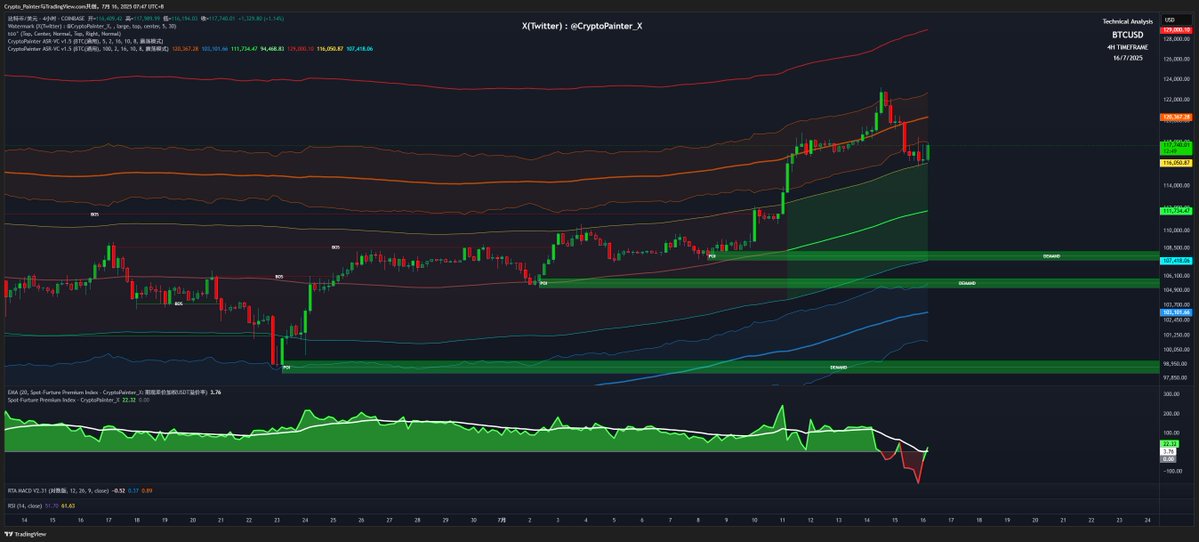

ASR-VC indicator 4h channel status update:

The expectations in the quotation have basically been fulfilled, and at present, $BTC except for the fact that it did not touch the orange line exactly, it can be regarded as having gained support along the yellow line on the oscillating channel!

Therefore, before the yellow line falls below, the 4h level strong bullish trend still exists, and has not yet turned into a volatile market, theoretically if the price is still dynamic, then when the orange line moves to the 4h high supply area, it can be tested again.

On the other hand, the spot contango index has begun to decline again after a wave of obvious recovery last night, which is not conducive to the bulls, indicating that the buying of dollar spot funds is not sustainable enough.

Summary: On the current disk, the probability of the 4h to daily level beginning to turn into a volatile market is greater than the probability of trend continuation, if the shock lasts for a week, then the final callback test target is the middle track of the gradual upward movement.

ASR-VC indicator 4h channel status update:

Rightly, the $BTC price has gained support along the yellow line on the 4h shock channel, which means that the current bullish trend at the 4h level is still unbroken, and the next thing is theoretically a rebound.

The spot premium index has returned to the surface from the deep water area, indicating that this wave of spot supply has temporarily stopped, as long as the whale does not transfer coins in the short term, then there is hope that the price will rebound to the orange line!

In short, it is still an idea, the yellow line is not broken, there is still the possibility of a new high, the middle track is not broken, and the large-level trend is still bullish.

But I expect that the high probability trend is that the yellow line will fall below in the next test, and the final price will have to wait for the middle track to come up and then step back to test once.

Conservative estimates, probably on Friday?

50.2K

39

The content on this page is provided by third parties. Unless otherwise stated, OKX TR is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX TR. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX TR is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.