I believe we haven't fully appreciated how chain abstraction is solving our most fundamental problem as onchain users:

hyper-fragmentation.

From liquidity, users, and even app development.

Among the solutions, @ParticleNtwrk is leading with its Universal Accounts (UA).

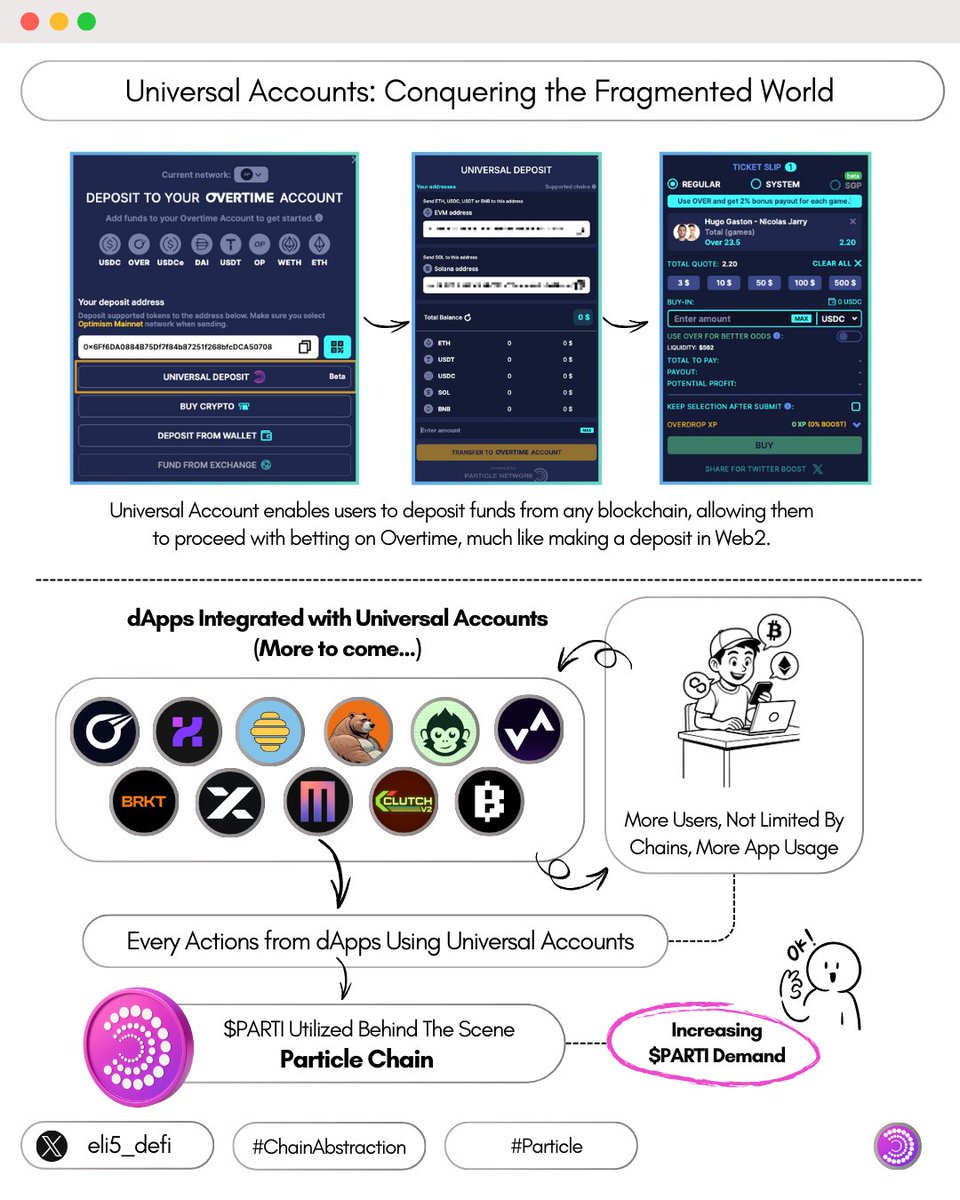

In simple terms, UA addresses the complexity and fragmentation of web3 by enabling a unified account with a single balance across any chain. This eliminates the need for users to switch between chains or use different gas tokens.

Several projects have already adopted UA for their dApps to scale and enhance their products:

➢ @Overtime_io: Betting across multiple chains

➢ @zkhelixlabs: (Re)staking from any chain

➢ @honeypotfinance: Cross-chain swaps and token launches with cross-chain incentives

➢ @beraborrow: Borrow from any chain

➢ @ChimpxAI: AI-assisted DeFi across all ecosystems

➢ @ivx_fi: Trade options and perpetuals from any chain

➢ @BRKTgg: Chain-agnostic prediction market

➢ @MYX_Finance: Trade perpetuals without chain hopping

➢ @mantis_app: Enable AI agents to execute cross-chain transactions

➢ @ClutchMarkets: Do parlay on Polymarket across the chain

➢ @blumcrypto: Trading any coin on the market

And this is where $PARTI comes in as the core economic engine for Particle Chain. Every action taken through dApps using UAs—such as deposits, swaps, stakes, and borrows—is paid in PARTI behind the scenes by app providers.

This creates a powerful flywheel:

UA integrated into dApps → dApps are no longer limited by chains and can onboard more users + become part of a composable network → Usage of UAs explodes → Demand for PARTI increases.

And obviously you can also experience the firsthand experience of UA by trying @UseUniversalX and their onchain scanner bot @ux_alphabot.

The future is abstracted.

One account, one balance, any chain also means any dApp.

Today, we're making history by announcing the first Cohort of chain-agnostic dApps in Web3.

Ten initial projects of all kinds, all accessible to users from any chain, with any asset.

They are:

@Overtime_io (Live)

@ClutchMarkets (Live)

@honeypotfinance (Live)

@MYX_Finance (Live)

@mantis_app (Live on Monday)

@BRKTgg (Live soon)

@ivx_fi (Live soon)

@ChimpxAI (Live soon)

@farawaygg (Live soon)

@blumcrypto (Live soon)

...as well as a few more TBA.

Together with @UseUniversalX, they represent the bleeding edge of a unified experience that will soon become the norm across our industry.

If you're a user, try it out. You'll never want to bridge or think about chains again.

If you're a developer, we want you to participate in Cohort Two. Hit us up.

Full announcement and all details at:

I believe we have not yet truly realized that Chain Abstraction is addressing one of the most fundamental issues for on-chain users: Hyper-fragmentation.

Whether it's liquidity, user experience, or application development, fragmentation severely restricts them.

Among many solutions, @ParticleNtwrk is at the forefront with its Universal Accounts (UA).

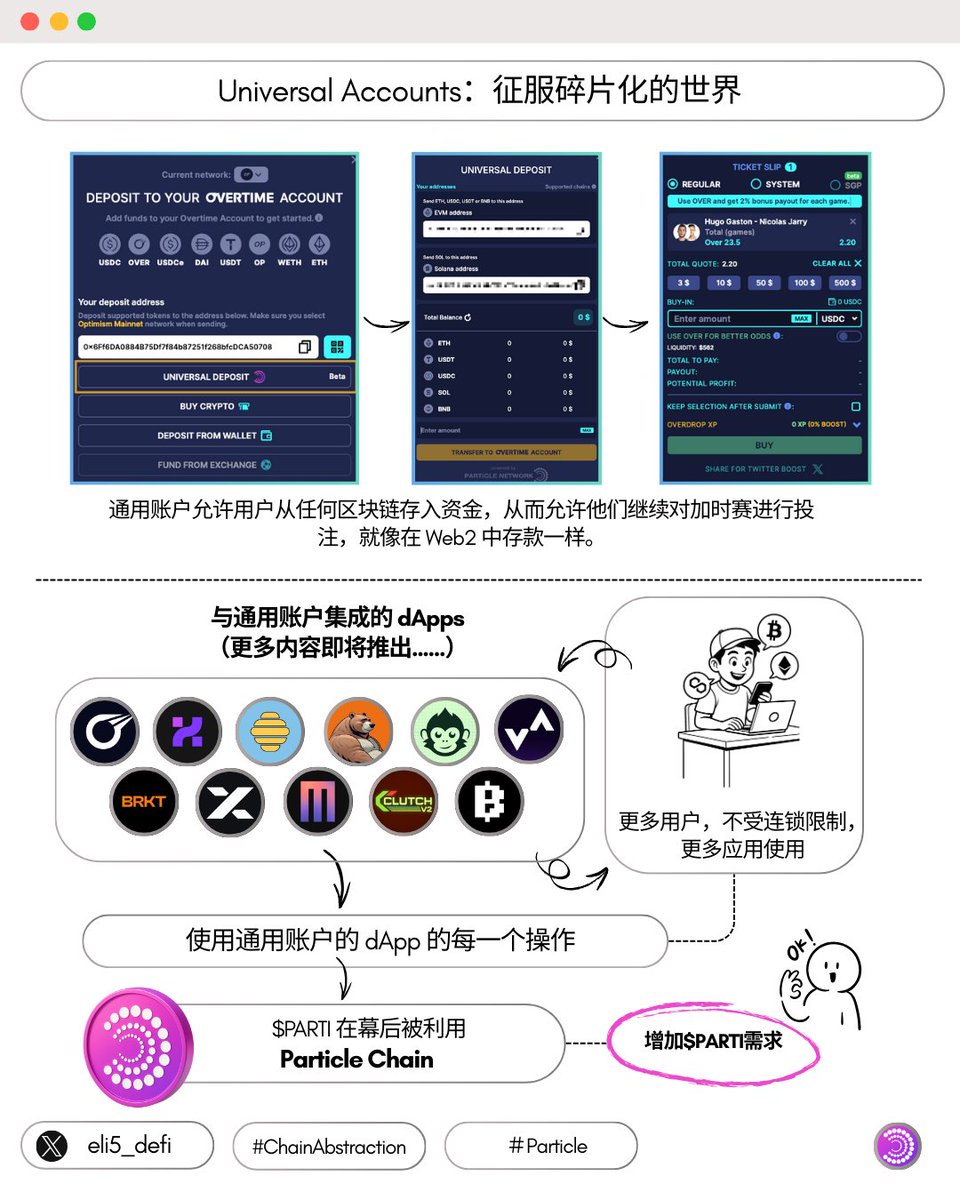

Simply put, UA solves the complexity and disconnection between chains in Web3 by sharing a balance across any chain through a unified account system. Users do not need to frequently switch networks or use different gas tokens.

Currently, several projects have integrated UA to achieve product expansion and optimize user experience:

➢ @Overtime_io: Supports multi-chain betting platforms

➢ @zkhelixlabs: Supports (re)staking on any chain

➢ @honeypotfinance: Cross-chain exchange and token issuance, with cross-chain incentives

➢ @beraborrow: Lending from any chain

➢ @ChimpxAI: AI-driven DeFi operations across ecosystems

➢ @ivx_fi: Trading options and perpetual contracts on any chain

➢ @BRKTgg: Chain-agnostic prediction markets

➢ @MYX_Finance: Perpetual contract trading platform without chain switching

➢ @mantis_app: AI agent-driven cross-chain transactions

➢ @ClutchMarkets: Cross-chain parlay betting on Polymarket

➢ @blumcrypto: Any currency in the trading market

This is where $PARTI comes into play—it is the core economic engine of Particle Chain.

When users perform operations in dApps integrated with UA (such as deposits, exchanges, staking, lending, etc.), the underlying gas payment is completed by the application developers using $PARTI.

This forms a powerful positive flywheel effect:

dApp integrates UA → Breaks chain limitations, attracts more users and forms a composable network → UA usage surges → $PARTI demand rises

You can also experience the charm of chain abstraction by trying out UA, using @UseUniversalX and its on-chain smart scanning bot @ux_alphabot.

The future is abstraction-driven.

One account, one balance, any chain also means any dApp.

Today, we're making history by announcing the first Cohort of chain-agnostic dApps in Web3.

Ten initial projects of all kinds, all accessible to users from any chain, with any asset.

They are:

@Overtime_io (Live)

@ClutchMarkets (Live)

@honeypotfinance (Live)

@MYX_Finance (Live)

@mantis_app (Live on Monday)

@BRKTgg (Live soon)

@ivx_fi (Live soon)

@ChimpxAI (Live soon)

@farawaygg (Live soon)

@blumcrypto (Live soon)

...as well as a few more TBA.

Together with @UseUniversalX, they represent the bleeding edge of a unified experience that will soon become the norm across our industry.

If you're a user, try it out. You'll never want to bridge or think about chains again.

If you're a developer, we want you to participate in Cohort Two. Hit us up.

Full announcement and all details at:

Tagged my friends to check Particle's Universal Accounts

> @blocmatesdotcom

> @AleaResearch

> @CipherResearchx

> @HouseofChimera

> @YashasEdu

> @belizardd

> @SherifDefi

> @0xCheeezzyyyy

> @Foxi_xyz

> @moic_digital

> @Mars_DeFi

> @YashasEdu

> @thelearningpill

> @kenodnb

> @Flowslikeosmo

> @DeFiMinty

> @Haylesdefi

> @Hercules_Defi

> @DeRonin_

> @0xAndrewMoh

> @0xDefiLeo

> @Defi_Warhol

> @CryptMoose_

> @0xelonmoney

> @TheDeFiPlug

> @arndxt_xo

> @CryptoShiro_

> @the_smart_ape

I believe we haven't fully appreciated how chain abstraction is solving our most fundamental problem as onchain users:

hyper-fragmentation.

From liquidity, users, and even app development.

Among the solutions, @ParticleNtwrk is leading with its Universal Accounts (UA).

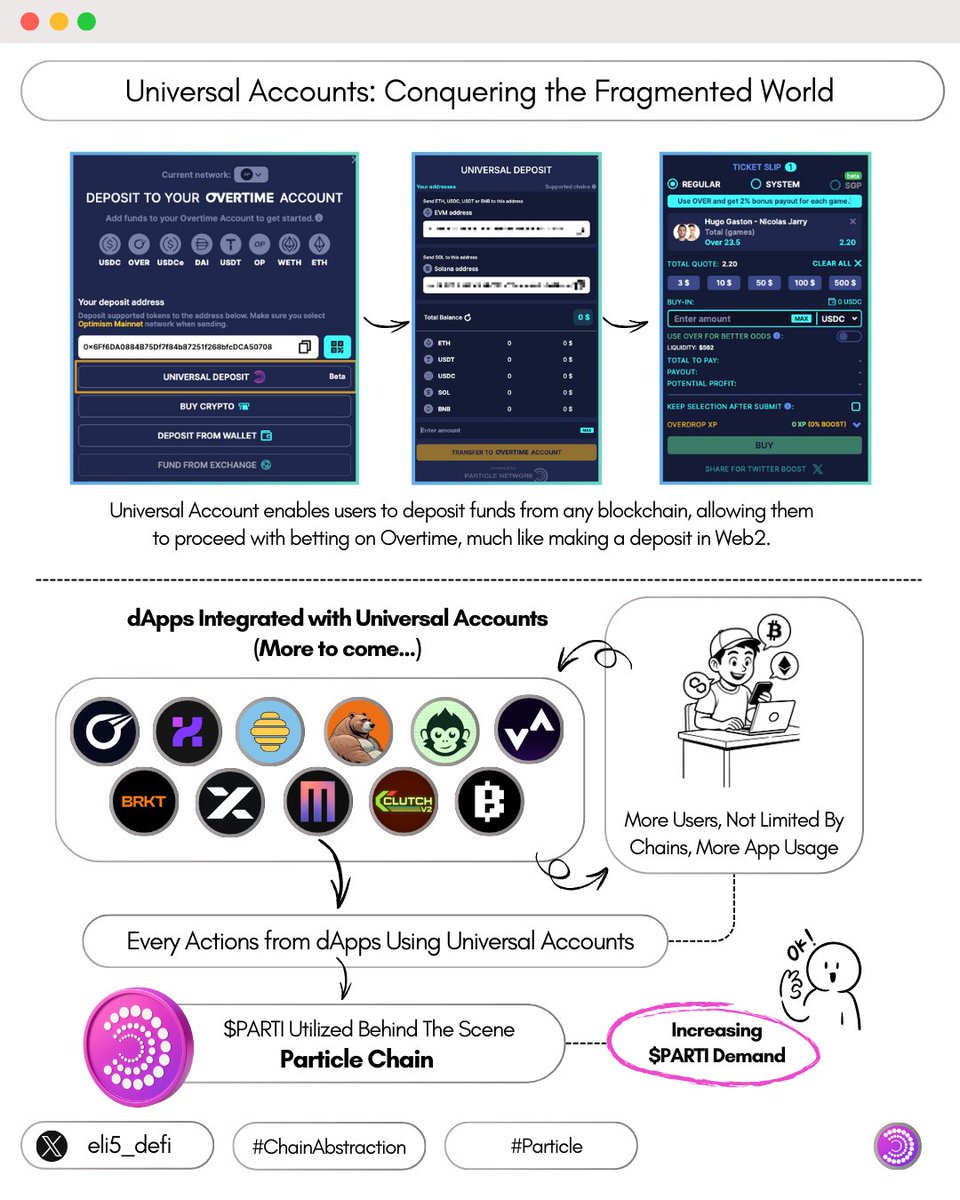

In simple terms, UA addresses the complexity and fragmentation of web3 by enabling a unified account with a single balance across any chain. This eliminates the need for users to switch between chains or use different gas tokens.

Several projects have already adopted UA for their dApps to scale and enhance their products:

➢ @Overtime_io: Betting across multiple chains

➢ @zkhelixlabs: (Re)staking from any chain

➢ @honeypotfinance: Cross-chain swaps and token launches with cross-chain incentives

➢ @beraborrow: Borrow from any chain

➢ @ChimpxAI: AI-assisted DeFi across all ecosystems

➢ @ivx_fi: Trade options and perpetuals from any chain

➢ @BRKTgg: Chain-agnostic prediction market

➢ @MYX_Finance: Trade perpetuals without chain hopping

➢ @mantis_app: Enable AI agents to execute cross-chain transactions

➢ @ClutchMarkets: Do parlay on Polymarket across the chain

➢ @blumcrypto: Trading any coin on the market

And this is where $PARTI comes in as the core economic engine for Particle Chain. Every action taken through dApps using UAs—such as deposits, swaps, stakes, and borrows—is paid in PARTI behind the scenes by app providers.

This creates a powerful flywheel:

UA integrated into dApps → dApps are no longer limited by chains and can onboard more users + become part of a composable network → Usage of UAs explodes → Demand for PARTI increases.

And obviously you can also experience the firsthand experience of UA by trying @UseUniversalX and their onchain scanner bot @ux_alphabot.

The future is abstracted.

97

12.59K

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.