Remember when @bennybitcoins coined the metric "DeFi Velocity" (volume per $ of TVL) at the bottom of the bear market post FTX?

This is the output of what he was talking about 2.5 years later👇

Does it matter that Ethereum has 6.6x the TVL that Solana has?

Should investors care?

I think it's a fair question to ask.

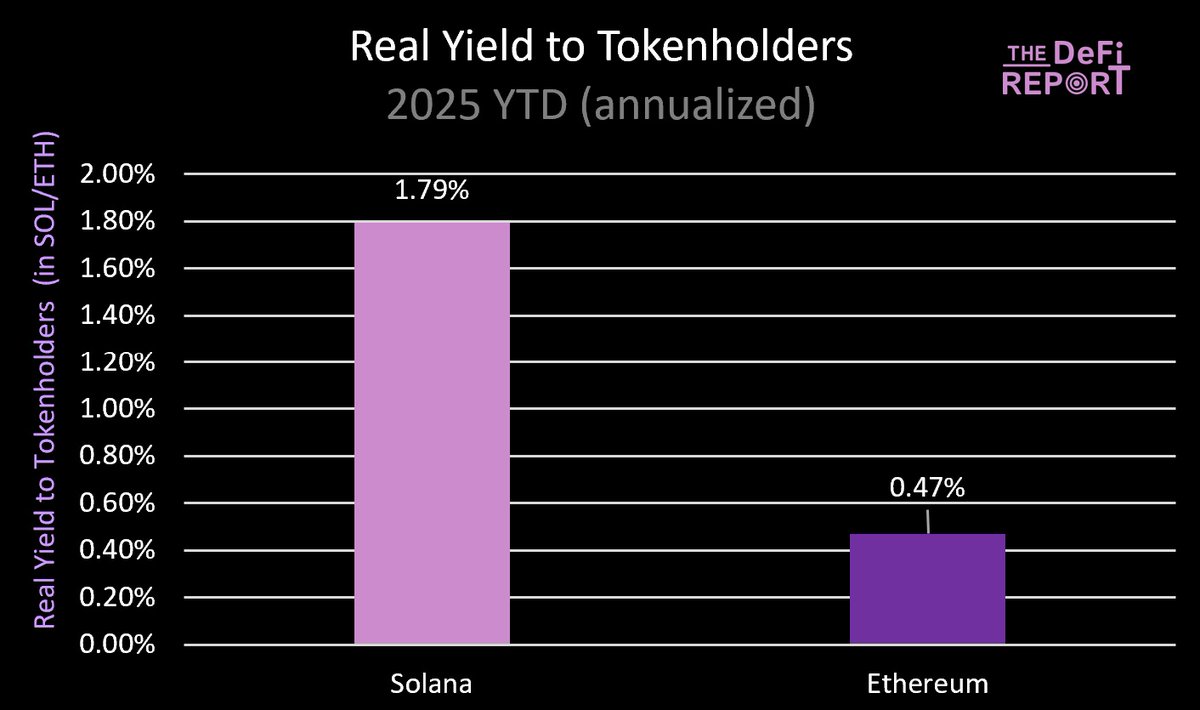

Because when you look under the hood, it becomes clear that Solana is doing a better job of monetizing the assets it has onchain for validators and tokenholders.

$7.6 billion TVL = $493 million of *real value* for tokenholders on Solana YTD.

Meanwhile, $50.5 billion TVL = $147m of *real value* for tokenholders on Ethereum YTD.

The data is revealing that *execution and velocity* drive real value.

While TVL and Assets Secured look more like vanity metrics.

I'm not saying they don't provide any signal.

But at the end of the day, investors want to know what they get in return for taking on risk (buying and staking the token).

That's why the chain with the highest *real yield* could be the long-term winner.

-----

*Real Yield on Solana = MEV Tips shared with stakers. It does not include issuance, base fees, or priority fees (which can be added if validators choose to share those).

*Real Yield on Ethereum = MEV + Priority Fees shared with stakers. It does not include base fees, issuance, or MEV kept by Searchers and Block Builders.

-----

We're covering this topic in detail with readers of @the_defi_report later this week while asking the question:

Should SOL be trading at a 65% discount to ETH?

If you'd like to have the latest research hit your inbox when it's published, you can sign up below 👇

4.02K

5

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.