Today, SEC Chairman Paul Atkins made it very clear: he supports the transition from traditional finance to crypto finance.

This means that in the future, finance, including securities databases, will have the opportunity to migrate from off-chain to on-chain. "Just as audio recordings have transitioned from analog vinyl records to tapes, and now to today's digital software, fundamentally changing the music industry, the migration of on-chain securities could also reshape every aspect of the securities market. This can be achieved through issuance, trading, holding, and usage." The SEC will be committed to "establishing practical standards for market participants through rulemaking, interpretation, and exemptions."

What does this mean? As mentioned a few days ago, crypto stablecoins will experience their biggest boom period, and RWA (especially U.S. Treasury bonds and stocks) will truly have their moment to go on-chain. In this process, how Ethereum will handle the accounting of assets worth tens of trillions of dollars will be the biggest narrative of this cycle, aside from crypto AI.

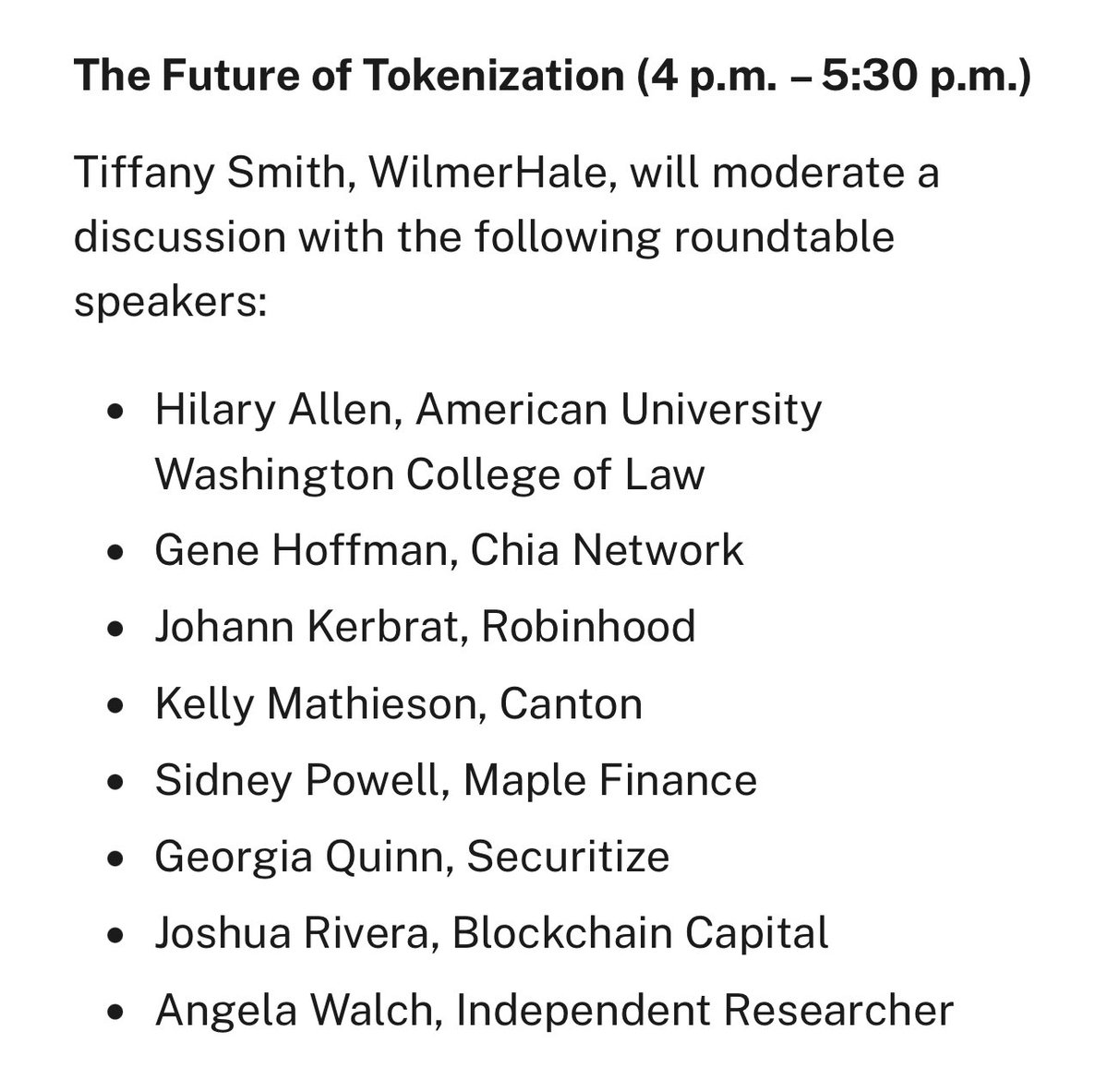

The SEC held a roundtable on asset tokenization on the 12th (“Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet.”), with its chairman Paul Atkins also delivering a speech.

This can be seen as the starting signal for asset on-chain adoption. In the coming years, aside from the wave of stablecoins, the likelihood of more assets like U.S. Treasury bonds and U.S. stocks being tokenized and moved on-chain is significantly increasing.

The probability of the on-chain economy surpassing $10 trillion in scale in the next few years is rising.

178

90.51K

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.