#BTC Trends and Discussion Records with @coolish 📝

The market is currently highly divided. Half of the people think that combined with rate cuts, prices will go up directly, while the other half believe everyone has lost money and are extremely bearish.

💡 My opinion: We are in the late stage of triangular consolidation. OBV is currently at a low level, but the price is at a high level. Therefore, I think it won't be easy to break through directly.

Moreover, at the current position, if we want to push it to 120,000, the consolidation time is insufficient.

‼️ Wei Shen believes: Whether the time is sufficient becomes difficult to say if we consider variable speeds. Additionally, whether it's enough to push up and create a trap or enough to push up and sustain are two different standards of "sufficiency."

If you look at BTCUSDT or BTC/IXIC, since 2017, there has been a clear parabolic structure. This parabolic structure adds difficulty to the game, such as "besides spring, summer, autumn, and winter, there is also global warming." This "game version iteration" and "overall and local variable speeds" are the core sources of difficulty in trading #BTC.

Using a rigid "carving a boat to mark the spot" perspective won't work well. You need to adapt creatively and flexibly.

This parabolic presentation is also why many people like to use log charts to view long-term trends and draw slanted channels/trend lines. However, I believe the log normalization algorithm itself lacks some fundamental principles directly related to #BTC's parabolic trends. In other words, "there are many normalization algorithms, why choose this one?" Moreover, after applying log, the error becomes significant, so I don't use log charts.

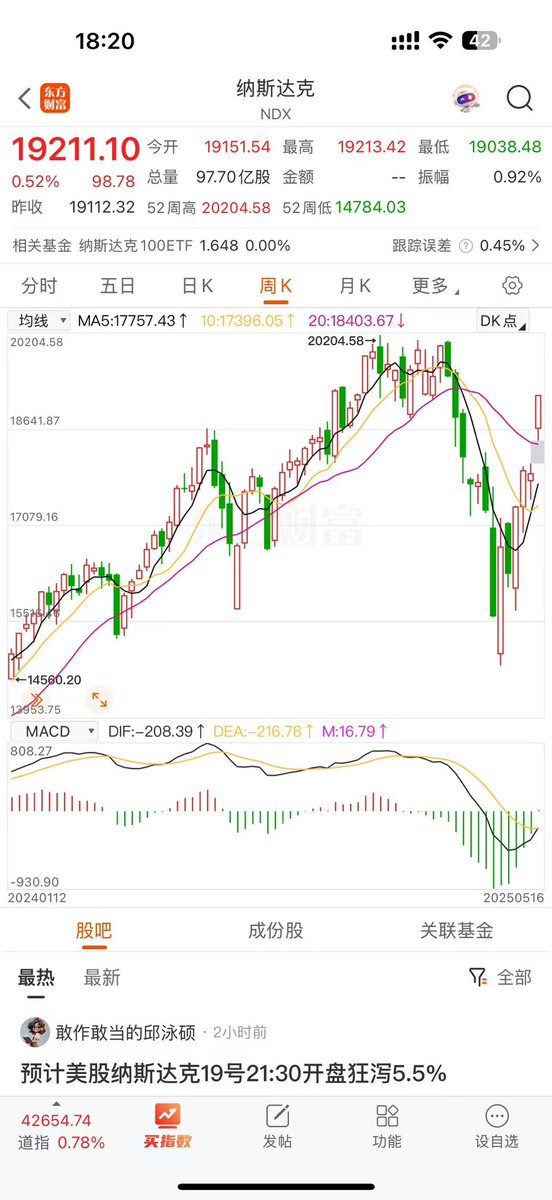

You can see this parabolic structure in gold and the Nasdaq index. When the market is large enough, it becomes typical and serves as excellent learning material.

💡 My opinion: However, there is currently an issue that everyone is ignoring. See Figure 1: The Nasdaq gap-up candlestick suggests a high probability of a pullback next week. I mean, last week's weekly candlestick has reached its limit.

‼️ Wei Shen: For example, on December 5, 2024, discussing BTC, you can understand the meaning of "the time required for a suitable shorting top": "Just reached ATH, if bearish, you can take profit without shorting. Every time ATH is refreshed, the suitable shorting time needs to be delayed by at least one month. Because forming a top requires a month."

So, if we evaluate the probability of filling the gap, then for filling this weekly-level gap, I believe the probability of it happening later than next week or even later than the week after next is higher than next week. The required time is positively correlated with the previous time and intensity.

See Figure 2: The top on the left is more suitable for taking profit on longs, while the top on the right is more suitable for shorting. It took over a month because the previous setup lasted nearly a year, followed by a 100-day major rally continuously refreshing highs. Using another more figurative and personified description: The more "rare" the previous situation, the longer the time required for the subsequent reversal.

💡 My opinion: There's not much space above; it has to go down. When it will go down, I don't know. But the risk-reward ratio for going up is very small. This is not the top. It's a stage high point. The trend is still upward, but it needs sufficient downward consolidation before rallying again.

Summary: It's essentially a matter of adding positions during pullbacks versus adding positions during breakouts. Since the outlook is bullish, just use different strategies to respond to different situations. Embrace change.

Show original

28.9K

64

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.