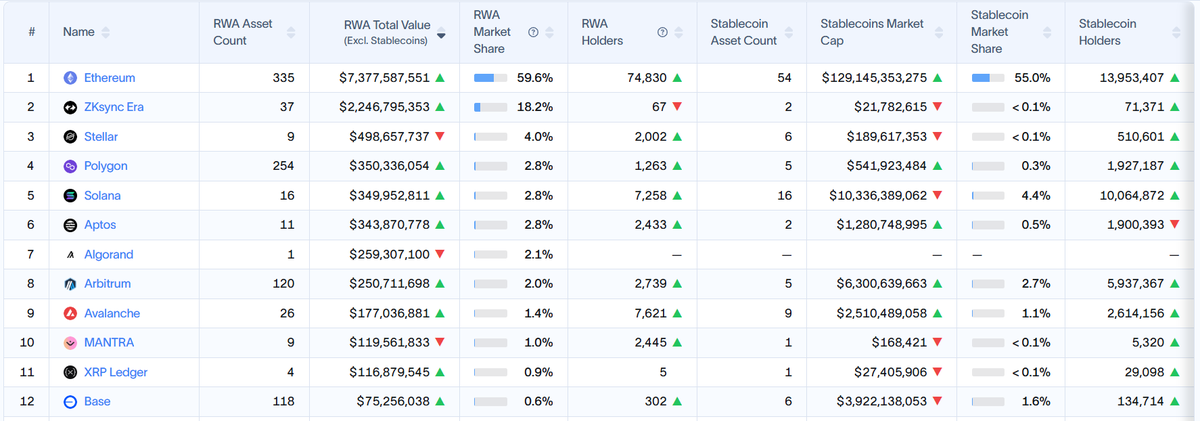

Aptos has silently climbed to the 6th spot in the RWA rankings with $344M in tokenized assets. They're literally just $6M behind Solana! 👀

Aptos: $343.9M across 11 assets

@solana: $350.0M across 16 assets.

What's fascinating here is the efficiency.

Aptos is achieving nearly identical TVL with 31% fewer assets. This suggests higher average value per tokenized asset on Aptos.

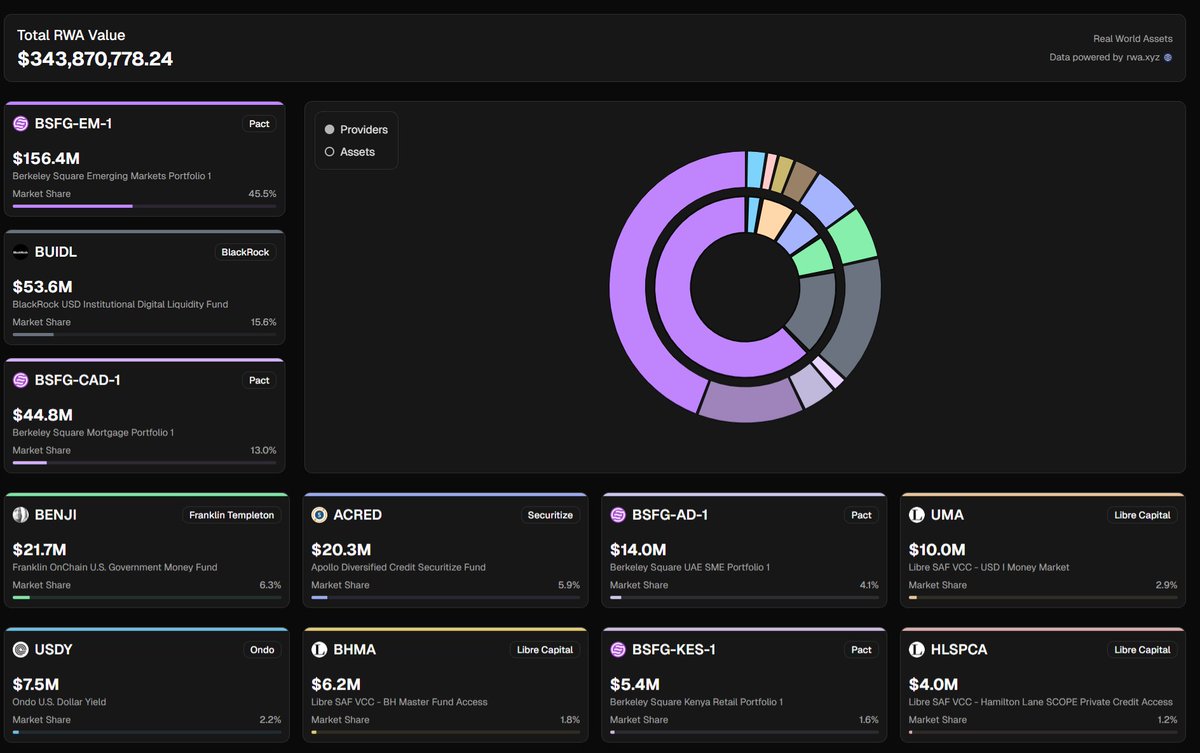

The big players aren't sleeping on Aptos:

• Tether/USDT: $820.6M (50.9% market share)

• Circle/USDC: $394.7M (24.3%)

• PACT: $220.5M (13.5%)

• BlackRock's BUIDL: $53.6M (15.6% market share)

BlackRock, the world's largest asset manager - has a presence on Aptos.

This institutional validation cannot be overstated.

Looking at the distribution:

• Stablecoins: $1.3B (the foundation)

• Private Credit: $220.5M

• US Treasury Debt: $92.7M

• Institutional Alternative Funds: $30.5M

This diversity shows Aptos isn't just a one-trick pony. They're building across multiple RWA categories simultaneously.

@pactconsortium bringing Berkeley Square funds ($156.3M + $44.9M) and @BlackRock bringing BUIDL ($53.6M) to Aptos gives it something many L1s lack: institutional credibility.

@FTI_US's presence, though smaller at $21.7M, adds another respected name to the roster.

What happens when RWAs hit mass adoption?

Imagine this:

• Bonds, real estate, invoices, treasuries—tokenized on-chain

• Billions flowing in from TradFi

• Aptos positioned as the high-speed, high-throughput backbone

The value of APT could reflect that future.

Now add some spice.

•Tokenized assets become the base layer for DeFi 2.0

• Lending against RWA collateral

• Yield from real-world cash flows

• Cross-border stablecoin rails built on Aptos

All roads lead to increased demand for APT, both in utility and value.

If RWAs continue their path to becoming a multi-trillion dollar on-chain market as many predict, Aptos is quietly positioning itself to capture significant value.

5.18K

97

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.