Yield Alfa for LPing/Restaking ↓

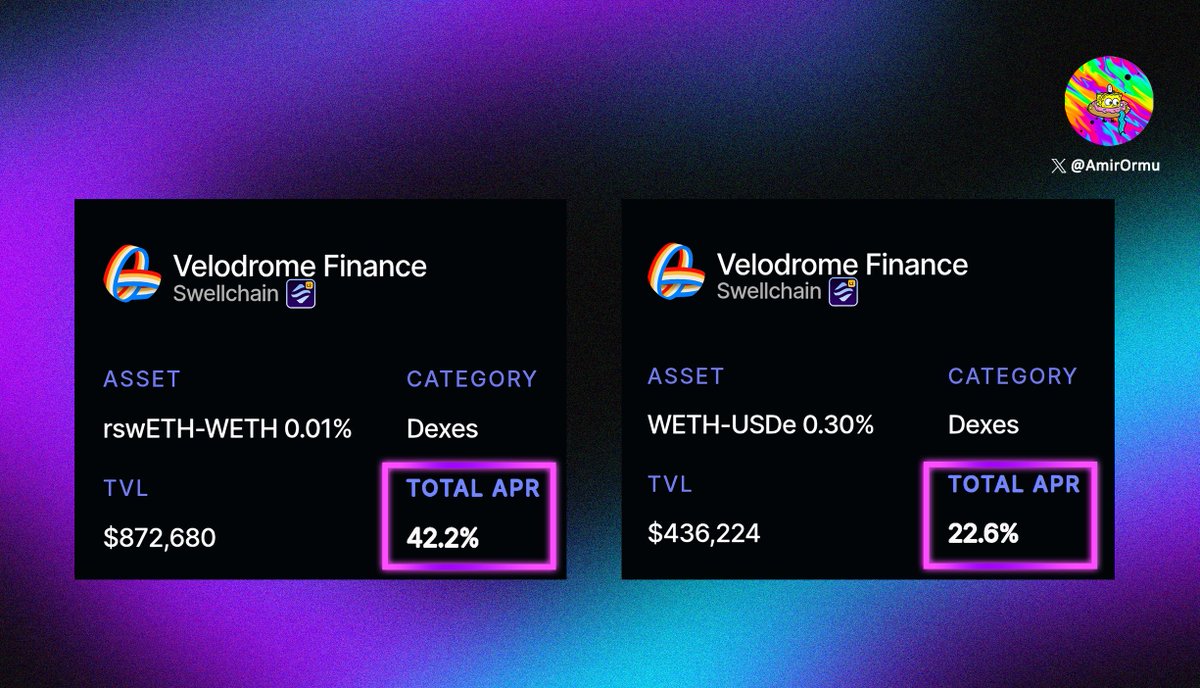

Check out yields on Swell's L2 (@swellchain) for Velodrome's stable pools:

• 41.2% APR on (rswETH/WETH) pool

• 22.6% APR on (WETH/USDe) pool

How to Start?

You can start with restaking ETH into rswETH → Deposit into farming vaults and AMMs. (Velodrome in this case)

You can stack multiple yield layers without moving chains. LSTs/LRTs like swETH, ezETH, rsETH, weETH, and sUSDe are all already live on the chain.

Many haven’t heard about the chain, and it's visible from the APRs and the TVL of some of these pools. Already integrated big protocols like Velodrome and Tempest tho, so the chain is ready to onboard the users.

And here's what you need to know about the chain:

It's an L2 built on Optimism's OP stack, which is mainly designed to compound LST/LRT yields. It's also a Proof of Restake chain so it is backed by EigenLayer's security as well.

Basically an all in one L2 with dirt cheap gas for farming yields (staking + restaking + DeFi yield, all in one place) with $72M TVL and 27k bridged wallets.

3.12K

32

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.